A quick history

In today’s article, i’ll be presenting my research into the coming Uranium bullrun, a market I dug into once I found a very good company to invest in. But I wanted to just present a short history of when I came upon the stock. While I didn’t know much beyond what we all know at the time – That Uranium is mainly used for nuclear power plants and weapons – the fundamentals of this company were so good that I needed little convincing it was going to go up inevitably and perform exceptionally well, as long as the market in general went up.

When I discovered it, I had already allocated nearly all my capital into the markets in other companies I also knew would do well. I cancelled my last order on a speculative rare earth junior, cut it in half, and made sure to invest at least €100 in the uranium miner to make sure I was in before this thing exploded, at any given time. Few investors understand the need for quick and decisive action when finding something good. But as I expected 100 times returns or more, I wanted to invest far more then a measly hundred and decided to generate the capital for it by selling the information about the miner; Share the wealth and we’d all get rich.

I decided to charge a 10% finders fee and work on a basis of trust – Meaning any messages i’d get about the offer, i’d consider “a serious offer”, and i’d send over all my research into the company and the market. Trust is earned, and in this case it would be earned by giving the other the ability to screw me over, where usually in this age of business, everybody tries their hardest to screw the other guy. And I can spot a gap in the market a mile away.

Initially I did little research into the Uranium bullrun, as it was of little relevance. Due to hyperinflation prices of all commodities would go up, including that of Uranium. I knew the main problem with the market was a raw resource cost below the cost of production of said resource, and this had been the case for many years. I got this from a Rick Rule interview that set me out looking for Uranium juniors in the first place. The moment that’d change, the bullrun would get started on its own accord, as i’m well aware of the effects of long term supply deficits due to my work on Silver.

I may not have know anything about the market, I know plenty of the trouble with renewable power and its grossly overstated “green” benefits. I know that Nuclear power is the only realistic shot we have at carbon neutral base load power, and I’ve also known for a long time that the environmental lobby would rather cave to nuclear power, then give up their Antichrist Co2. So it was always going to be a matter of time. Once Fundamentals came back into play in markets, Uranium would take off, because fundamentally it’s the only hope for our increased power needs in the 21st century, and there simply is nothing more to it then that.

I’ve watched several presentations over the years on wind and solar power starting to have detrimental effects on nations power grids, especially the Australian and Californian power grids. This is because Wind and Solar provide peak power; When the sun and wind are active. Sometimes its really sunny and windy, which requires massive grid capacity to absorb the peaks. Together with bad forestation management, both California and Australia found out in 2020 what the effects are of not upgrading your grid at the same time as installing more peak capacity while reducing baseload capacity. It’s simply not viable to create copper cables ten times as thick as they need to be 90% of the time. As this reality is becoming untenably destructive, a return to fundamentals is imminent.

As time progressed towards and past the US elections, more information started coming to light on the start of the bullrun being the moment the next US administration is inaugurated. I’ve also collected that information and will be presenting it today.

Finally i’ll note what everybody is probably most interested in: Price performance and history of sales. While i’m naturally not going to talk clients; I will talk numbers.

I’ve sold it 9 times, netting me roughly ~4k, with 3 rejections. No rejection based on the company – One didn’t believe in the Uranium bull run, One rejected on ethical grounds (I redirected him to Wool, which was cratering at the time and ended up bottoming about 2 months later), and the last was literally dead broke – so gave him free financial advice instead.

I didn’t put all of it into the miner, as i’m poor and I’ve had capital needs (2020 was a rough year), and i’m not gonna plow everything into a single stock no matter how much of a sure thing it is. Never the less, the Miner’s still my largest position by far, being roughly 30% of my stock portfolio last time I put money in, bringing me to a total of €1375 before it took off. The first Monday it did; it doubled in a day. I’ll present the performance later with my full portfolio, but I can already tell you everybody who invested in it when I sold the information made massive returns already. Even so, it’s still early days, and with that in mind lets get to what everyone wants to know. I’m hereby happy to present to you:

Peninsula Energy Limited

Peninsula Energy Limited is an Australian company and a ASX listed stock, but it’s somewhat of an odd duck. Its main project is located in Wyoming inside the United States. It’s flown under the radar for a long time, and the reason why I became infatuated with the stock is because I found the reason why it flew under the radar: Nobody knew about it or its potential, at least at the time. I’ll get to that in a moment, but lets first go through the financials and relevant links.

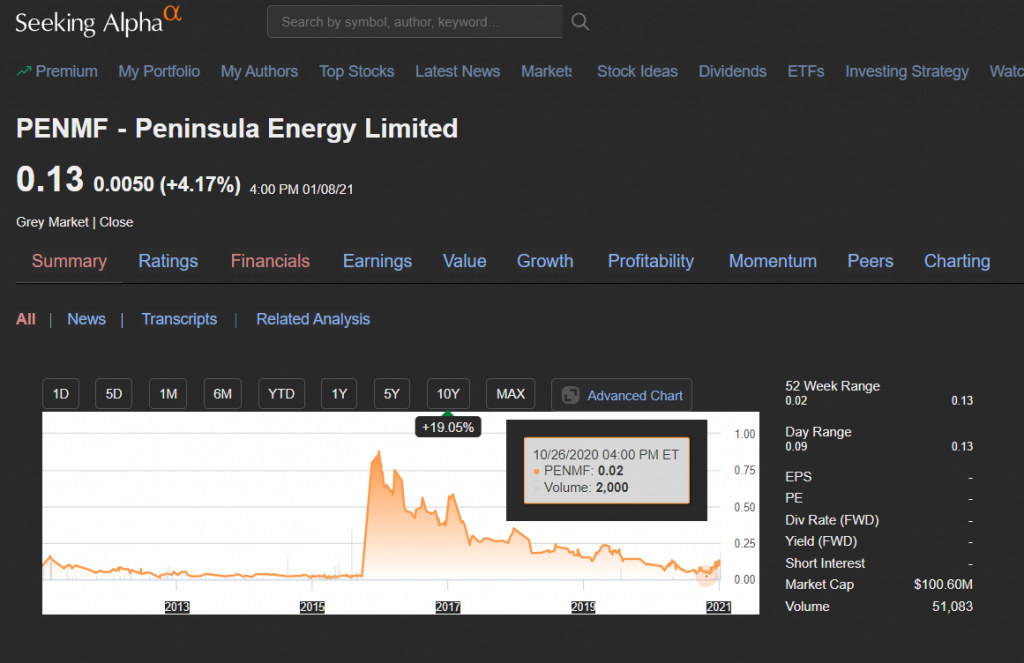

I’ve been using Seeking Alpha so far for it’s quick overviews, but keep in mind that some numbers such as debt aren’t always current, but the numbers that change daily tend to be. I’ll be using the numbers as of January 8th 2021, and i’ll only mention the numbers relevant to me. It’s easy to get lost in too much data, and not all the numbers are relevant to determine future performance. I’ll also skip definitions – it’s not hard to google a term and read investopedia. I’ve had to do that myself this year too, many times.

https://seekingalpha.com/symbol/PENMF/overview

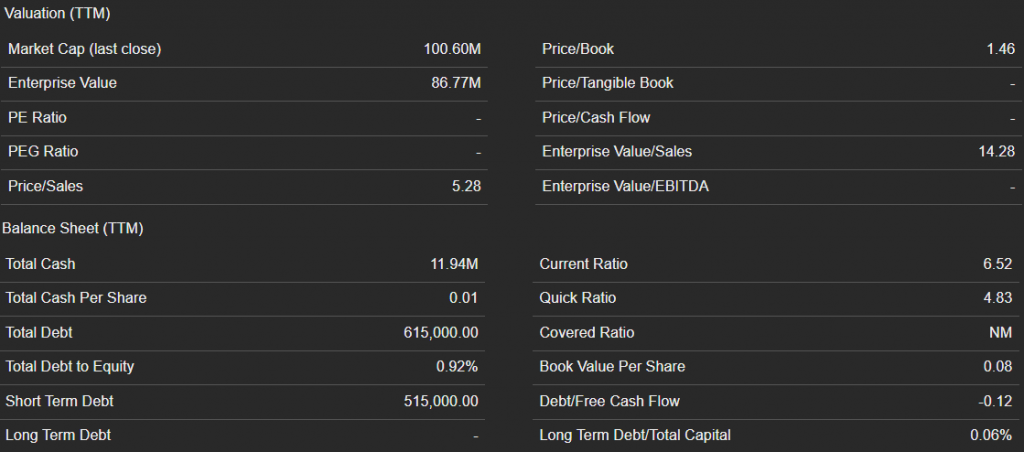

Currently; Their Market Cap is about $100 million and their Enterprise Value is listed as about $86.7 million; With a price to book of 1.46. Their cash is listed as $11.94 million and their debt is 615,000, or 0,92% of equity. Current shareprice is ~$0,13.

When I found it in August, their enterprise value was approximately 10% below market cap at around a 50 million market cap. At that time, their Price to book ratio was 0,37, and their shareprice was about $0,04 to $0,05. It afterwards crept up to $0,07 and collapsed again to $0,03, as it was trading like a thinly traded penny stock. This was weird, because there was plenty of liquidity available in the stock, as shown by the ASX volume numbers during 2020:

https://www2.asx.com.au/markets/company/pen

While it had been thinly traded for years, this is fully explainable by the cost of production of Uranium being below the sell price. The Uranium bear market is well known at this point so I wasn’t impressed with the continually sliding shareprice. There was plenty of float as shown by the volume throughout 2020, just none available past August because the price had collapsed down to the bottom and all weak hands had been shook out.

Penny stocks trade differently from “mainstream” stocks. Because you’re effectively trading among a very small group of people it’s not uncommon to see days without a trade. Nobody wants to sell anymore, but at this price, no one is buying either. So to see a stock with millions in liquidity trade 40k shares one day, and 10k another, with a shareprice of $0,05, is surprising, and not something to turn away from but to investigate.

Finally, what convinced me to take a deeper look is the last commodity bullrun. During 2011, Peninsula went up to a share price of $5,60 – a 140x increase from where I found it at $0,04. I’ve often said price shouldn’t determine why you invest, but it should inform. I knew that the fundamentals now were quite different for uranium as opposed to 2011, due to the years of underproduction. I knew the coming commodity bullrun would exceed the previous one. And I knew the next decade would look better for Uranium then the last, simply due to renewables not working out as expected.

And most importantly, the company was still alive after surviving the collapse in prices as a risky junior. Companies that survive a decade long bear market are lean mean money making machines – a tactic that worked out well for my other company where I applied it, Klondike Silver, currently up 528% from when I found it. Shame I didn’t get that much in returns (due to a LONG waiting queue to sign up for a brokerage account in March), but there’s always the next one. I’m pretty certain I can keep doing this consistently now.

Lets get deeper into the company itself rather then its financials:

First lets talk a little bit about their flagship Lance project, and what it means to investors, rather then what it means for the company.

Their flagship project is located in Wyoming while they’re an Australian ASX listed company. This means that there’s both Dollar and Australian Dollar (USD/AUD) exposure, which’ll be useful during inflation or hyperinflation. As they will most likely sell within the continental US, they will be paid in dollars – while bringing the profits home mean they pay out dividends (once that happens) in AUD. They’re also listed on multiple exchanges – I have my shares in Euros – adding even more safety, as those dividends are converted to Euros before I touch them. In transit, it’s somebody else’s problem, meaning they’ll be inclined to hurry (today it’s mostly all automated anyway).

And during inflation or hyperinflation, as long as it’s not your currency, it’s not your problem. While multiple advanced economies can hyperinflate fairly simultaneously – it’s never exact. Even if two go at once it still offers protection: If the USD And Euro hyperinflate at the same time, the Australian company just gets more dollars each day, while paying out increasing amount of dividends in euros. Meanwhile, the company itself will just opt to keep its cash/dividend reserves in AUD; Or in dollars and simply never convert if the AUD hyperinflates, exchanging dollars for euros. There’s more ways then just gold to protect yourself, though the yellow metal remains king.

The project itself has a license to produce, and they’re actually producing small amounts, but that’s part of the reason they’re “undiscovered” right now, which i’ll get to in a moment. Here though we have to look at their main investors presentation, which has been updated throughout the year. The November 30th version is even more positive then the August version, but they differ in wording and the August version is key to my explanation, so I will be using both to describe why I think this company is still very much undervalued:

November 30th presentation:

https://www.pel.net.au/wp-content/uploads/2020/11/201130-PEN-Corporate-Presentation.pdf

August 17th presentation:

https://www.pel.net.au/wp-content/uploads/2020/11/200817-PEN-Corporate-Presentation-Final-7.2c.pdf

In this case, we need little more then Page 4 of both, though i’ll talk through everything I found here in the text and mention where I found each.

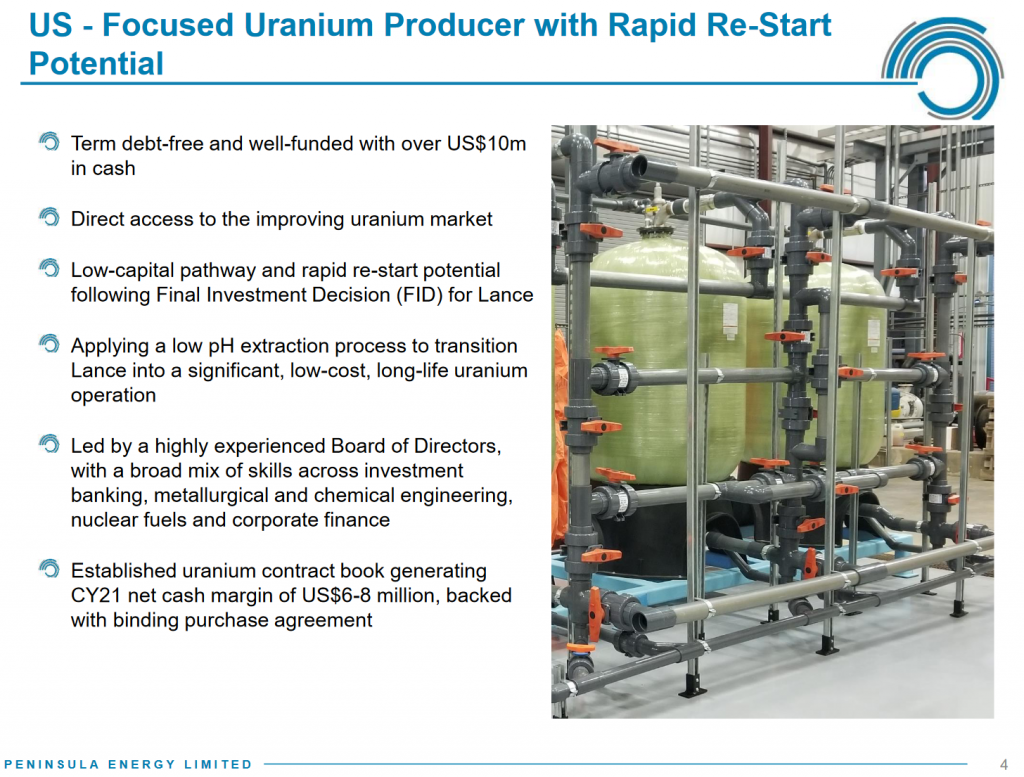

To stay with their Lance project, the following is most important, from the November 30th presentation on the same page:

“Flagship Lance Project, located in Wyoming, is the only US-based uranium project authorised to use the industry leading, low-cost, low pH ISR process”

This line wasn’t there before in August, so they’ve since gained authorization, indicating an upward trend towards production. Not just that, but the process they’re using is the best in class, thus we can look forward to great margins once the bull run gets under way.

The above also alludes to the reason why this stock is much better then people think it is, and the biggest reason I wanted to invest as soon as I could. To show this, i’ll first use the bullet point as I found it in their August presentation:

“Low-capital pathway and rapid re-start potential following Final Investment Decision (FID) for Lance”

I called this entire thing on 1 word and 1 word only:

Restart

See, most juniors don’t actually have a mine or mining equipment, or production facilities. They’ve got the location, and the metal in the ground – but they need capital expenditures (or CapEx) to get started. Once they receive that investment, they start building.

But! If the buildings and facilities are already there, but idling, being maintained or otherwise are temporarily shut down… Then we speak of restarting. And restarts are a completely different beast from normal juniors with no facilities. Those juniors without facilities will go up in the 2nd wave, when the majors already have gone up and higher margins afford more profit opportunity. The 3rd wave then being juniors who think they’ve found paydirt, but need capital expenditures to explore, not to build. Once those get too risky, the market tops.

But restarts aren’t 2nd wave juniors. They’re first wave majors. The moment the price breaks through their CapEx requirements, they can be up and running in Months, not Years, and immediately start making sales. In fact…. They are by far the most profitable, as they start the bull run trading like a junior, but immediately convert to a production major when funded and the price explodes.

This is further emphasized with the updated line in the November presentation:

“Extremely low capital requirement for restart of the Lance Project”.

The fact that these two lines differ is also one of the reasons it is an undiscovered stock. When I found it, it showed that the company had about a $100 million CapEx requirement, split over 2 phases, each about $50 million in size. This CapEx is ludicrously low compared to the “world class” billion dollar CapEx gold deposits I see many gold companies advertise with – and that’s just to get started, not deliver production. So why hasn’t it gotten funded yet?

The answer can be found on Page 8 of the November presentation: Their All In Sustained Cost of production for their Phase one needs an Uranium price of $41 a pound – and even in the April spike, the price never passed $36 a pound before correcting down. Simply put; They’re not profitable yet and have to continue in maintenance mode.

But their Phase 2 is quite different, and would produce Uranium at $31 a pound, for $43 million ontop of the Phase 1 CapEx cost, which seems to be even lower now at ~$21 million. Since the shareprice has already gone up to a $100 million market cap, it wouldn’t take long for them to fund themselves after the general market takes off – let alone if any big investor gets wind of this.

Regardless, in August, the price was correcting down again with no guarantee the Uranium Bullrun would get started anytime soon. So why still invest?

Well, this is because the other reasons on page 4. Since the new presentation is somewhat different and less revealing, i’ll quote the line from the August presentation:

“Term debt-free and well-funded with over US$10m in cash”,

Its here that we encounter one of my rules of trading (which I might release later in a book or something). This one’s straight up lifted from Peter Lynch, because why mess with perfection:

“It’s very hard to go bankrupt without debt”.

As I mentioned before, Penny stocks trade differently from “Majors”, or stocks generally $1 a share or more (let’s not bring inflation into this). When stocks are at the bottom, price no longer matters. Because you’re trading with so few people, most not wanting to sell lower and most not wanting to buy higher, the price will fluctuate up and down seemingly without reason. And because you’re talking pennies, paper losses and gains fluctuate wildly too.

In this case, the “reason” for the price fluctuating become the individual reasons of the few people still trading. Somebody might not want to sell, but if their other investments are losing money as well and they need to take losses somewhere, they might do so by selling a penny stock they own. Whether that’s your penny stock or another is a luck of the draw, depends on when those individuals got in, their tolerance for risk and loss, as well as how informed they are – those who bought on price and lost will sell long before the people who read quarterlies will.

At that point, there is simply no way to predict price, even for me. So it is to be ignored. Since price isn’t relevant at all at this level, it is a different question that becomes most important of all:

“Will the company go bankrupt?”

How this question is answered decides How I eventually invest. Companies where the answer is “likely” or above – I won’t buy. If the answer is “not likely”, I know they’ll likely dilute more, as most of the time they’ll live, but they’ll also need additional capital, and for penny stocks 9/10 times that means either dilution or a price hit when a private placement matures and warrants are sold into the market. As such, I don’t invest the full amount, but I dollar cost average down and buy the dip until I think it’s time to let the snowball roll – unless it’s about to start rolling, of course.

If the answer is a straight up “It’s impossible to go bankrupt” – I have no qualms about throwing the full amount in right away, as well as building up my position as long as I can. Then and only then does price history inform me, and only the most recent history: The “bottom range”. In Peninsula’s case, it had dipped to $0,06 in March, rallied in May on the Uranium spike, but had since collapsed to a $0,08 to $0,04 cent range and was bouncing around between there since July. So I those were my buy in targets. Since i’d be getting sales piecemeal, i’d just put in orders whenever I could. There was blood in the streets already, no need to wait for another massacre.

I actually got lucky, cause my largest sale happened around the time the price had slowly crept up to $0,07, but then collapsed to $0,03 and bounced around there for a while. For once I put in limit orders instead of hitting the bid, and managed to get €1000 filled at €0,04, dollar cost averaging me down considerably. With thanks to the weak hands.

Another thing Peter Lynch says: “The most important organ in the stock market isn’t the brain, it’s the stomach”. If the company cannot possibly go bankrupt, the shareprice may go lower, it cannot go to zero. At this point, whether you sell or not only depends on your ability to hold onto whatever it is you own. Don’t use margin kids! Not in this market. A spike will stop you out and cost you your profits, future opportunities, if not straight up your shirt.

A good example of this is when I logged in a few times before the shareprice exploded. €0,04 wasn’t the exact bottom, €0,03 was (that I saw). And when the numbers get closer and closer to the base increment of 0,01 (or even lower), Percentage gains and losses get bigger and bigger. This is what we’re all after, that massive increase at the end, but that does mean at the bottom – you have to be able to stomach large fluctuations in your nominal wealth.

By this I mean when I logged in after getting €1000 filled at €0,04, with the price being at €0,03, it showed I was down nearly 500 euros out of €1375. Together with my other stocks filled in July – my account was deeply red. I mean when I had bought everything, i’d put about €3000 euros of my own money into the account, with €2000 euros of my sisters money, and I was down €1200 euros plus. Since my trader is nice enough to display that with deep red numbers… Well, it gets your attention. It’s hard to explain how much money that was to me at that point in my life, and still is.

I didn’t even blink. “Welp that’s my luck fer ya”.

Because I knew those companies would do well. For reasons that simply hadn’t come to pass yet. Why would I sell them if I have the ability to hold onto them? If you buy a company for a reason, not a price, the red numbers and percentages mean little. Hell, even the green percentages mean little, because i’m not gonna sell until my reasons are met even if the price starts to go up.

I just have rotten luck so i’ll buy on the peak of a correction thinking it doesn’t matter. In the long run it doesn’t…. But I could’ve bought more with a little patience :p

Anyway, with it being hard to go bankrupt without debt and with a rapid restart potential, I knew it’d be a winner and time spent on the bottom just meant accumulation, not loss. But how long could they stay debt free? Well, for that I spotted another line in the August presentation:

“Established uranium contract book generating CY21 net cash margin of US$6-8 million, backed with binding purchase agreement”

Well, it may be very hard to go bankrupt without debt, it’s goddamn impossible if you’ve got guaranteed sales backed by a binding purchase agreement for the next year.

This answer my question fully. “Will it go bankrupt?” “Not before 2022”.

With the questions of Price and Debt answered, the next important question becomes Timeframe.

“When will it go up?”

In Peninsula’s case, the question can be partially answered right away: When the long term Uranium price hits $41 or somewhat above. Once their Phase 1 becomes profitable, there’s no sense in not investing the full amount and go straight into Phase 2 as it’d be vastly more profitable within a very short timeframe. Infact it may go up sooner then that, when somebody is willing to take the financial hit to produce at a loss if the price is expected to stay higher then $41 a pound in the short term.

So then the question becomes:

“Will the price of Uranium exceed $41 a pound before the end of 2021?”.

Considering what I know of the Comex, Economics, Inflation, the need for Reactors, the increased geopolitical hostilities and the soon to come panic out of fiat currencies, with President Biden recently announcing to pursue $2000 stimulus checks and a $3 trillion tax and infrastructure spending bill; Let me answer the above question as follows:

HAHAHAHAHAHAHAHHAHAHAHAHAHAHAHAHAHAHA

*gasp*

AAAAAAAAHAHAHHAHAHAHAHAHAHAHA

No problem.

But since you do not know what I know let me continue talking about the company.

Experience of management also matters, but i’ll be honest. At the bottom of a bear market, I never look at management experience. This because all the rookies have already gone bust, that’s why its the bottom. I basically learned this while exploring for Silver and Gold juniors in the second quarter of 2020. Since I work on the basis of fundamentals first, I always look at management after I already found a company that financially should do well. Haven’t seen a single company without atleast a host of silver foxes. For a value investor, it seems to be of little concern.

Naturally the management has to be good but i’m just saying, if the company is good at the bottom of a bear market, the management has to be good to have survived that long. There’s also value to be found in badly run companies with new management (the first stock I picked at the end of march was Great Panther Mining after management was replaced, it went up 100% shortly after, but not much since); However I don’t look for badly run companies – I just won’t miss an opportunity if it falls in my lap.

In any case, If anybody cares, they list a combined 150 years of experience in the sector across 7 people mentioned – So I think we’re good.

As they mention in the November document, their market cap is undervalued compared to peers. This is due to them shutting down production because of cost, and converting the site to the lower cost industry leading process. They couldn’t have known in the 2010’s when they made the decision how long the bear market would last, so it was a prudent one at the time. But as they’ve temporarily ceased to be a producer, their earnings have cratered and they’ve fallen out of the public’s eye.

In short – it’s the market which is wrong. Both for not selling earlier when earnings dropped, and not buying from July 2020 onwards. But then again the CFD trader with the lowest loss percentage i’ve looked at said “74% of all people lose money with this trader”… So i’m not really surprised that the market is stupid. Considering their market cap was listed as $65 million AUD in the November presentation and currently is $129 million AUD, I think they were right. I still wouldn’t consider that a high price – merely overbought in the short term. The moment they get their CapEx investment, it’ll take off much higher. Personally I wouldn’t wait for corrections if one isn’t in yet, just dollar cost average down when they happen by buying dips. The risk that it’ll take off while you wait has become quite substantial.

If all of this wasn’t enough; There was one more reason that pushed me over the edge, and made me value this stock not as a “good” or even “great” stock – but a “legendary” stock. Currently, this information isn’t even on their website anymore, further hiding the true value of the stock. It’s the main selling point out of everything I used to sell this to others. Due to their website redesign a few months ago, I can only show that the document existed and I saw it, as well as showed it to others who confirmed it, before it disappeared.

Here’s a link to the page from the Wayback Machine, which serves to catalogue and save internet pages:

https://web.archive.org/web/20200930002847/www.pel.net.au/investor_info/top_20_holders.phtml

Back in August, they still listed their Top 20 shareholders on their website in a PDF document. Upon looking into this document I made a startling discovery:

I knew none of the names on there.

By this I mean ofcourse they have large shareholders, but that’s because companies need capital to build, so they need ways to raise capital. Sometimes it’s a bond issuance, sometimes they dilute shares into the open market, sometimes they arrange for a loan with shares as collateral or straight up trade shares for cash.

In their Top 20 shareholders, every single name I saw there were banks, generalist investment firms or money lenders. Many banks have commodity divisions where they lend to just about anybody. While i’ve never worked or interacted with these banks, I know enough about banks to know that they don’t care. They’re not there to make friends, they’re there to make money; Any which way possible. And if they can’t make money on the shares, they’ll make money off selling the assets in bankruptcy, so who cares about performance after the initial presentation.

But if somebody like Rick Rule, who’s a great enthusiast about these things, were to know about a company with fundamentals this ridiculously good, he’d have done a private placement already. For sure. People like him always have a fund for when they come across companies like that, I would. If I had the money, I would’ve long ago. Heck, Peninsula was 30% of my portfolio before it went up, just 1 stock, a penny stock bouncing in single digit cents, after having generated months worth of income selling it and putting most of it back into the markets. That takes balls, even for me. But when you know, you know.

ANYONE with a boatload of capital already would be crazy not to roll the dice on this one. If Rick Rule knew, he’d be a top 20 shareholder for sure. Especially since the bottom position on the list was tiny, something like $150,000 at the average shareprice around that time. Very easy to get on there.

Meaning, that when one of these big names would find out about it… It’d skyrocket purely on their name investing in it alone. And it’d still go up many fold after that simply on fundamentals. It’s this realization that made me shift into generating as much capital as I could right away. I expect to turn my €1375 into atleast a million before i’m done with this company – If ever, depending on dividends, as their production cost will be one of the lowest possible. Never bet against innovation!

Finally, I wanna talk about the negatives, as everybody must be wondering what the catch is. There always is one after all.

There is none. I’m serious, i’ve looked, the other people I sold it to all did their own research (which I encouraged by the way), including my biggest sale who was an experienced junior investor, he didn’t find anything but an improving upwards line, including a positive audit and solved past troubles. The only negative comments I could find pertained to the cost-competitiveness of their process in the sector, probably alluding to their Phase 1 $41 cost. Those comments were from 2018-2019, where the spot price per pound was nearly $10, or 30% lower.

Cost competitiveness is very much a function of price. Something that’s not competitive at $30 a pound could have no problem competing at $60 a pound. Again, the question is simply can they sustain until the time when the price goes up? The answer is clearly a resounding “Yes, for atleast until 2022”. Their strong non-debt and cash positions will easily extend this, and if page 13 of the presentation is to be believed – they would have little problem surviving an entire decade if push comes to shove, and have existing relationships to take advantage of higher prices when they come. Finally – these binding sales only represent 15% of capacity (as mentioned on page 13 of the November presentation), so when higher prices come, they easily have the capacity to supply them outside of existing contracts.

Now that i’ve presented the company and what it means for investors fully, I wish to further present my evidence that the Uranium bullmarket is imminent – and while the price action since November has been favourable, it is barely even a sneeze. While it will be impossible to gain my level of percentage gains as I bought in so low, this company and many others will go up many fold still, and let me tell you why.

The Uranium Bullmarket

First, let me start with some generalist knowledge. There will be MANY reasons why the market is about to take off like an ICBM, and all combine to prove the price spike will truly be as big as 2007, if not vastly exceed it; As well as stay up this time, as insane as that sounds considering Uranium’s relative abundance in the ground at this time. While the company itself will already do well in the short term, let me explain fully why I don’t intend to sell for many, many years.

It is no secret that i’m well versed in the area of Economics. I’m very much up to date on the money printing going on in the United States and indeed around the world. I can tell you that we are very close to hyperinflation in several major economies, the US included, and the process has already started. However, in the first stage of hyperinflation, it exhibits itself as “Inflation that can never be controlled again”.

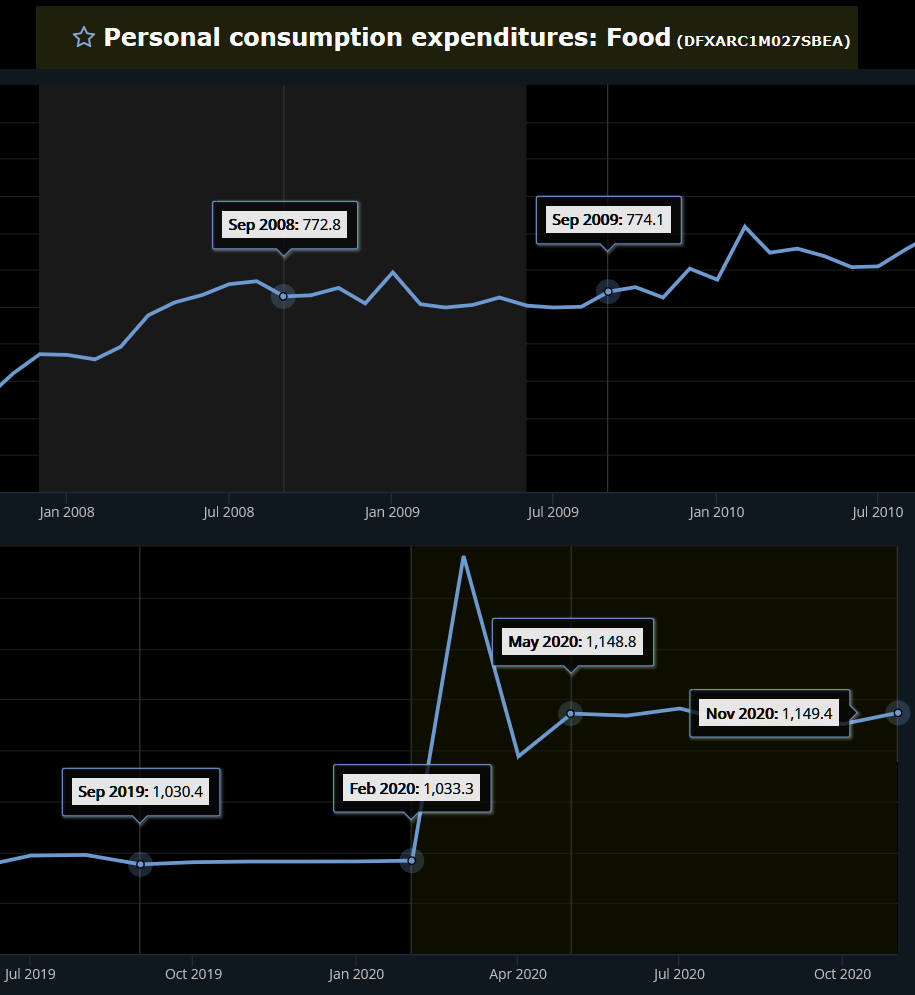

Since mechanically speaking, hyperinflation is just “alot of inflation”, it starts as a higher-then-expected print, but “nothing to worry about”, so nothing is done about it. This is already true for the US economy, where food prices spiked in the March panic, but have since never returned to below an increase of 11% over January of 2020:

https://fred.stlouisfed.org/series/DFXARC1M027SBEA

With the CPI measure used by the government heavily manipulated and its inflation measuring methodology continually changed, including once this year, it’s hard to get an accurate read on what inflation means to the general price level in the US. As such, i’ve come to rely on the most basic measure possible: Food.

And the reason for this is simple; Humans can only consume a limited quantity of food, quantities that are generally similar to each other especially when taken across a population of hundreds of millions. It is impossible to fake – Only more humans, more food intake per human, or an unstable currency affect the total amount of money spent on food within a nation each year. Between July 2009 and July 2019, the US population increased by 7%.

During approximately the same time, from September 2009 to September 2019 (the repo crisis), food expenditures rose by 33,1%. Subtract the population increase, we get 26,1% in increase in food costs.

So unless Americans got 26,1% more fat, the currency depreciated by 26,1%. There can be no other explanation. Since that’s over 10 years, that makes 2,61% the annual rate.

Between November 2019 and November 2020, food expenditures increased by 11,31%. Since this is too short a time for population increase to matter, and people definitely didn’t eat 11% more in a year, there has been 11,31% of real inflation, regardless its source! Whether the population spent more or less on other items doesn’t enter into it. The point is, they don’t spend more or less on food – the consumption rate of the measured asset is constant.

It only changes by one external factor, population size, something we can easily measure and subtract. Once compensated for this – it shows the fluctuations in the currency nearly perfectly, and shows the mystery i’ve been puzzled about for many years; Why there’s more inflation then the official CPI measure, but less then alternative measures, such as past variants of the inflation calculation. In short; those were wrong too. Those measure the prices of the things people bought – but it does nothing to measure to price of the currency itself. If nothing else, the global shutdown experiment of 2020 should’ve shown how poorly the modern “basket of assets” inflation measure performs at measuring real life costs of citizens.

People will point to everybody eating at home for the increase in food costs, but this is untrue: Expenditures have gone sideways since May, through closure, partial reopening, near full reopening and into a second round of lockdowns. Policy has been anything but solid, yet the line going sideways has been. This mirrors the last great crisis: From September 2008 until September 2009, through collapse, bailouts and QE – food expenditures remained flat. This mirrors the period between September 2019 and February 2020 as well, Post-repo crisis but pre-covid; Showing as well that the start of the financial troubles of the United States had Nothing to do with the virus:

And the November data doesn’t even include the $1 trillion spike in M1 money supply, which takes a while to work through the economy. I suspect food costs to rise again in the very near term, especially with massive additional stimulus giving people more money to spend on food – this includes people at food banks, who are currently not spending on food, as they’ve ran out on money, so a minor supply squeeze will happen at the same time.

It is this second stage of hyperinflation that will see asset prices start to rise, and it’s been part of my predictions of doom for the Comex; As well as the political wrangling being the reason for its demise taking longer then expected. It’ll come though, very soon, especially now that the US Democrats have achieved a blue sweep.

Hyperinflation is a process, something our modern tech hypercharged ADHD society tends to forget. People may be stuck on a timeframe of a day, reality is not. The first phase of hyperinflation is normal or even lower then expected inflation that is impossible to stop. In our age, this first phase started for the United States on September 16th 2019, when the Repo market broke and nobody wanted to lend the US any money anymore for anything less then 10% interest. In short; the US went bankrupt.

Ever since that time, the Federal Reserve has engaged in unlimited amounts of money printing to keep the system going. A blood transfusion to a victim riddled with gunshots; Just pump enough blood in and they’ll keep going no matter what the mess. And by “unlimited”, I don’t mean the absolute monthly amount in Quantitative Easing that they’ve been engaged in since September 2019. I mean the fact that the moment they turn it off, the system collapses again, until they turn it back on. It’s not the amount that matters in the first phase. It’s that it has to be there, or the system immediately dies.

A good example of this is the doomsday prediction by Zoltan Poszar on December 15th 2019, predicting another repo crisis before years end, and the Federal Reserve responding on December 16th by printing half a trillion dollars in year end repo liquidity. This was so much, it wasn’t even all taken down – though most of it was. Comments at the time likened it to Alan Greenspan’s “Y2K liquidity spike”, when Alan Greenspan flooded the markets with money to avoid any panic around the Y2K bug, 3 months before the market topped and the tech bubble popped. History never repeats, but it often rhymes.

They could’ve given up. They could’ve said “Alright well, the system has a problem so we’re going to let it clear and fix the aftermath, not the problem”. Saying No is always an option… unless it really isn’t. Therefore we must conclude…. It really isn’t.

QE is here to stay, and QE-infinity is aptly named. Even if it’s decreased, that is a temporary bluff, it will only have to be increased so much further shortly afterwards. The US Dollar is a ponzi scheme gone exponential, and there is no stopping it now. As more and more dollars are printed, they will find their way into private hands. The Cantillon effect only determines who benefits the most, not who benefits exclusively. Central Bank Digital Currencies will only hasten the process, not change anything about it.

In the second stage of hyperinflation, asset prices will go up, but haven’t yet. It is the twilight zone between currency having value and not having value. Hyperinflation is defined separately from inflation because the process is purely psychological, while inflation is purely mechanical, and arises from supply and demand interactions. The second phase of hyperinflation is the phase in which this relationship flips from mechanical to psychological, and in technical terms, I can only describe it as “you’re going to see some shit.”

Initially everybody will be flush with purchasing power. It’s much easier if you think of the dollar in terms of Purchasing Power, not in nominal amounts. The first time the money gets spent is when it has the most purchasing power. The goods that it buys are replaced at a higher price. The merchant that gets this money for these goods, also spends it on goods himself, which then get replaced at a higher price. This is simple mechanical supply and demand, and is still active in the initial stages of the phase.

However, the key takeaway is that the currency never stops coming. It is the time factor people always forget, which makes them suffer both from Normalcy bias and Recency bias: They think that because of supply and demand, the demand and supply of currency will equalize like it always has, which is normalcy bias. At the same time, they won’t buy silver if the reason for buying is it going out of stock, because if they check right now, there is still plenty of supply, nor have there been any problems recently – where recency bias gets its name from. What they don’t realise, is that in the future, it’s impossible for supply and demand to equalize, because the supply of currency has become infinite, even if there’s too much already.

Because we’re all individuals, at some point, somebody is gonna call bullshit. Somebody is going to say, “i don’t want the currency anymore, I only want assets, because asset prices keep going up. So if I put my money into assets, i’ll get richer by selling them for more money later”. Since I converted all my life savings into physical silver and gold in December 2019, i’ve been calling bullshit on this for quite a while, so you don’t have to worry about being first. Infact, if you don’t have any physical silver at this stage, you’re VERY late to the game, and i’d buy that first above anything else.

Yes I know nobody you know has Silver. That’s the point. What’s happening to the price of Bitcoin and Tesla now that everybody’s piled into it?

Exactly. Again, Timefactor.

This goes for all individuals, even rich ones. Especially rich ones, because they tend to be more savvy in money matters and they have FAR more to lose when hyperinflation starts destroying capital.

So once the relationship starts to change during the second phase and asset prices start to rise over a general level instead of individually (and i’ve got a few screenshots showing that well underway at this point), the rich are gonna bail on the system, take their profits, and shove it all into companies that cannot print assets but rather produce them through labor, such as physical metals or elements with utility, such as Uranium. Sure, Gold and Silver are gonna go first, but everything gets overbought because humans never learn. Once those do – What else can’t be printed and has utility?

This again doesn’t happen all at once, as it’s a process. But every day, one or two of the millionaires will call bullshit, and every once in a while a billionaire goes. Realise that when they’re publicly calling bullshit, they’ve privately already shifted their wealth to benefit from the attention their public pivot brings. So the fact that no high profile billionaire or millionaire has called bullshit yet and has gone fullbore commodities and precious metals should worry you, not comfort you. Rather it means they’re still accumulating or stuck with price levels that are too low to make a move and start the pump.

Jeff Bezos sold $10,2 billion in stock this year. Where do you think that money has gone? Not into Silver because that’d be enough to buy out all the 400 million ounces on the Comex’s balance sheet, which’d cost (funnily enough) $10,196,800,000 at the Friday the 8th of January closing price of $25,492 an ounce.

The moment this rotation starts happening, especially in the reserve currency of the world, every Capital expenditure you can imagine in the commodity sector is going to get filled very rapidly.

This is like a giant Mexican stand-off that’s about to go off. The moment one moves, they all have to move, because there’s 3 ways to get rich in the markets: Be smart, Be first, or cheat. Nobody likes a cheater, and while being smart is nice, it’s a hell of a lot easier to just be first. Also being dead last is a sure way to lose it all.

We’re talking several world class gold deposit projects, meaning worth $1 billion or more in 2020 dollars, getting funded within months or weeks of eachother. Maybe even days if it gets bad enough. Stuff that seems totally unimaginable now, will not only happen, it’s going to get surpassed in a second round of funding juniors in possession of such projects or even bigger ones – not because they’re expected to turn a profit, but because they’re not expected to turn a loss, or lose too much. A 10% loss is still better then having your billions wiped out entirely, and everyone will be looking for a way to survive the transition of the old currency to the new one – whatever the hell it ends up being.

If you think it impossible: At the time of writing on January 7th, the combined gold stocks of the Comex, I.E. Registered, Pledged AND Eligible categories, come to 38,180,246.652 ounces of gold; Which are worth $72,878,454,809.33. Doing the same for Silver yields an amount of $10,743,229,307.57. This combined amount of $83,621,684,116.90, or $83,6 billion, is approximately 70.25% of Warren Buffet’s position in short term treasury bills only, worth around $119 billion at the end of 2020.

Clearly, a ~$70 million in CapEx expenditures for a killer value proposition like Peninsula is peanuts. Not to mention their expansion capacity and opportunities.

But this doesn’t just go for miners. It is here we’ll get more into the main driver for usage of Uranium: Carbon Dioxide free base load power through Nuclear Reactor power generation. Nuclear reactors are currently too expensive to build, but that’s only because of capital allocation and political willpower. With Hyperinflation taking care of the Capital, now we just need the political willpower. And that too, is coming, rapidly.

The changing of the winds in how Nuclear Power is viewed

In this section or presentation i’m not going to debate the benefits of nuclear power over other forms of power. As far as i’m concerned Nuclear is the only chance we have until we get Fusion to work, or we’re simply gonna run out of electricity sometime in the future. However it doesn’t matter what I think, it matters what the US political class thinks.

They clearly are the global trendsetters when it comes to climate policy, no matter what the Germans want you to believe. Those fucking morons turned their coal AND nuclear powerplants off, now they’ve got no choice to complete the Nord Stream 2 pipeline to use Natural Gas base load power, which is the only option left at this point, and they’re going to have to listen to Russia if they want a warm winter. And they’re STILL importing French nuclear power to make up the difference when the wind dies down on a cloudy day!

Whatever, my Gazprom investment thanks their foolishness (Also still incredibly undervalued by the way go check out THAT market cap to enterprise value spread).

Diatribe over, allow me to offer some articles that started coming out after i’d already made a few sales of Peninsula that show the winds are changing in Nuclears favour.

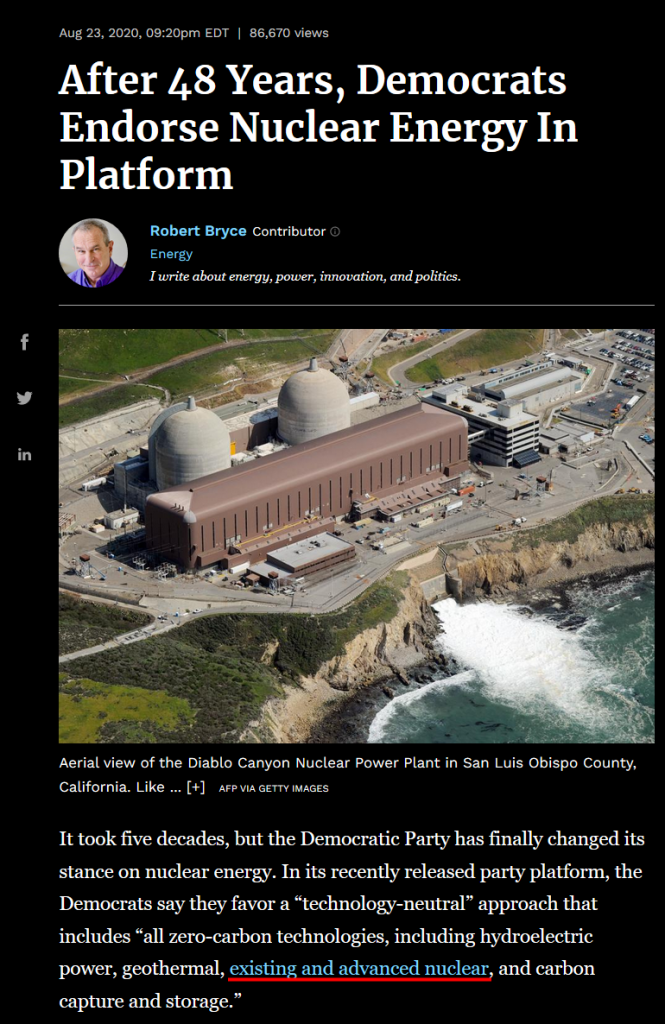

The very first change came on August 27th, in the middle of the Presidential Election. It’s well known Trump favoured nuclear power, so naturally the Democrats had to stay against. However I saw the following article pass by on twitter:

I will quote the first two paragraphs as they are the most relevant. I tend to work with patterns anyway, not just specific articles, to prove my points.

“It took five decades, but the Democratic Party has finally changed its stance on nuclear energy. In its recently released party platform, the Democrats say they favour a “technology-neutral” approach that includes “all zero-carbon technologies, including hydroelectric power, geothermal, existing and advanced nuclear, and carbon capture and storage.”

That statement marks the first time since 1972 that the Democratic Party has said anything positive in its platform about nuclear energy. The change in policy is good — and long overdue — news for the American nuclear-energy sector and for everyone concerned about climate change.”

What would’ve been a major shock to the industry in 2019, went completely unnoticed in 2020. This because the democratic party platform did not matter in the slightest, and could be summed up by “Not Trump” – as that was all anybody cared about anyway.

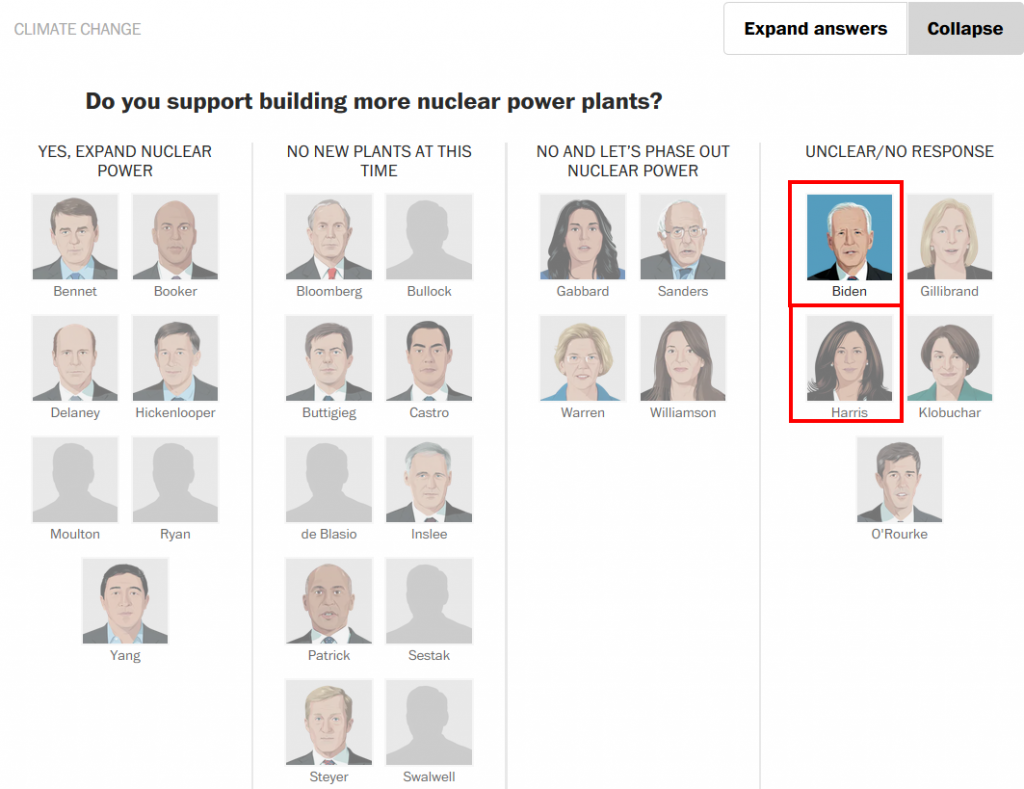

Furthermore, Joe Biden ended up winning the democratic primaries, as well as choosing Kamala Harris as his Vice-President. When the race was still going on, the Washington Post reported the stance of each candidate on Nuclear Power… But again nobody cared about that at the time:

https://www.washingtonpost.com/graphics/politics/policy-2020/climate-change/nuclear-power/

Both are listed as unclear and or no response, which within the democratic party, is the only possible “yes” you’re going to get. As Trump was decidedly pro-nuclear, saying you are too before the election means you agree with the orange bad man, and we can’t have that. However, if you say no, even partially, you’re closing the door to the only real and practical solution there is (Looking at you Bernie. Feeling the Bern of the Californian Wildlife yet?).

People in general, especially in this day and age, completely underestimate the value of keeping your mouth shut and not saying anything (as well as opening it at the right time, by the way). If you never say you’re against, you’re not flip-flopping when you turn out to be for.

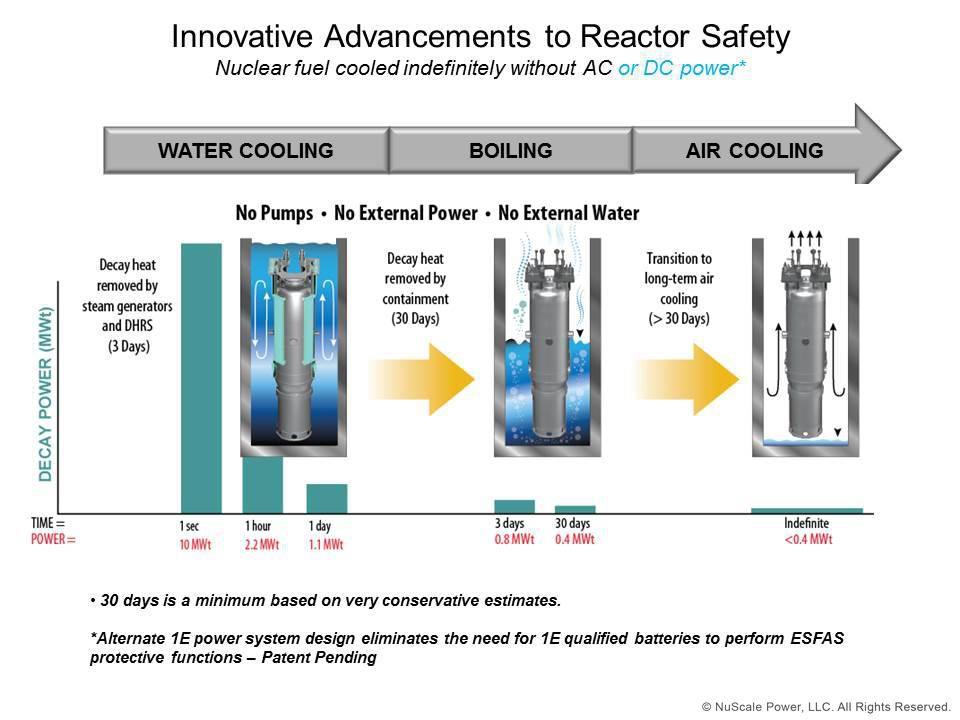

More news came out not too long after, this message specifically being about South Korean miniature reactors being approved for use within the United States:

It is clear within the industry, atleast for the western focused world, that large nuclear plants are done for. Each plant costs billions to build, and the public has lost their taste for large possible disasters. Instead, the focus is now on smaller, more advanced designs, that are nearly impossible to meltdown purely by their own design, and even if they would, the disaster could be easily contained and cleaned up.

Russia is leading the charge in this case, as they’ve never shied away from using nuclear power, if nothing else for military means:

Their use of nuclear technology on ICBM equipped submarines has given them a lot of expertise when it comes to small, modular reactor designs – designs that have now been commercialized. I first read about it when a newly launched ship containing 2x50MW nuclear reactors headed off for a northern Siberian town, which usually got cut off in the winter from the grid – but now they could generate the needed power via the ship – which could sail away again for use in other places in the summer.

By virtue that the Russians are far ahead of the Americans in this field, and the Democrats which are now coming to power with a unified senate, house and presidency absolutely hate the Russians, means we are going to see some truly incredible investment into miniaturized nuclear power in the western world very soon – if for no other reason to stay ahead of the Ruskies.

It also helps that there are still 55 reactors under construction currently worldwide, and the locations of where those are mainly being built might as well be the US top 10 most wanted list. Not to mention China added another 10 to the list just recently at the start of this year. If it wasn’t for those silly Germans the US would be last, not first.

Bill Gates sure seems to think so:

https://www.zerohedge.com/technology/mini-reactors-complement-renewables-carbon-free-electricity-era

Say about the man what you want, he’s very rich and very powerful, so the fact he’s started throwing billions at the problem is going to turn heads all on its own. He’s quite the narcissist so he’ll get his way come hell or high water, so if he wants mini-nukes, he’ll get mini-nukes, whether that turns a profit or not (though, eventually, it’d better).

So far I’ve only talked about the United States as it’s most beneficial to my presentation. But as I mentioned, the US is the trendsetter in this area, and if they say it’s OK, others shortly follow:

The United Kingdom is also looking into Miniature Reactors to provide clean power. The French need little convincing, and the Germans will have no choice but to follow eventually too when their privileged position within the EU ends and they too have to face reality as no longer being the main beneficiary of the Euro (through artificially depressing their currency’s value to boost exports, thanks to the southern European spendthrift).

All of this goes to the supply of Uranium, as more users means a more restricted supply at current production levels. However, as if restricting the supply through usage wasn’t enough, the United States is planning to manually restrict the supply further.

The following came out in September as well:

The United States Government announced a draft document detailing a substantial decrease in importing Uranium from Russia – starting slow over the next 3 years then accelerating into 2040, with total imports of Uranium currently being 20% from Russia, to be reduced to no more then 15% in 2028 – a minimum 25% reduction.

Uranium is found all over the place, including within the United States, so clearly this setup is designed to build up domestic mines before accelerating the reduction in foreign supply. Good for my miner, which will only need 6 to 12 months to expand production capacity.

This alone would create a storm for Nuclear, but not a perfect storm. The man that will accomplish that single handily is John Kerry.

John Kerry’s held many positions of power within the US governmental apparatus and his name carries a lot of weight; and he’s been the one who signed the Paris Climate Accords on the US’s behalf. Trump leaving these accord’s been a thorn in the Democrat’s environmental agenda, so they are sure to return to them. Especially now that John Kerry’s been named “Special Climate Envoy”, and with a Democratic senate, will have no problems being approved for this.

John Kerry is a Notorious Nuclear Convert:

As far back as January 7th 2017, John Kerry voiced his support for the next generation of nuclear technology:

“During a speech at MIT on January 9, 2017, Secretary of State John Kerry explained that he once did not believe nuclear was a viable solution and supported Bill Clinton in shutting down nuclear research. He went on to say that, given the challenge of climate change and the advances in nuclear proposed in Generation IV, that researchers should “go for it”.”

This was at a time (in 2017, weeks before Trump was sworn in) that Nuclear Power was still a big no no within the Democratic party, especially with the aftermath of Fukushima still on full display. The only reason he could get away with it without being excommunicated is because of his long history within the US political apparatus and positions of power.

And in fact, he has not backed down from this position, even during the Trump years and a clear pro-nuclear stance by the Republican Party, and in opposition to criticism from the “renewables lobby”:

A section of the article from September 2019:

“He [Kerry] talked up the future of small-generation nuclear power, citing its safe use by the US Navy. But experts have cast doubt on the technology because of cost, technical limitations and its failure to be deployed commercially anywhere in the world.

Kerry said people arguing that the cost of action to fight the climate emergency was too great were not factoring in the massive storm and disaster damage bills.”

Showing clearly that the real expert is the one who wields power.

As he’s not been one to back down from miniature nuclear power when few people were on his side, now that he’s getting a special post and has more powerful people looking in the same direction, it clearly is just a matter of time – a very, very short time, thanks to hyperinflation, and a few billion in capital expenditures won’t look like billions much longer.

There are various other Tidbits i’ve picked up the past few months, but they’re more anecdotal.

I recently heard it said that the entire Uranium mining sector is about $20 billion dollars big in market cap. This puts it currently at 1/6th of Warren Buffett’s treasuries position, 2,4% of Tesla’s $834 billion market cap (that was 2,79% and a $716 billion a day ago when I calculated that for the first time before market open on the 8th, I swear to god they went up $118 billion in a day); 0.9% of Apples $2,2 Trillion market cap (also up $90 billion, or 0,04% down in a day), and exactly 2% of the United States M1 money supply increase between November 16th and December 14th 2020 – and 1% of the M1 increase between April 13th and December 14th 2020, at $1 and $2 trillion respectively. Again – The ENTIRE uranium mining sector’s $20 billion. Total.

When I found the miner, I mentioned to my Russian friend I was going to invest in Uranium. His response was “Ahhh, good old Uranium” (well he’s a Russian after all). Then he said that “all above ground stocks would be depleted within the next 10 years at this rate of consumption”. I never questioned him on this, as I said, aside from having my trust as a very good friend, he’s Russian. I’ve heard similar musings several times.

Finally I’ll talk a bit about future projections, as the question i’ve undoubtedly got the most was “What’s your timeframe for this?”

As I said before, i’m not entirely sure. For me, it depends on a sequence of future events. I don’t believe in Destiny, I believe in Agency, and that includes making the wrong choices.

The setup for the company is literally the best i’ve got in my arsenal, otherwise I wouldn’t have gone to such lengths trying to generate capital to put into the company. If I didn’t have capital needs for life expenditures as well as a very small portfolio outside of this stock, I would’ve put in more. At these prices should I suddenly come into a lot of money, I would add more – though because it remains an outsized position, I would add to other companies as well.

I don’t believe in diversification, AKA investing in different sectors because of some arbitrary percentage number in any one sector, but I do believe in divestment. Meaning, i’m not going to invest in Tech because “I’ve reached my allocation in precious metals and now I have to”. But I will invest in both Silver and Uranium if I think both have supply problems as well as fundamentals that will do well in a general environment, such as an inflationary or hyperinflationary environment. Silver is also mainly used in Solar panels, of which demand is sure to grow too, as they serve the peak power market well (but are currently misused to due promoting them as a “one size fits all solution, and we can take care of the night with batteries”).

They are therefore complementary investments in the coming environment, and I have no problem divesting between Uranium and Silver. The same with Gold, Rare Earths, and Nickel/Cobalt.

But aside from adding to my position in the short term; The medium and long term depend on the company itself. Inflation has absolutely no bearing on whether a miner has 1 mine, 3 mines or 10 mines. It’s clear that this company will benefit early on from a low expenditure and strong capital position, which means they will have plenty of capital for the next phase of the bullrun, which is where juniors without facilities but with confirmed deposits start to go up.

Should they be wise and reinvest their excellent position in consolidating with other very good companies and expand their operations, using their established business contacts to secure sales, the company might go up many times over still, even in the second phase of the bullmarket. At that point i’d be a fool to sell, and i’d just hang on to the stock or maybe even add to it. Though – I wouldn’t add to it beyond the second phase of the market, but for personal reasons.

As stated i’m pretty confident I can keep doing this at this point, and i’d just put any future capital in the next stock at the bottom after the stock’s already gone up alot. Since it’s inevitable the Nasdaq gets crushed in Hyperinflation, i’m sure i’ll invest in tech stocks as soon as a new, stable currency is introduced and the economy recovers, as just one example.

But when i’ll sell is again dependent on the company. If the dividends are already good in the 1st phase, and they use their expertise in the industry to properly manage whatever companies they absorb in the 2nd phase, Then the dividends will be fantastic going forward and I will just use it as dividend income. Since I got €1375 in at roughly €0,05 a share total, should the company reach its previous peak of €5,60 a share in 2011, then my principal turns into €154,000. If the company offers just a 1% annual dividend at that stage, I would get €1540 euros a year – more then my principal investment in passive income.

If they keep that up, I would just invest the full amount (minus taxes) into another company at the bottom, Every. Single. Year. And it would cost me nothing, as it is passive income, the company generates it for me. That’s how you make your capital work for you kids!

And a 1% annual dividend for a commodity miner in a bullmarket during hyperinflation is exceptionally low. Yamana -which is a gold and silver miner – already offers a 1,4% dividend, raised a few times this year even during the gold price correction from July onwards. And as stated, I have expectations of Peninsula rising well above their previous peak, even on company fundamentals alone due to their superior process within the US. None of this even assumes a buyout by a larger fish in trouble and in need of quality assets – which is then sure to pay a hefty premium.

In which case by the way, my attention would shift to the overall company that bought it – if upon analysis it meets my approval for further growth i’d stick with the dividends rather then reinvestment. If it’s a bad company trying to shore up their balance sheet – i’ll sell. But honestly i’d hope they’d stay independent, because the setup is there for it, and they could turn into one of the major producers within the US by themselves.

In phase 3 of the bullmarket – the speculative phase – i’ll be keeping a closer eye on it. Because of my way of investing I don’t have to track performance of companies at the bottom – If they’re still good, i’ll throw money at them when I have it. But once companies have gone up a lot, human nature comes into play: We never learn and always run things into the ground. At some point, even if they do everything right and maybe especially if they do, Peninsula will be greatly overbought, and i’ll sell my position. It’s also because of this reason I wouldn’t add to it in the 3rd phase of the bull market: Because of my low starting position, i’d dollar cost average up like crazy, and that’s not what I want – I wanna dollar cost average down before it goes up and end up with exponentially more shares that then go up.

My timeframe for all of this is pure speculation and should be treated as such. I genuinely don’t know, because nobody knows the future. I can just spot a good deal and follow logical consequence, that’s all. But if I were to guess….

Short term i’d expect to last up to 3 years. Hyperinflation never lasts long, but we’ve never had hyperinflation in a global reserve currency before either. Geopolitical events can shift hyperinflation and slow down the process: Should the US go to war with China, I doubt NATO would intervene, but I also don’t doubt NATO would support the US financially, and with it hold up the dollar for the duration of the conflict. Prices would go up, but be limited to supply and demand mechanics. Psychological effects wouldn’t come into play unless the war goes poorly and Morale becomes a factor.

Medium term would be 3 to 10 years. In this timeframe i’d expect hyperinflation to have taken place for sure, as well as have resolved itself: Weimar hyperinflation lasted only 6 months, with other countries in Europe at the time (in the 1920’s) showing similar timeframes. Whether it’s Gold or Crypto or something out of left field, humans have such a need for a stable currency with intrinsic value that we’ll find something, and fairly quickly too. We always do.

Again, that has no bearing on how many production facilities Peninsula has, or how many reactors they have to support with them. Many reactors will be built in the CapEx phase of hyperinflation (because if the US doesn’t they’re even more stupid then I thought, which is saying something post- the capital riot), and those reactors need to be fed long after the economy has stabilized too. As the Uranium price is only a small factor of total operating costs, even for mini nukes, the price might stabilize at a new level far higher then the current one, even adjusted for inflation, through pure demand. So my intentions are to hold for longer then 10 years, but I won’t hesitate to sell at a moments notice when I see things go sideways. Never get married to a stock!

Long term would be 10 – 20 years. The Draft agreement goes well into 2040 and I don’t expect the US to resume imports after many domestic companies have popped up. The Shale sector must also be considered; By this time it should’ve already imploded, been sanitized and slowly start to reboot as the oil price recovers with the global economy – and then starts to soar because all the easy to pump up stuff is still gone – the reason shale got started in the first place – except now the easy to pump up shale stuff is also gone.

Purely out of necessity, the US will continue to build reactors. Regardless of size of the Electric Vehicle industry, reactors are the long term future. Oil won’t “run out” – it will simply become uneconomical to spend on certain uses, especially when there are viable alternatives. One of these uses is motor transport, as battery power density is finally approaching and within range of civilization wide use. As less oil is being found, the natural gas price rises too. While there are plenty of gas fields left in the world, the current day abundance comes from the US shale sector, which essentially “gets gas for free” and has created a huge supply glut because of it. Large enough for the US to try and sanction Nord Stream 2 out of existence so they could sell 25% more expensive liquid natural gas to Europe just to get rid of it. I mean… C’mon now guys. C’mon.

Regardless this too is all long term, because even if society wants to – the Nickel, Lithium, Cobalt and Rare Earth mines to sustain a battery future simply aren’t up to scale themselves yet. For these mines to scale up, the demand must first be there to justify the investments. But in 10 to 20 years, that economy of scale will exist as oil becomes more and more uneconomical for transport uses, and only more baseload power will be needed to keep civilization running 24/7.

Then there is the interesting fact that humans have never, not once, in the entirety of history, become more energy efficient. Oh sure, technology has, but humans haven’t. That is to say, whenever there’s a technological increase that unlocks an increased form of energy density we can now use, say going from steam power to coal to oil to nuclear; We never use less power. We invent new ways to utilize more power.

For example, society worked just fine with horse and carriage. When we discovered oil and gasoline, we could’ve “just” used it for more efficient streetlamps, replacing the whale oil with petrol, and kept the horses and carriages. But instead, we invented internal combustion engines to drive cars and power electric generators, and we’ve used up ever increasing quantities of oil since, for reasons hardly anyone even questions because they come so innately to us. Increases in car engine efficiency haven’t lead to more efficient cars, but simply to more cars on the road as more people could afford to drive one. It were the oil price spikes in the 70’s and later emissions that started driving efficiency, not human nature.

My point is: Once we have abundant nuclear base power…. We’ll get addicted. Really, really addicted.

Currently, society isn’t aimed towards cheap and abundant power, even though we could easily provide it by just building overcapacity. It’s a question of allocation of funds, not actual funds. The Federal Reserve has printed $120 billion in Quantitative Easing every month since March of 2020 (a hell of a lot more too in the early months) and continues to do so to this day. Last I heard, a full-blown “inefficient unaffordable reactor” that provides a Gigawatt/hour of power costs about $10 billion, as per the Russian article.

The US Federal Reserve spent enough money justbuying US treasuries and Mortgage Backed Securities between June 2020 and January 2021 (you buy $40 billion of those a month you have NO idea what’s in them by the way), enough to afford to build 84(!) nuclear reactors, providing 84 gigawatts of power. A quick google shows, without taking peaks in usage into account, 1 gigawatt can power 725,000 homes (though more realistically about 300,000).

Taken the first number, the Federal Reserve already spent 60,9 million homes worth of Co2 free baseload power on what can be called in the gentlest of terms; Non-Renewables, over a period of just 7 months.

Officially, the United States budget deficit of 2020 was $3,13 trillion. At $10 billion a pop, this could have built 313 1 GW nuclear reactors.

Providing Co2 free baseload power for 226,925,000 homes theoretically – pretty much covering the United States in abundant power – and 93,9 million homes realistically, with what they borrowed in a singular year. Though it doesn’t seem like anybody wants much to do with reality anymore.

Nor does that calculation because it’s all based on giant inefficient $10 billion designs. With pure economy of scale of small reactor designs, being able to mass manufacture components for lots of smaller reactors, the cost per megawatt would drop like a brick, and Nuclear would easily outcompete all other forms of power generation due to its superior low maintenance costs. So you wouldn’t power 94 million homes, you’d power far more, and actually create a shitton of high paying high tech jobs to build the darn things. A reminder that Joe Biden announced another $3 trillion infrastructure plan.

At some point the entire planet is going to wake up to this. Uranium isn’t actually rare – the stuff’s in the ground everywhere. Sure, as an element on the periodic table it’s relatively rare, but we can continue to build reactors for the next 200 years and only then start to run out. Since even the monolithic reactors have a life expectancy of no more then 50 years – there’s plenty of time left to start building like crazy.

And once electricity becomes truly abundant – it’ll unlock all sorts of new industry we cannot even imagine right now. For example, in a report from 2015 it’s mentioned that for the US aluminium industry, electricity costs come to a third of the cost of producing a ton of aluminium.

A third! Imagine if electricity was so abundant it was damn near free, the US alone could increase its output of aluminium by 33%, decreasing the cost of all aluminium products by 33%. Plop a few mininukes nexto a few smelters and voilà; massive competitive advantage. Just like the Ukrainian Aluminium Smelter industry which they placed next to a bunch of hydroelectric dams to get cheap power.

https://theconversation.com/the-trouble-with-aluminium-7245

This article from 2012 has a good example of what could be:

“It is true that a lot of energy is required to make Aluminium. CSIRO calculate that the embodied energy (all the energy used to make the material) for aluminium is 211 GJ per tonne, compared to 22.7 GJ per tonne for steel. This huge difference in overall energy required to produce the metal helps explain the enormous difference in the scales of the two industries: last year, nearly 1500 million tonnes of steel was made in the world compared to 40 million tonnes of aluminium.”

Once we introduce economy of scale into the nuclear power industry, and we discover that lack of abundant electricity was the thing holding humanity’s progression back – power usage will never go down. Once the Aluminium industry is as big as the Steel industry, and Aluminium is found in an order of magnitude more products – Humanity won’t ever be able to scale that industry down any more – which means we’re required to keep building Reactors to feed it.

This was going to happen anyway – my longest term predictions all include Fusion power. In short, if we don’t get fusion to work, we are screwed as a species. On the other hand, once we get fusion to work, power will be so abundant we will be saved as a species. And it’s a shame we can’t just work towards that goal since it’s now so close, and only requires a re-allocation of funds, not some strange magical technology we know nothing about. Willpower is all that is left, and once humanity discovers abundant power, the willpower to ever let nuclear power go will not be there.

So while it’s inevitable that Peninsula, as well as the entire sector, becomes overbought and i’ll sell someday – it is my hope that that day will come either long after i’m gone, or because the first commercial fusion reactor started operations and nuclear power will be phased out over the next decades. I won’t ever bet against human innovation, and necessity is the mother of all innovation. Once we discover how much we need abundant power, we won’t ever give it up again.

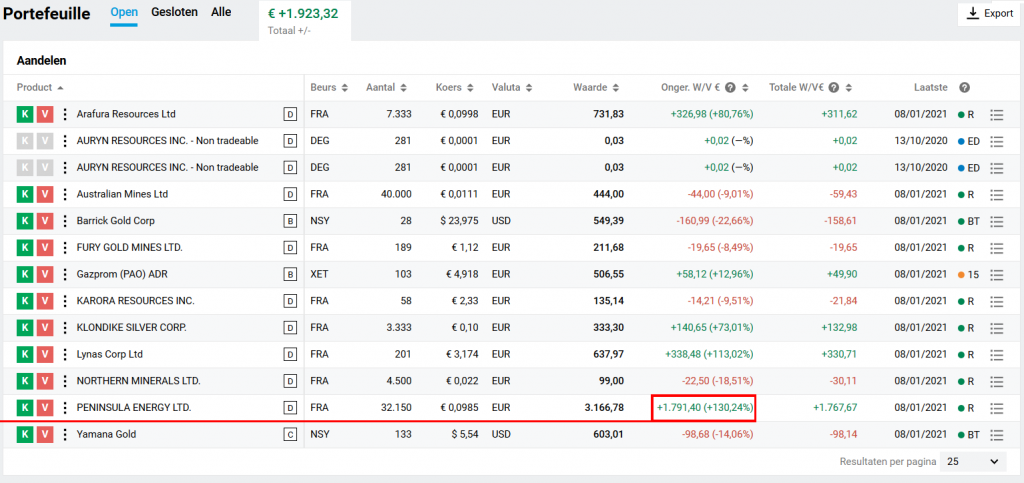

I hope you enjoyed this presentation of the best stock pick I encountered in 2020, as well as my views on the coming Uranium bull market and humanity’s future! Here at the end, i’ll post my entire portfolio, to show how well the stock has done for me by Friday the 8th of January’s close, as well as show the rest of my investments as i’m sure my followers have been curious for a long time.

NOTE: I DO NOT recommend investing in any other stocks I have other then Peninsula, as I wouldn’t feel right doing so without individual presentations of their own.

You don’t know why I bought each stock, so you don’t know how long i’ll hold or why I have it in the first place. Feel free to try and find that out on your own, I encourage research, but I discourage blind faith. Though I will say if i’d add to anything outside Peninsula it’d be gold companies/producers. Also keep in mind my stocks are in Euros and the Euro is quite strong right now comparatively. So without further ado:

If you would like to hear more about such finds as Peninsula whenever I find them, come join the Desogames Community! It’s all integrated with my Twitch; www.twitch.tv/desogames – as my main focus is growing that community. By getting a monthly sub you get access to the community section of discord as well as sub only streams where I’ll present finds such as this in a structured manner a week before public release – and you’ll be helping me out with my passion beyond just money! I’ll also later integrate a newsletter, which becomes a password protected article on my site and the password will be mailed around via the Twitch mail all subscribers function.

Every Saturday will be a subscriber only stream where I look at suggestions my subscribers throw my way and analyse the company live on stream for all to benefit from. Should I find an exceptional company i’ll also present it in the same manner as Peninsula. As I wish to grow the channel and i’m sympathetic to the plight of the poor; ALL content locked behind a Tier 1 or 2 sub becomes available for free one week later, after the release of the next locked content. For the highest gains, speed is of the essence, so that’s what you pay for.

For the earliest possible access to my research and finds, there’s the Tier 3 sub, which gives access to the VIP research channels on discord. Often i’ll be busy but find stuff too big for twitter, and I’m using those channels for notes and sources collection. If I find a company like peninsula and I think its good, even before writing an article i’ll talk about it there. I eventually hope to create a core community of researchers to start generating real wealth and value for all. Naturally – all this stuff is locked and hush hush until it’s ready for release.

I’ll also be posting first drafts of articles there (not including books or premium paid for research), while the community at large doesn’t get to see them after a 2nd and 3rd draft minimum. This is for the community’s own protection as my opinion isn’t set in stone at that point and people should do their own research – but if done with haste it’ll always beat the time I take to write an article.

Finally, if you wish to catch me on the Daily, please follow me on Twitter.com/Desogames where I post updates about ongoing (public) research as well as any news I come across. Longform articles can be found on my website Desogames.com – as well as how to find other places with content outside of Twitch and Twitter (and a future archive with links to all my produced content).

I thank you for reading my presentation and your time, and I wish us both luck!

– Kirian “Deso” van Hest.

You can find me at these places:

Twitter (For daily stuff and contact!): https://twitter.com/DesoGames

Twitch (Finance and Games!): https://www.twitch.tv/desogames/about

Youtube Channel (Future repository for video content): https://www.youtube.com/channel/UCLVuYr6ahkoDu3yrPflStKA

Podbean (Via which i’ll distribute Podcast Audio content):

https://desogames.podbean.com/

THANK YOU FOR READING AND YOUR SUPPORT!!!!!