I never liked Bitcoin. Hated it from the start. Not because of its lofty goals of providing a mathematical limit to the amount of money printed so that politicians would be unable to print more. In fact that is one of the many considerations I’ve held in the back of my mind trying to decipher economics and develop systems that keep society going down the right path; That the possibility exists to mathematically limit the currency in some way. That alone makes Bitcoin’s invention itself a value added to this world. But that is not the coin in operation. Why i hate Bitcoin is because the coin has no value of itself, making it Fiat, yet A LOT of energy has to be expended just to pretend that it does have value. Bitcoins are printed just like a Dollar is printed. The only change is that we’ve replaced the person printing it with a cold uncaring god called Mathematics, which cares not for our cries to have more currency.

When Bitcoin arrived on the world’s stage i already had experience in tech and economics. Having done a system administrators education from 2003-2007 (simply because i was already good at computers and i needed some form of diploma), and keeping up to date with tech thereafter i came across Bitcoin the moment it got big enough to reach the first tech specialized websites, which i think was between 2009 and 2010. At the very least i was aware of Bitcoin and had already dismissed the concept as unethical before the 10k pizza purchase, which is a well known event within the community. At that point, besides having seen the odd documentary throughout my teens, i dove deep and hard in to economics after the September 2008 crash so i already read and watched quite a bit on the subject before i read about Bitcoin. Naturally being involved with Tech I’ve also followed Bitcoin throughout it’s lifetime, as crypto became quite the hype within the tech community. I’ve ready quite a few debates since then while never forgetting my initial impressions, all the while during deepening of my knowledge of economics as far as it could go.

And i want to say up front; I gave it a fair shake every time Bitcoin became bigger and more people saw value in it. By my very nature (bio coming soon!) i am in continual self doubt, so i think that I’m wrong quite a bit. I’ve considered being wrong in Bitcoin, and I’ve come to find that there is value in both trustless transactions as well as distributed ledgers where i dismissed both initially. However, both are separate things from the current implementation of Blockchain Currency – all based around Bitcoin – as well as the bitCoin itself. And every time i had to run through bitcoin back to front with more knowledge then before (most of the time when trying to invent a better alternative myself with my supposed better understanding of economics), keeping in mind i was wrong, i came to the same conclusion every time anyway. The coin is worthless.

So forgive me if i first indulge in explaining the economics behind Bitcoin and the flaws within, before i move on to why Tether will be the death of it. Because it’s important to understand it’s provable in multiple ways that Bitcoin has no value in and of itself. The energy used to generate Bitcoin does NOT “back it” as some suggest, which i shall deal with later. First let me offer an original argument, a contradiction that lies within Bitcoin, and why it can never be money. It cannot even truly function as a currency. This because Bitcoin, like all blockchains, Is Not Fungible.

Gold is Gold is Gold. This is the basic concept of Fungibility. It means that 1 grams of gold is as good as half of 2 grams of gold, regardless of shape, size or condition. Yes there are differences in the price of gold depending on shapes, but this is for reasons other then fungibility. For example coins have collector value because of Sentiment, not the Fungibility of the gold. The latter simply makes sure you can sell the coin at the same place you can sell bars or jewelry made of gold. And for something to be money, it has to be fungible.

Or, to put it very bluntly: I can take a one ounce gold coin, fuck it up with a hammer and still – provided it’s in one piece or i collect all the pieces – get the value of 31,101 grams of gold out of it. Sure, i might have to pay a laborer a slight premium over a functioning gold coin due to the unworkable shape and the effort required to reshape it, and naturally the collectors value is lost. But this does NOTHING to the value of the gold itself – the price drop is merely because of the unwieldiness of the object(s) previously known as a gold coin and the desire of people to store their value conveniently as well as the loss of Sentiment.

Feel free to put a Bitcoin on a USB stick and hit it with a hammer to see if it retains it’s value.

Now, you can argue this is the same with a Dollar: Burn it and it has no value. Well, no. The United States Dollar as it’s full name is, is backed by the full faith and credit of the United States Tax payer. The value in the note isn’t in the actual note. It’s not even the words written on it. Certainly isn’t “in God we Trust” (well you better since you certainly can’t trust the Fed, but those are articles for another day). It’s the few numbers and letters that make up the Serial Number on that note.

Everything else on the note is either there for convenience or anti-counterfeiting measures. The numbers aren’t even needed, people know a Benjamin Franklin is $100, that is to say notes with the portrait of him. If you really wanted to go through the trouble, you can write down the serial number, burn the note, call up the Fed, let them know which number is out of rotation and what happened to it; and they can just reinstate it to you by printing a new note with that serial number. Because the real dollar isn’t the one you burned, it is the databank entry connected to the serial number on that note. Most likely though, they’ll just give you a new note, delete the old serial number from the databanks and add a +1 to the next batch of notes they print. Automated systems and all.

Why not? Just because a system for consumers to do so hasn’t been physically made (because it’s a stupid value proposition, just don’t burn notes) doesn’t limit any central bank from doing so. With this i mean to say, it’s the Serial Number that makes a Dollar Verifiable, and it’s the central authority that makes it Fungible. A dollar is a dollar is a dollar because the Federal Reserve says it is. And the serial number allows them to say so and keep their word. Verification and Fungibility are two KEY components of any currency (with gold, its the physical properties such as weight, density etc). oh and by the way, Money is just currency with a intrinsic value of its own (I’ll eventually write a book about it!) so feel free to just use it interchangeably as long as all participants of the conversation are aware of the difference.

Bitcoin isn’t Bitcoin isn’t Bitcoin. >A< Bitcoin is >That< Bitcoin is >That< Bitcoin. You snooze you lose. That is to say, If you actually put a Bitcoin on an USB stick and smash it, it’s lost forever. Since the verification is baked into the coin (it can only be used within the bitcoin software system and if only one copy exists it’s gone), if you can’t offer the coin to the system, the system will not refund you your coin. Start adding theoretical (But possible) situations into the mix and it gets weird quick: What if you print out a Bitcoin?

In the case of the Dollar that’d be counterfeiting and you go to jail. Your printout is not a dollar because the central authority says so. People might not like it, but some sort of central authority always exists, even if it’s the average of the collective vote, or a software program. But if you print out a Bitcoin there’s no way to say it is or isn’t a Bitcoin (If it feels weird thinking about sheets with 1’s and 0’s, imagine Punch Cards for old mainframes or self playing pianos instead). If you print it out twice, and if you can scan it in twice, the first instance of the coin will transact – But the second instance will return an error; Something like “this coin is not in this wallet” or anything equally digital sounding.

Even if you consider the first print out the original because of chronological order, and scan in the second printout first, the system will happily transact the “counterfeit” Bitcoin for you and it won’t return it either when you complain offering the first scan with a date as proof. In this case, the central authority is the software, and the software is telling you your Bitcoin is not fungible, because the papers cannot be interchanged for bitcoins, merely for one bitcoin, yet both papers are accepted as a bitcoin anyway. By that i mean, you could print out a bitcoin, exchange the paper for another bitcoin, transact the digital bitcoin before the paper is deposited, netting you 2 bitcoin and making your paper promise worthless – except it’s not a promise. It is literally the bitcoin; the sequence of 1’s and 0’s in the right order that so much energy was expended to obtain. Should you choose to keep your promise, the other person can type it in and transact with it as if it was the bitcoin, because it is. This breaks verifiability too, because now a bitcoin is not a bitcoin is not a bitcoin.

With Gold (or any material good) it’s no problem because you cannot digitize it in the first place, so you can’t print it out either. You can only digitize a promise to that commodity, and as long as gold isn’t digitized it remains subject to physics. As a central authority physics says that gold is still gold, no matter what form it is in. Digitized promises, just like the gold standard is a paper promise to a good and is only as good as the promise, not the good backing it. This is also one of the reasons i don’t think we’ll ever see physical money again because it has lost the convenience race to digital assets, but i digress.

So what is Bitcoin fungible with, if not itself? Well; Data storage capacity. Whatever solid state cells or magnetic bits on a hard drive platter that hold the sequence of Ones and Zeroes that make up a Bitcoin. Copy those states, and you copy the coin. Copy other sequences and you can duplicate the sequences. Two times two cells is the same as four cells, offers the same value, the same amount of storage, the same… or well, similar performance, but not every gold coin has the same purity either. In effect, it’s fungible with the Digital Dollar as it also uses up storage space – Minus the centralized authority cause that’s the whole point. Therefor, it’s value is the same as the data storage capacity it occupies, not the energy it uses to be sequenced in the right order within that storage capacity. It if wasn’t, if it was tied to digital storage, it could never be copied to another medium. In effect, the CTRL+C and CTRL+V action would have to be a blockchain action itself, with the previous copy requiring to continually exist. This means it is fungible with all other digital media, which all also consists of 1’s and 0’s that can be copied into the same space.

Yes, i know that brings with it alot of other complications for digital media, but again, that’ll require a book of its own. This story REALLY is long enough already. For now let’s stick with Bitcoin. Since the Ledger is about 301 gigabytes big as i write this, the entire intrinsic value of Bitcoin is about $75,25, taking a conservative $0,25 per GB of SSD data storage. Conservative because data storage technology continues to improve and the price per gigabyte continues to go down.

This together with my punch card example should already prove conclusively that Bitcoin is NOT backed by the energy spent to calculate it, but don’t worry, I’ve got more ammo to fire. I’ve even got a live experiment: This time, rather then printing it (which was a more absurd example, as i find Reducto Ad Absurdum a good way to show logical fallacy), we Copy it Digitally as Jerome Powell would say.

This time we make a backup by of a wallet containing crypto currency inside. Pressing Ctrl+c and Ctrl+v with a wallet containing crypto currency selected in Windows or an operating system of your choice will do. Naturally, this takes only a fraction of a second. Then, rather then opening the original wallet, we open up the copy of the wallet. Then, we transfer the Crypto currency out in an transaction. And while this makes the coins in the first wallet now worthless because the software has protections against double spending, this is not the point.

The point is that the system just accepted a Bitcoin created with the energy equivalent of not even a fraction of a fraction of the original. The supposed value originating from the fossil fuels burned attached to the original sequence of 1’s and 0’s is lost. As I stated, the real world value of digital 1’s and 0’s is the storage capacity of those 1’s and 0’s. Aside from storage, the only thing that makes the sequence special is it’s uniqueness; only that sequence is accepted. Once the sequence has accepted, feeding the same sequence from the same location into the system is rejected.

If you argue the value was transferred with transaction of the copy, you agree the coin itself is worthless; A separate sequence of 1’s and 0’s was accepted and only the transaction has value. This is fine! There is value in transacting… But this makes the coin itself Fiat. And now it also means the value of Bitcoin is the utility value of it’s ability to transact compared to other Fiat, and that makes it worthless compared to either regular fiat which is vastly more efficient and scalable or far more efficient crypto if you want to use cross border finance as an example.

As the late Billy Mays would say though, But wait! There’s more! Let me offer another conclusive argument why Bitcoin is in fact not backed by the energy spent on it. And this time it’s built into Bitcoin itself so it cannot be denied. I ask you this question: What where to happen if we turn off 99% of the machines on the Bitcoin network?

The answer is of course that the Hashrate craters, and the Artificial Difficulty adjusts down to compensate for it. We’ll ignore the economic chaos such an event would bring with it, think more like 1-2 years down the line when things have stabilized and Bitcoin has basically had its growth reset to 2013. Now there’s a whole bunch of economic reasons why the artificial difficulty should go down, and I’m not arguing that it shouldn’t.

My whole point is: You can achieve the same with less energy. Or in other words, it IS possible, very easily so, to achieve the same amount of transactions, and mine the same amount of Bitcoin equal in value according to the central authority as earlier mined bitcoin which took more energy to mine. These new Bitcoin would be mined with a FRACTION of the energy that it requires right now, by doing nothing more then switching off 99% of all machines mining it.

This is important because for Gold as well as every single other real world commodity, this is absolutely not the case. Proponents of Bitcoin will say that everything is backed by energy, and because Bitcoin uses up energy to mine it, it has value. This is simply not the case. The UTILITY value of energy gives the energy its value. For example, had modern Diesel been available in medieval times, it wouldn’t have had any higher value then wood. Because humanity had no other utility for it other then heating or creating light. Oil lamps existed long before anybody thought of making an internal combustion engine. You can’t argue they could’ve used it to run industry or cars when there was no industry and there where no cars. Only all other inventions leading up to the invention of diesel, the constant growth of energy utilization is what gives diesel its modern day value.

The fact that energy is transmutable into so many useful things gives energy itself its value. Oil has insane amounts of utility value. Especially since you have to realize “energy” doesn’t exist. It’s always a collective term for a bunch of resources that provide transmutable work if they are consumed (Oil is certainly not Uranium, but they get lumped into “energy” all the same, for they both are capable of generating it). For gold, Assuming the same mining equipment (This equates to technological advances in Bitcoin mining rigs), and naturally the same mining grade rocks, the cost of Ounces Of Gold Per Barrel Of Oil is always the same, because it’s governed by physics. The process of extraction always remains equally energy intensive, using the same equipment and techniques. Scale does not matter. Shut down 99% of all gold mines in the world, gold output will plummet and the price will go through the roof. This is not the case for Bitcoin.

But this goes to the very essence to why commodities have value. Utility comes first, that’s why energy ranks highest. Scarcity comes after; you want as many of the valuable thing as possible, and you use Utility to rank what resource you’re willing to spend to extract or create what other resource. If diesel has more value then gold, diesel will not be used to extract gold. Oil is cheap now, so we’ve been using it as a base of energy for a century, but it won’t stay that way and the people in charge know it. That’s why the world is moving to electrification and central generation of electricity. Forget climate change, economics is the reason to move to EV’s and carbon neutral, aka Nuclear, power generation. If it doesn’t look that way now, give it another 20 years.

But i digress. The point is, if we’d turn off 99% of all Bitcoin machines, the transactional capability remains the same. We shut down 99% of all drills in all mines and fire 99% of the people working there, the production and availability of gold craters. The energy use in both cases cratered by 99%. Bitcoin is NOT tied to energy.

Which puts it back in league against Fiat, but as I’ve stated before, the utility value of Bitcoin is vastly lower compared to that of other fiat. It’s acceptance in locales is extremely limited to both international fiat such as the USD and local fiat currencies of nations. It can only function as an intermediary between crypto exchanges – which themselves serve as intermediaries between Fiat banks and the crypto end user. In other words, the only reason why people use Crypto to escape their local currency is because they want to convert it to another local fiat currency which they aren’t allowed to hold or isn’t available in their part of the world; Usually the Dollar. But then again, a large portion of the value of Bitcoin (or crypto in general, again, currently) comes from Crypto’s ability to convert between Fiat. Where that ability limited the party ends right quick. Say for instance when the US government decrees that no fractional reserve bank can convert dollars into crypto or crypto into dollars or face Russia type sanctions.

Again, we return then to Bitcoin’s value being tied to its transactional capabilities. Which at the time of writing averages 4 transactions per second. This is not a typo. To do so, it uses up an estimated 72 Terrawatt hour per year. According to https://digiconomist.net/bitcoin-energy-consumption/, this is comparable to the energy use of the country of Austria. This means the entire country’s electricity use, all 8,88 million people and all industry within, from the smallest nightlight to the biggest smelter. Imagine giving the country of Sierra Leone, with it’s 8,1 million inhabitants, the energy budget of Austria. The amount of poverty and suffering that would change in that nation alone and through second order effects in the nations around it. Instead it powers 4 transactions per second.

SWIFT, the international banking system, does 173.6 transactions per second. That is just the highest level banking system, between countries. Visa does 1700 per second. Both certainly don’t use the energy of a small affluent country to do so. So compared to those two alone, the utility value of Bitcoin is vastly lower. Even if it’s not zero, it certainly isn’t more then a few bucks. For reference, currently Bitcoin’s market cap is half that of Visa.

Since the real value of blockchain currencies currently lies in the transacting only while the coins themselves are valueless, this brings another problem to the table which i like to call the Next Transaction paradox. Meaning, if for some reason you cannot transact with Bitcoin but the coin itself still exists, what is the value?

Zero. Because Bitcoin derives it’s entire utility value from its transactional capabilities. The coin itself, if the network is dead, is completely and utterly worthless. Without electricity it’s worthless, without internet it’s worthless and without solid governmental support (AKA the government promises to leave independent crypto alone or actively support it) it is still worthless. Should the encryption of Bitcoin be broken (hacked), as unlikely as that is, it also becomes worthless.

This might sound silly but it is actually really important. Intrinsic value is the basis of all human perceived worth. Meaning; Humans don’t believe something is worth something if it doesn’t have some intrinsic value. Now, humans are generally stupid and as such easy to convince something has value when it doesn’t. “Snake oil” salesmen have been around since the beginning of barter. But that doesn’t take away from the fact that they need, at the very least, that perception of intrinsic value or otherwise even the most gullible customer won’t believe either the lie, or even the truth. Good luck convincing anybody of the truth if you cannot prove the intrinsic value of that truth.

It is important to keep the General Perception of people in mind. This perception of Bitcoin has already changed over its lifetime. Until after the January 2018 peak in the Bitcoin price, the most heard narrative when it came to Bitcoin news was, it’s going to be the next evolution of Currency. Shops would soon accept bitcoin and you would pay for goods with bitcoin directly. Some shops did, the number grew and the growing number was frequently reported on in general news (while closures, not so much). Ten years down the line and not much has changed; growth has stalled. So Since about 2018 the narrative has changed to how big the network already was, and how much computing power it represented; all the machines calculating Bitcoin and by extension the energy being used, rather then merchant or end user acceptance.

The idea that Bitcoin is backed by the energy the network uses, while surely not new (i do not hang around in the crypto community so my perspective is that of an outsider, as always) hasn’t been hyped up in the mainstream until this year. In fact this hype evolved out of concerns of skeptics over how much power Bitcoin was using for the services it provided, which was then turned around into “this is a good thing”. The comments that i see getting upvoted by the masses have definitely changed to this narrative. At the time of writing, the entry of a few new companies taking up multi million dollar positions in Bitcoin is being touted as the next big example of demand increasing. With a star investment position of $425 million currently.

At the same time, Tesla is 9 times the market cap of GM, produces 1% of their number of cars, never turned a GAAP profit, sold half the EV cars that GM did in China during recent times while slashing prices within China 7 times in recent months amid negative press of their safety and build quality; a roof flying off on the highway and bumpers falling off while driving. And on the 14th of October their price closed up 3,28%, +$14.65 per share, times the total shares of 931,81 million = $13,651,016,500. In a day. While the Nasdaq closed down -0,8%.

What i mean to say is that it doesn’t require much to have somebody throw any kind of cash at anything in a Mania with an ocean of liquidity floating around. Unless you’re Silver.

My point is objectivity doesn’t matter to the perception of intrinsic value; It’ll last as long as the fantasy can last. Then one day a “reality check” comes, meaning the fantasy ran into some real world production limit that permanently caps the supposed permanent growth, and the price adjusts closer to that intrinsic value; Usually substantially lower. In short, if the public perception gets reset by the fantasy hitting a brick wall such as a big name within the space exploding and the real world consequences of that, those changes are always violent and always get people hurt. Which is very unfortunate, hence the stern warnings of some.

Just to put another nail in the value coffin, crypto currency can be “forked” too. This means that somebody just copies the entire Blockchain up to a certain block and then continues to mine blocks separate from the “main” chain. This can be done for instance if there are updates to a network which some users don’t agree with (and I’m going to conveniently ignore the fact you can “update a currency” completely cause I’ll gnaw my own leg off at this point), so they continue on a copied chain under the old rules. Bitcoin Cash and Bitcoin Gold are such forks of Bitcoin, with Bitcoin SV being yet another fork of Bitcoin Cash. Since after a fork, all accounts retain the same amount of currency in their accounts as under the old chain up to that point (since it’s a literal copy of the chain), as long as people consider the copy to have any sort of value, it is literally like printing money. While it’s a very circumstantial way to print money, one that’ll collapse quickly if it starts happening too often, Bitcoin Cash still has a market cap of $4,7 billion, Bitcoin Gold $141 million, and Bitcoin SV $3,1 billion.

But since the Bitcoin Blockchain was split in two, IF Bitcoin was backed by the energy spent on mining it, then the value would’ve been split in half too as the currency supply representing that energy doubled. And as such, Bitcoin and Bitcoin Cash should each be worth 50% of that energy. There are 18,5 million Bitcoin and 18,5 million Bitcoin cash out there, but Bitcoin Cash is worth $253 per BCH, while Bitcoin is worth $11,440 per BTC at the time of writing. And in its entire history, Bitcoin Cash has never approached the value of Bitcoin – even at the moment of creation it was instantly worth half of Bitcoin and the spread between the two has only increased since. This is yet more proof each Bitcoin (or any fork of Bitcoin) is not backed by the energy originally spent on it.

And all of this so far has only gone into the intrinsic value of the coin itself. I do this because many other crypto share many of the same flaws of Bitcoin that I’m arguing against and i don’t wanna type a dissertation on each and every one of them. So NO NEED to ask me “hey what about this coin?” because at this point i consider it all fruit of the poisonous tree, if not a ridiculous buzzword because anything with “blockchain” gets VC dollars thrown at it to try and make a quick buck by selling to suckers before it implodes. Let me also shine a spotlight on why having a pure deflationary currency is also completely asinine. Because EVEN IF the coin had value and functioned properly, which it doesn’t, it could never function as a currency or backing of anything else because of eternal deflation causing an eventual inevitable crash.

Many people misunderstand inflation. I’ve written about this before (see my QE is inflationary article Here). But many people, including pretty much everybody in the “professional” economics trade misunderstands deflation even harder! Every central bank certainly does. So let me dig into deflation, so there can be no misunderstanding.

Just like inflation is the increase in available money supply, deflation is the decrease in available money supply. Since there is more or less of a good, the price of that good goes down or up. Austrian economists would agree that’s the dynamic of supply and demand acting on the currency, though i dare not label myself as part of any specific school. I continue to be an independent actor as I’ve always been forced to be.

Usually, this deflation is brought about through the contraction of credit. Therefor people have come to see the contraction of credit as causing deflation, and every central bank has printed kitchen sink levels of currency to try and prevent it. To lighten the heavy economic load so far I’ll let Batman do the talking for me here.

The reason it doesn’t work is because they’re putting the cart before the horse. A credit crunch doesn’t cause deflation, it is a result from the natural forces which cause deflation. Credit contracts after deflation starts, not the other way around.

The problem arises from eggheads, beancounters and straight up math nerds not being able to quantify those natural forces in numbers, that “invisible hand” in the market that flips the sentiment from expansionary to contractionary. This has lead to to put it mildly, severely misguided policy. Rather then try and work with descriptions; the data driven nature of crony capitalism has simply abandoned trying to describe them wholesale; and grabbed the first numbers based second-order effect it could find; namely credit contraction. So let me begin by describing what really causes credit contraction: Credit expansion.

This might sound overtly simple, but it’s true. Human nature is such that some people, in fact most people, are quite bad at estimating or innate chance calculation. If you buy an uncommon object, meaning one most people wouldn’t buy often and thus have no experience in estimating its value; Then and walk around on the street asking random people what its price is, you will get wildly varying answers. Now, if you average all those answers out you get something amazing: With a large enough dataset, the average price will be very close if not exactly what you paid for that object. As i understand it, that’s at the basis of the “Efficient Markets” theory.

Which is also a load of horseshit. Because it doesn’t take into account that you’re dealing with alot of individuals who don’t KNOW what the average is, because they’re not Borg. They don’t hear what everybody else would pay for a object in their head. It completely ignores human behavior and the dissemination of knowledge over time, like so much economic theory does. If the truth is snowed under lies, no value is estimated correctly.

Let me hit you with some real world experience. I ran with some people who built up a multi-billion fortune from absolutely nothing in a few years. Namely a few people who had played Diablo 2 for years and had amassed a great wealth in perfect or near perfect gear. Now you might laugh, but time spent is still time spent, labor is still labor, and video games (especially the early ones where economic theory wasn’t much a consideration yet) turn out to be perfect microcosmic simulations of society at large. After all if your ingame economy doesn’t function properly, nobody will play the game, because that’s not fun and there are plenty of games where it does function. And games still cost alot of money to make, so you want them to be successful.

Here, the amount of ingame wealth they had accumulated couldn’t have possibly come from just playing the game and keeping whatever gear that dropped when a boss died. Since the game itself works with a very low chance on an extremely large amount of items, the idea behind Diablo 2’s endgame isn’t actually running endless boss runs until you get the items you want, though that’s still part of it. The real end game is trade based on unknown values. Which is why, after all these years, one successor down and another one in the works, the game is STILL played heavily by a core audience (and Diablo 3 will die when Diablo 4 comes out, because they killed the breath of that system with the ingame auction house which it never really recovered from).

The reason my friends where able to get such amounts of money was simple:

They Scrooged people.

No not screwed. Scrooged. The key difference is simple: People had no idea how much an item was actually worth. So they walked away satisfied – not screwed – but still severely underpaid.

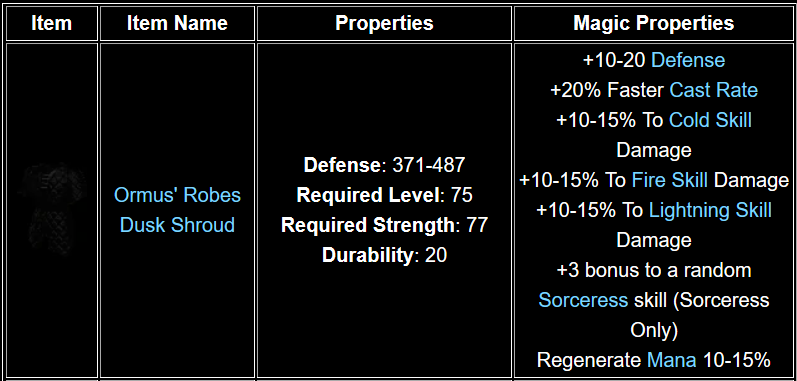

And how could they understand the value? How do you know how valuable +15% fire spell damage is when you’ve never played anything that uses spells or fire in the game? Suppose the first class that you play that reaches the level where the really valuable gear starts dropping is a Barbarian, which for the people who don’t understand the context; just smacks things with a bigass weapon. You spend a day or 3 doing boss runs, joining games that are basically just automated runs, having a good time of it, then this drops:

Without a way to look up price, if you don’t know how valuable it is or how valuable the items you’re getting in trade are (or don’t even look it up so you have no clue what it is), you have no way to gauge price. This is one of the reasons why Barter was replaced by Currency-With-Intrinsic-Value AKA Money AKA Gold/Silver. Easier to determine value of goods if you have a guide in the value of the intermediary (which is why a stable currency is so important). If you’ve played multiple characters, spent quite a bit of time trading, and have come to understand what each modifier does, you can price things more correctly (more because absolute price does not exist due to all trading being human). Looking at this item in a vacuum as i don’t think many people will have played Diablo 2 intensively these days, you would think the real value lies in the +45% total damage across the elements. Since Violence is something that’s less abstract to us then “regenerate mana”.

This is exactly why my friends made ungodly wealth. Because that’d be completely wrong. The way the game is played is usually with a focus on 1-2 specific abilities which synergize well with specific gear. Say, a “Frost Orb build”. It would use no lightning or fire damage. The real value lies in both the +3 to random skill, making for example the Frost Orb much stronger by increasing its level (and thus level up its damage) by 3 levels beyond the maximum attainable through experience levels, as well as the +20% cast speed – quite an insane stat to have on any armor. More attacks per second also translate into higher damage output, but in an more abstract manner. We understand 1×43 better then 2×27.

So you would sell that item to my friends for a high price. They’d try to lowball you, but you’d have none of it! You want a high price for such a high damage item, and by god, you’re gonna get it! And my friends will pay it after haggling it down a few percent. You feel like a boss because you didn’t take any shit from these morons, didn’t let them haggle you down and you got more then you where willing to pay for, walking away from the deal saying to yourself “Hah! Suckers! i would’ve taken half that!”. Idiots with their shiny plates.

My friends would then go around and within minutes in another game sell the same item for either 50x or 49x times what they paid you, depending on negotiations with you. Yes, easily that much. If they where nice. The moment they learned you knew nothing of items you could be sure the items you where offered had very high stats that looked good but in practice where worthless, and we’d talk about 100x-150x multiples on a single trade.

All of them where good at the game and had played alot, but all of them had also become rich by simply trading up. That’s what i mean by Scrooged. I don’t think my friends ever made a single trade where the other person walked away feeling screwed, even though they technically got screwed hard and i’m sure many of them ended up hitting themselves in the head once they had more experience. Which my friends considered offering a life lesson, by the way. But the cold hard truth is: Far more people will never ever realize that they made a mistake, much less the depth of it, and will always feel like they’re getting the good end of the deal. A trade where both parties walk away satisfied is a good trade. Ignorance is bliss… but it’s also why most people remain poor.

Now, the point of this little story is simply that ALL people are really bad at estimating value, a few are just substantially less bad then others through either experience or innate talent. This includes investors at so called “Venture Capital” firms. Better called “Educated Guess” firms because that’s what they’re really up to. Even my friends who became really rich ingame are in the end bad at estimating the value of items, because even with their amassed wealth, there’s always a bigger fish (which is a story for another day). No matter how good you are somebody else is always better, you just have not met them yet; and pray you never will. There’s always somebody who works harder at finding the right price to profit off the spread with people who don’t know the right price. And there’ll always be people who get it horribly wrong.

To bring the human nature story back to Credit Expansion and Deflation; As credit expands and more money enters the economy, it always extends too far because there are always some idiots who go too far trying to make a buck. This doesn’t even include fraudsters, even with perfect protection human nature would cause it to happen anyway. Naturally, a bad idea will always remain a bad idea, and at some point it will implode. And the whole point of credit isn’t to extend it. Something that also seems lost on modern central banks. It’s to get all your money back with a tidy profit made off interest, which you charge to cover the risk that you might not get your money back. While on the other side of the trade, value is supposed to be created that survives the payback time of the loan; at which point it will add value to society that couldn’t have existed otherwise – which is what gives the process of lending its true utility value. The time compression of earnings, repaying a large amount over time and being left with the materials after repayment that allowed you to repay the loan in the first place; To use them to further increase your own capital which you couldn’t have done without the value time compression of the loan.

Naturally, once a bad idea implodes and the credit extended to that idea is defaulted on, the money invested is lost and the lender of that capital must take a hit; Known in our era as a “Write-down”, where the asset is scrapped off the balance sheet and the company incurs a cost. Here we meet another law of trading, namely that Money Can Only Be Spent Once. Once the capital on a bad idea is lost, it cannot serve as a basis for a new loan.

In other words: Credit Contracts because of losses incurred by lenders who cannot lend money twice after overextending themselves on bad bets. And will continue to do so as long as the bad bets remain within the system.

This this is an effect of human nature, this same behavior can be found on a societal level. On a local level, it happens all the time. But on a regional or national level, situations must align for this to occur. In other words, there has to be a reason – information wise – why everybody is either exuberant at once or hysterical at once. This is why we speak of Manias and Panics.

As an FYI, a “Fed Put”, or “Q-E Infinity” are both pretty good national informational reasons for participants to be exuberant about markets.

Once a lender has lost that capital and cannot lend it out again, credit creation lows down, which is logical. I’ve only described one loan but equally logical, there are many loans out there, many will end up overextending themselves and many will end up going bad in time. Again, logically if a lender of such loans incurs too many losses, he’s going to stop making loans. Assuming the losses aren’t too big to cause bankruptcy, in order to save money all a lender has to do is stop making new loans and wait a while for existing good loans to repay themselves. After all, the interest is fresh money, which can then be used as principal. If it’s not lent out it immediately goes to reducing leverage by increasing the asset side of the balance sheet vs liabilities remaining.

But this means total credit available contracts. Good borrowers can’t get a loan either, not because the lender wouldn’t want to give them a loan, he simply doesn’t have the money for it or has to reassign that money to reducing leverage through reducing liabilities. No matter how many “reserves” they have, it’s not the amount of liabilities that is the problem, the problem is on the assets side (specifically a lack of assets) so further increasing liabilities does not help – until the time where it starts to actively hurt due to the artificially increased scale of the economy. Looking at you, Federal Reserve. Can’t fix too much debt with taking on even more debt.

Naturally what happens or what is supposed to happen is that frivolous spenders get punished. Those who far overextended themselves and their credit will get hurt by the sudden stop of available credit. Naturally the rest of their loans, kept current by the availability of fresh credit, either have to be paid down by generated income AKA work, or must be defaulted on.

At this point it’s not hard to contemplate the chain reaction that would follow if there where alot of frivolous spenders, since their defaults would cause credit to contract further. THIS is why central banks are printing like mad, because the governments of the world have been the frivolous spenders which the central banks have enabled all the way, and there will be hell to pay once the people find out or the party ends on its own. But another day survived is another day survived.

Because money goes to paying down credit but no new money is entering the system in the form of new credit, the total supply of money for the economy available must contract – *unless* manually expanded. Which is what central banks have been doing and why there hasn’t been any actual deflation in 2020, even though consumer credit contracted severely. As I’ve explained now, credit contracts because of human nature. It contracts because stupid people made stupid bets that blew up and value was lost.

Deflation rewards frugal savers. Because credit contracts and with it the money supply, the people who DIDN’T frivolously spend, the savers with cash in the bank, become relatively richer. Because there is less currency around, the value of currency versus goods goes up, exhibiting itself in falling prices of consumer goods. This causes people with money in the bank to gain even more money. Thanks to one Ben Bernanke, the whole financial world is afraid of a “deflationary spiral” that might occur, because money in the bank becomes worth more and more so why would you ever spend it! This was the big problem of the great depression, the deflationary spiral! Luckily the gold confiscation saved us from it!

No; taken over a whole there was massive inflation. Investopedia lists the event as follows: “The deflation that took place at the outset of the Great Depression was the most dramatic that the U.S. has ever experienced. Prices dropped an average of ten percent every year between the years of 1930 and 1933.”

A whopping 30% in total! Seems dramatic, until you realize that first off they’re wrong and the CPI never dipped below -10.7 per month in the 30’s while in in June 1921 it hit -15.8; something i would call considerably more dramatic. It’s just that that depression was allowed to clear itself and we tend to remember longer events better.

And secondly because gold was confiscated and revalued higher, inflating the currency supply of dollars by 70% in one day in 1933 that whole deflation was killed right quick, and then some. Yet they still managed to crash the economy again after that through bad government decisions throughout the 30’s; Real GDP dipped -3,3% in 1938. People think it was the massive inflation of WWII that saved the day but it wasn’t. It was the retooling and massive construction of factories and shipyards that that money bought, buildings and machines that where left standing after the war ended. By accident the US used what is normally the real utility value of loans, having the real world stuff still be there after the loan is paid back, to lift itself out of depression. Had the US ended the war as bombed out as Europe – which destroyed the value the loans given to them to finance the war as the factories where not still standing, and they required yet more loans to finance rebuilding; Financially things would’ve gone very different for the US indeed. Instead it was left with a truly historically massive production base that outproduced the debt down to managable levels after the war; While being left with a vast amount of the world’s currency (gold) to lend out to the other nations in need of it. Interest on loans and being the last man standing saved the US.

As Rick Rule says, the cure for low prices is low prices, and the cure for high prices is high prices. To say a deflationary spiral can never end is to deny human nature, it is to deny Needs and Wants. In other words, the computer I’m typing this on has started showing signs of trouble as well as being outdated, so I’ll need to buy a new one soon. Meanwhile, I’d very much want to own a home, but i can’t afford one right now because I’m poor as shit.

Even if we ignore the computer which I’ll buy at whatever price it is whenever i need it, If i have $10,000 now, once a $500,000 house costs only $10,000 i WILL spend that money on it. Why the hell wouldn’t i! I want to own a home. Wouldn’t even mind owning a bunch and renting them out! But considering i don’t own a home now and am so far away from ever owning a home, i’d rather “bank” that deal and end up with a home; without any regrets for not being able to buy 2 homes for $5,000 each.

Basically put, not everybody’s an eternal greedy son of a bitch. That might seem weird to Federal Reserve board members worth millions due to having invested into ETFs that Blackrock has bought at the Fed’s behest. I can see why. Most people are fine with getting small profits, and even more so with a substantial one. Only when society at large gets swept up by manias or panics do greed and fear start controlling markets and does blind faith start controlling selling and buying behavior. It should also be noted that acceptance leads to the loss of fear (AKA rock bottom).

So once the spiral hits the bottom, interest rates will top out and start to drop as people will are no longer afraid to lend again. Which, defined as when the wants of savers outweigh the needs of spenders, can happen really quickly; As long as there is no interference. The “Lost depression” of 1920-22 proves as much. The only difference being, when the economy resumes its growth and flips back to inflation the people who are now lending are different from the people who where lending previously, as they lost their money on ill conceived loans. You can see how this whole process isn’t in favor of the banksters. And once this process has bottomed out, as more currency becomes available to the economy in general again due the increase in wealth of savers, inflation will pick up again, as lenders are no longer burdened with bad debt, due to the new lenders not being the old ones. The trick of bankrupcy is simply that “no longer burdened with bad debt” doesn’t mean the idiot lenders from before survived their ordeal; it means that people who never where that stupid to begin with accumulated the capital necessary to become lenders themselves, through frugality.

At this point i’d also like to remind everybody that a bank deposit is in actuality a loan to that bank. The bank is liable to you for the amount you lent it when you deposited money into your “account”. So if you wonder how banks are supposed to grow their income out of deflation; the good banks which didn’t overextend loans on stupid ideas see the asset side of their balance sheet grow as the principal of the loans to them, the deposits, grow in value. They can then use this new relative wealth to lend more (as a $10 lent before deflation carries less purchasing power then $10 lent after the deflation, so loan size can shrink while retaining similar economic activity).

To bring it back to the start; this whole story is to show that you both need Inflation and Deflation. Because just as much as i showed that you need deflation from time to time, you need inflation as well! To increase the supply of money when the supply of real world value was increased – this is how you keep a stable currency. At the same time, Inflation is needed to punish Obsessive Hoarders of cash. People who save just a little too frugally. Just like you have frugal savers and frivolous spenders, you have frivolous savers and frugal spenders (also known as savvy investors). In other words: Frivolous savers are psychopaths whose only desire is the accumulation of YET MORE CASH, even when they already have so much, and they have to be punished as well from time to time. Money itself isn’t the end objective, the end objective is the labor that money buys in order to produce and add value to the world. And if somebody keeps sitting on a pile of cash rather then investing it in a value adding business, from time to time, they need to be incentivized to use that money.

In a purely deflationary system such as Bitcoin, this will never happen. There is no way obsessive savers are going to get punished. The whole system rewards holding the coin until it becomes more valuable, ad infinitum. There is no single point where I’d want to spend, because (theoretically) there’s no single point where the bitcoin goes down in value. The supply available will just continually contract. But to think it can go on forever, is to deny human nature. At some point, somebody is going to take their profits. And then an another, and then another. Even during the South Sea bubble, at some point somebody exchanged their Livres for 3 post coaches filled with gold (because they where redeemable in gold until they weren’t). Nobody’s going to hold onto it once they realize the paradigm has changed and their perception of the currency’s intrinsic value changes, and assets will be bought up left and right while the currency is abandoned while its value relative to other assets plummets. Those still holding it will be left with nothing. When it will happen is unpredictable, but that it must happen is certainty.

As far as Ponzi schemes go, it is quite genius. It is set up from the get go to yield ever higher returns to ever more investors. Until the day that it doesn’t. Not that i think it was set up from day 1 as a Ponzi scheme mind you. I just don’t think the creator had enough understanding of economics, and thus inadvertently invented a Ponzi scheme, much like John Law back in the day did with his Mississippi bubble without knowing what a Ponzi scheme was (the Mississippi bubble happened in 1720 while Charles Ponzi was active in the 1920’s).

I hope that so far i’ve proven my point enough that the coin itself is at the very least economically deeply flawed. But that brings us only halfway down the story. There is still the matter of how it will die, when that might be, and what Tether has got to do with it.

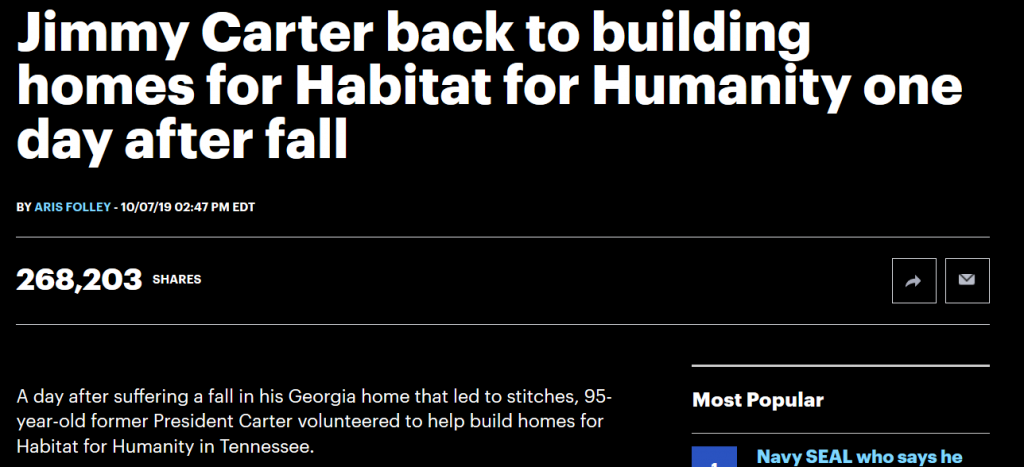

There’s plenty of theoretical things you can do to the Dollar too to make it fall apart in a second while in reality people still happily transact with it. Faith’s a real bitch, and ignorance even more so. If there’s anything 2020 has taught me is that people are perfectly fine with trading on both. But Bitcoins theoretical design flaws still have real world implications. For instance, there’s no way built into the software to print out and scan back in a Bitcoin due to the obvious problems mentioned above. The main implication of a flawed system however is it always has a security flaw, a way to break the system. The dollar is flawed too; In its case it’s the interest on money created as debt. Since this is money itself which is not created as debt by the central authority; It thus comes from nowhere (and also can’t be backed by debt as it was never lent, which makes it not money). This is impossible thus it must come from the central authority which can only create debt with even more interest that comes from nowhere. Run this setup for say 50 years and negative rates are the logical endgame of endless money printing within this system, where the system starts destroying the unbacked currency by itself through lending out more then is returned, thus destroying money in the process. Natural Credit destruction is supposed to compensate for this, but as history shows, credit is never allowed to naturally destruct if there’s anybody capable of stopping its destruction in fear of the (often political) consequences. Shoutout to Jimmy Carter, and the people who voted him out of office.

Gold is an elegant system because its central authority is Physics. In order for gold to not be gold not be gold, Physics needs to change, and good luck with that. For Bitcoin, the flaw exhibits itself also in the central verification mechanic; in the Mining of Bitcoin. Or more specifically, the “50% network attack” vulnerability.

Because Bitcoin needs to verify that That Bitcoin is that Bitcoin is that Bitcoin, it uses a distributed ledger with the Proof of Work method. Now I’m not gonna go into complicated details about that here that confuse the issue even more, go find a crypto expert for that. The point is, every decentralized form of trust has a weakness, much like a lock always has a weakness because it must still be allowed to open. The perfect lock can never be opened, thus is an oxymoron and doesn’t exist. In this case, you must still transact with somebody you don’t trust without 3rd party verification, which is left up to the system, which just transfers the trust to “how can i trust the system?”. In the case of national fiat, that trust is generated by the (supposed) creditworthiness of its tax payer base.

In the case of Crypto, the trust is distributed between the users via distributed verification… Until more then 50% of the Hashrate (the mining capacity) is under the control of a central authority – which then becomes the central authority on that network, being able to block transactions or double-spend coin and basically control the currency that way. In the case of capped coins like Bitcoin, they won’t be able to print more coin, but they will be able to basically steal every transaction. Meaning it becomes worthless to transact with, as faith in the fiat currency is lost. A good example of this is the difference in current market cap of Bitcoin Cash and Bitcoin Gold; both of which are forks of Bitcoin thus are extremely similar. Due to having suffered 50% attacks Bitcoin Gold has a current market cap of only $144 million while Bitcoin Cash stands at $4,7 billion. Basically; Crypto only works if enough people use it to never have 50% of the network fall into any one user’s hands.

Naturally, with a network as large as Bitcoin, that’s not likely to happen. So this is where Tether enters the scene.

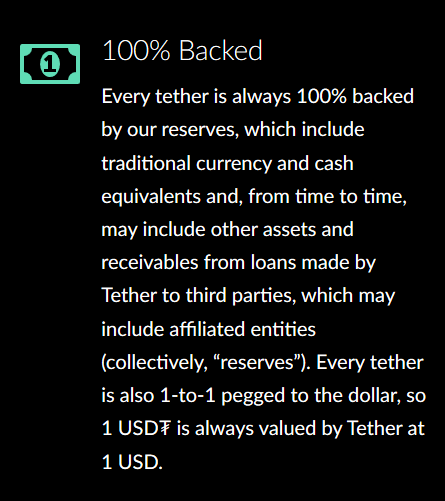

Tether is what’s called a “Stable coin”. Tether and other coins like it got the name because they’re pegged (or Tethered, haha) to another asset – in Tether’s case the United States Dollar. Tethers are listed as USDT and priced at 1 USD = 1 USDT. Whether they actually have this value or not is not yet of any importance, so for now, think: 1 Tether IS 1 Dollar, in all circumstances. Everyone else does. Also it’s important to remember; Tether Limited can print Tethers at will. The claim they are backed by Dollars is just that, a claim. There is not one thing, from oversight to regulation to physical limitations, stopping them from printing trillions today if they wanted to. Only that the charade would end right quick.

Now the history of Tether before 2020 isn’t really important at this point, other then a show of how reputable the company operating the coin is. So i’ll be brief. Tether’s never given out an official Audit of their books, and a semi-official one only once. They did so in June 2018. Copied from that report, findable as “proof of funds” on their main website tether.to, it literally states at the bottom under the header of FURTHER DETAILS AS TO ENGAGEMENT SCOPE:

1) FSS is not an accounting firm and did not perform the above review and confirmations using Generally Accepted Accounting Principles

2) The above confirmation of bank and tether balances should not be construed as the results of an audit and were not conducted in accordance with Generally Accepted Auditing Standards.

3) FSS makes no representation regarding the sufficiency of the information provided to FSS and all inquiries made by FSS have been directed to the Client and/or third party personnel responsible for maintaining such information, and the data has been obtained from the Client and/or third party personnel responsible for maintaining such information.

4) FSS procedures performed are not for the purpose of providing assurance and are limited to the findings listed above as of June 1st, 2018, Close of Business. FSS has not performed any procedures or made any conclusions for activity prior to or subsequent toJune 1st, 2018, Close of Business

5) FSS did not, as part of the Engagement, arrive at any conclusions as to Tether’s compliance with applicable laws and regulations in any jurisdiction.

6) FSS has assumed, without further inquiry, that the bank personnel providing the confirmations were duly authorized to provide such confirmations, and that the confirmations were correct.

In other words; Not very trustworthy. I believe the technical term is “Fucking sketchy”. That the market bought it is none of my concern. What is of my concern is that shortly after the event, Tether’s website changed their language of what backs the coin. At the time of the “audit”, it merely said that Tether was backed 1:1 by US dollars. Here’s a screenshot of what it says now (and has since 2019):

Furthermore it’s publicly findable knowledge (straight from their wikipedia no less) that:

“On 20 November 2018, Bloomberg reported that U.S. federal prosecutors are investigating whether Tether was used to manipulate the price of bitcoin.”

“On 30 April 2019 Tether Limited’s lawyer claimed that each tether was backed by only $0.74 in cash and cash equivalents”

Note that on the 30th of April 2019, Tether’s market cap, and thus the number of tethers in circulation as they are priced 1 to 1 USD to USDT and the market cap is in dollars, was $2,8 billion dollars. So roughly $800 million would fall under “assets and receivables from loans made by tether to third parties, which may include affiliated entities.” This too will VERY be important later.

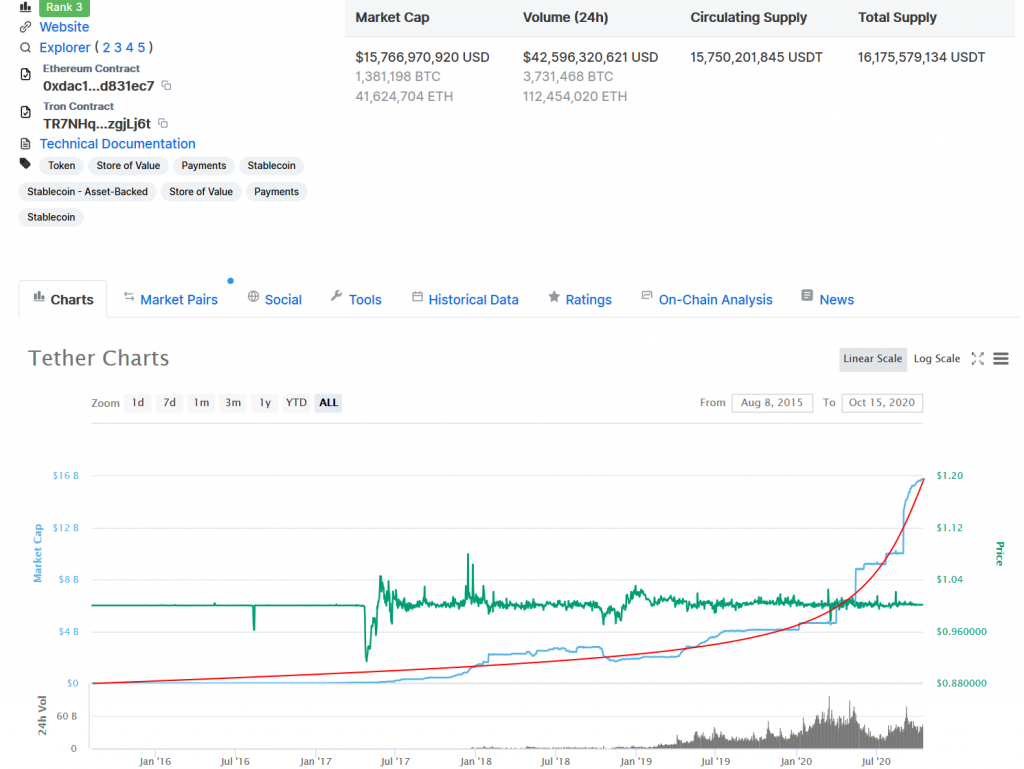

However for my purposes, their reputation pre-January 2020 does not even matter. What does matter is that all Ponzi schemes, that is to say schemes that require ever greater incoming funds to keep the scheme going, display the exact same pattern when they blow up: The number of greater fools required to sustain the fraud is an exponential function, as the promised returns on the total capital invested compound. In other words, if everybody pulls out they end in a hurry, and if the price drops below expected returns, people will sell/pull out. On a Chart, this price action always shows up as a Parabolic line.

In this case, the Market Cap is the circulating supply times the price. Because the price is $1 dollar per 1 USDTether, the market cap is essentially the circulating supply (with slight variations due to price variations when money is being moved in and out of Tether). This is also visible in the above screenshot, with the difference between market cap and circulating supply being only 16 million on a total of 15,750 million.

- On January 1st 2020, the market cap was $4,1 billion. And even though Tether’s Lawyer on the 30th of April 2019 said each Tether was only backed by $0,74 in cash or cash equivalents on a market cap of $2,8 billion, i’ll give them that.

- On January 6th it was $4,6 billion. But yknow, pre-pandemic, let’s say business was going well and somebody invested half a billion into Tethers. Unlikely, but possible.

- On March 7th to March 13th, there was massive volatility until the entire the market collapsed, and Bitcoin took a dive of 66% on March 13th. This is important because price crashes like that always tend to shake out scams in a hurry, as the scams are predicated on such a thing never happening.

- On March 31st, Tether’s market cap jumped by $1,500,000,000 to $6,1 billion. Not during the panic. 18 days AFTER the 66% collapse. At this point, the price of Bitcoin had already recovered from a ~$5,500 post crash average to $6,400 on March 30th.

- On April 7th, it jumped to $6,3 billion. Price of Bitcoin was $7,300.

- On May 14th, it jumped to $8,7 billion while the price of Bitcoin was $9,200. And yes, Jumps, since Tether’s market cap went sideways between jumps.

So just to summarize. Between January 1st and May 14th, with the fastest crash and recovery in the markets in history in between, Tether doubled the market cap (and with it the amount of Tethers in circulation) that took them 4 years to build up, while they admittedly didn’t even have full backing with a $2,8 billion market cap on April 30th 2019? And it doesn’t stop there.

On June 2nd, it jumps to $9,2 billion

On July 23rd it jumps to $10 billion

That last date was significant and why the $800 million in receivables from earlier is important. Because the following article is dated 6 days before that event, July 17th: https://coingeek.com/bitfinex-tether-fraud-investigation-to-proceed-in-new-york/

The ruling has immediate effects: iFinex now owes the Attorney General the requested documents and the $900 million line of credit between Bitfinex and Tether has been frozen. While it is important to stress that there have been no formal charges or accusations brought by the Attorney General’s office, the now-effective order is a big step in the ongoing investigation of Bitfinex, Tether and their associated companies.

During all this time and since the crash, Bitcoin climbed from $4,500 lows to about $12,500 in the middle of August. This is another important thing to keep in mind which I’ll discuss later. On August 12th, something must’ve changed internally with Tether. The price shows quite a bit of volatility while Ethereum surged from $370 on the 12th to $440 on the 14th. After which it dropped down again.

Then, on August 30th at 18:00, Tether Market Cap jumped from $10 billion to $13,35 billion. Around the same time, between the 27th of August and the 1st of September, Ethereum went from $380 to a peak of $480. I’m not much a believer of coincidences like that.

Am i willing to say they had $4,1 billion on January 1st? Sure. Because there’s simply NO WAY they found $11,65 billion in these past 9 months. The most logical explanation i’ve heard is “capital flows out of China”. Well fine, but the Chinese don’t want Tethers, they want Dollars. This means Tether is ending up with Yuan, converted to Tethers, which are converted to Bitcoin, which are then sold for Dollars… But this leaves Yuan in the system backing Tether, not Dollars. Fine for the Chinese who end up with the Dollars, not so much for everybody expecting to some day convert those Tethers “back” to dollars. Did i mention Tether launched an Offshore Chinese Yuan stable coin variant of Tether in September 2019?

So what explains this sudden explosion in market cap? How does the fraud work? And why hasn’t Bitcoin gone parabolic in response then?

Here we come to the mechanism by which Tether has been pumping up the markets. Why it’s so important to realize that other people THINK 1 Tether is worth 1 Dollar. This essentially makes it fungible with the dollar. One dollar is one tether is one dollar; because it’s “As good as” a dollar. Again, doesn’t matter if we think that’s true or not. It matters if the majority of users and the market at large think it’s true. Trade is no guaranteed thing. There’s no Set Price for anything. If you are willing to take a bag of shit in trade for a gold coin, then somebody can buy a bag of shit with a gold coin. It’s a stupid trade and I’d think the person getting the bag of shit is getting the raw end of the deal. But a trade is a trade none the less and it doesn’t have to make more sense then that. Just Business. You’ll find the more you learn about economics the more you learn that the entirety of trade in the world really runs on stupidity by one side or the other. Currency is just an intermediary so it’s easier to tell how much shit you can buy for a gold coin (that doesn’t even have to be an allegory, you can price biological fertilizer (manure) in troy ounces if you want).

All of this means that things will have the same price in Tethers as they do in Dollars, as long as the Merchant allows you to buy his product in both. In this case the merchants are represented by the other people on the other side of the trade. Regardless this is influenced alot by the exchanges as they are the central locations where you can trade one coin most conveniently for another, and they decide whether they allow you to trade bitcoin for tethers and dollars or not. If you cannot find an exchange to trade your crypto on, the transactional value of crypto plummets dramatically through loss of utility value.

In any case, if you can buy a Bitcoin with $10,000 dollars and you can buy a Bitcoin with 10,000 USD Tethers, then a Bitcoin is worth BOTH $10,000 and 10,000USDT according to the market. This means you can exchange the coins with each other at these exchange rates, which is set at $1 to 1USDT.

So you could buy a Bitcoin with 10,000 USDT. And then sell it for $10,000. Works just fine. It’s at this point i want to reference what i said earlier, Tether “Limited” (hah!) can print Tethers at will. So that is what they have been doing. They print 10,000 Tether backed by nothing, spend it on 1 Bitcoin worth $10,000, move that Bitcoin to their balance sheet and state “Because 1 Bitcoin = $10,000, and we have 1 Bitcoin, 10,000 Tethers are backed by $10,000”. They wouldn’t state this publicly of course, the Ponzi would collapse over night. The defining feature of manipulation is that the subject must remain unaware. Naturally, should Bitcoin then drop in price in the market, the price parity is no longer the case, which is the limitation of this particular Ponzi scheme. And that’s why the August 17th top, or any top is also very important.

I think the picture is becoming quite clear now. So let me summarize:

Tether is a Ponzi Scheme which requires ever bigger inflows of US Dollars to keep afloat. Much like Bernie Madoff, when this financial crisis hit, people started redeeming their Tethers for Dollars in the March Liquidity Crisis; though i admit this is conjecture since nobody’s seen their books in years, which is a giant problem in and of itself. Regardless in a crash people generally want nothing except the safest of assets. Turns out “as good as” the USD isn’t the real thing after all.

As i said, Crashes have a tendency to reveal scams in a hurry. Normally, Tether would’ve just sold what was on their balance sheet to “raise” the dollars needed to pay off one investor while waiting for another sucker. But since the entire market crashed, that wasn’t much of an option. Selling their Bitcoin bought at say $12,000 in June 2019 for $7500 before the crash or even $5500 after March 13th would knock too large a hole in their balance sheet. It wouldn’t even surprise me to learn in the future that Tether was more or less behind the Crypto crash on March 13th that wiped out 66% of Bitcoin and 85% of Ethereum in a day, simply because of forced sales in a hail mary to raise the Dollars they needed to meet redemptions behind the scenes.

Somehow they survived the first drop, but it necessitating them printing $1,5 billion worth of Tethers on March 31st. Naturally they’re not going to just dump it all on the markets in the first minute, that’d be way too suspicious. I’m surprised they had the balls to print it in blocks at all like they’ve been doing and raise the market cap in a straight line. Seems they thought so too and have opted for smaller batches since reaching $13,35 billion. But considering nobody else has either noticed or cared so far, i guess it was the right call.

With these Tethers, they buy whatever mix of crypto they want. Did i mention Bitfinex, the company really behind Tether, is a Crypto Exchange? Again just straight from the Wikipedia page: “the Paradise Papers leaks in November 2017 named Bitfinex officials Philip Potter and Giancarlo Devasini as responsible for setting up Tether Holdings Limited in the British Virgin Islands in 2014.[20] A spokesperson for Bitfinex and Tether has said that the CEO of both firms is Jan Ludovicus van der Velde.”.

Because overall supply of crypto diminishes the price moves up. Bitcoin with its maximum coin cap is the perfect match for this setup as its impossible to find more coins to compensate for this drain, meaning price HAS to go up with reduction of supply. This restores the value of whatever they already had on the balance sheet (but only on paper), as well as increasing the value of their current purchases. But since they basically are the market, they can’t sell everything in forced sales again. There is also the matter of their outside obligations AKA the Bitfinex loan.

How they ended up raising that money is as follows: For every 19,000 tethers printed, they bought 2 Bitcoin at 9500 tethers each, put 1 Bitcoin on their balance sheet taking it out of rotation restricting supply and keeping the price high, and sold the other into the market for $9500 Dollars, Dollars which then went to satisfying creditors who want to be paid in dollars.

The Ruling was on July 17th, with BTC at ~$9125. By July 31st (2 weeks later), BTC was ~$11,250. Ethereum was $233 on July 17th. It spiked to $388 on August 1st.

But all good things must come to an end as they say. You can’t keep printing double and then selling half into the market. There’s such a thing as Diminishing Returns (again people should play more videogames, they’d know about this stuff). If you have 2000 tethers, you buy 2 Bitcoin worth 2000 tethers, then sell one for 1000 dollars, you have 1 Bitcoin and $1000 on your balance sheet, and 2000 tethers out there that can be redeemed. If the market cap doesn’t go down, AKA nobody redeems the Tethers, you cannot sell that 1 Bitcoin into the market or move that $1000, but there’s also no problem because if somebody redeems 2000 tethers, you just sell the 1 bitcoin for $1000 and return $2000.

Suppose you then have to pay creditors $1000 to pay back loans. Now you have 1 Bitcoin worth $1000 backing 2000 tethers. So then you print 3000 more tethers. You buy 3 Bitcoin with tethers, sell 1 for $1000, put 2 on the balance sheet. Now you have 3 Bitcoin and $1000 backing 4000 in Tethers. In other words; where the fractional reserve (in dollars) of Tether used to be 50% (1 BTC vs 2k USDT) now it’s 25% (3 BTC 1000 USD vs 4K USDT), an action that was required to do to retain purchasing power parity, which is their motive to continue down this path once the pattern of conversion has started. As you can imagine it’s not a problem if Bitcoin goes up in dollars. If BTC then goes up $500, the balance sheet = 3 BTC worth $4500 + $1000 vs 4000 tether. They can even sell a Bitcoin into the market to make up for the difference in lost dollars! This is probably how they intended to fill the gaps in their balance sheet, and it worked for a while. Problem is the price needs to exponentially rise with the diminishing returns; The deeper you dig a hole the longer it takes to get out of it. To make matters worse, the price of Bitcoin can drop as well of course. $800 BTC = 3 BTC worth $2400 + $1000 vs 4000 tethers. You can see the problem here. BUT! Again, they can print more at will.

And that’s why the March Crash was so important. Black Swans like that pull down everything. Even Gold. Even Bitcoin. It knocked a hole in their balance sheet. And they covered it by buying double the amount and putting half on their balance sheet, half was converted to cash. The Diminishing returns turned $1 billion in July into $3 billion in September. This got too big even for them, so even since then, the market cap has “floated” up (they just started printing in smaller blocks) from $13,35B to $15,2 in 3 weeks, and $15,75 billion halfway October. They’ve had to resort to this method since Crypto corrected down again from their ridiculously pumped peak of $480+ for 1 Ethereum down to $324.

How many Dollars and how much Crypto is on their balance sheet nobody knows; but it has to be substantial by now. I’m willing to bet this all collapses very soon. The only clue as to how much they might actually have is in the volume of Bitcoin. The volume of Bitcoin ever since it’s 2017 peak has absolutely died. It doesn’t look that way on coinmarketcap.com or comparable sites, because volume there is expressed in dollars, not trades. Because the value of bitcoin has increased off it’s 2018 bottom in dollar terms it doesn’t show up. While the dollar value of bitcoin volume might’ve exploded, the trade volume has not. On investing.com this is clearly visable, coming from Bitfinex’s own BTC/USD pair:

Down from 2,3 million trades in December 2017 all the way to a absolutely pitiful 128,3k in September 2020, down 94,5%!!! October looks to be even worse. This is very weird for an asset that has supposedly kept growing since its inception. The Network Hashrate certainly has never stopped growing.

At some point, none of the people holding Bitcoin are going to wanna sell it for Tethers because there’s nobody left to sell Bitcoins for Tether. Everybody is either HODLing themselves or already sold. In short, Tether’s little scheme is (eventually) gonna run into the very first rule of trading; To Buy, You Need A Sell. If Tether Limited owns them all the Bitcoin from all the people willing to sell for Tethers, they won’t be able to buy more Bitcoin with tethers and the party ends – they’ll have to default on their Dollar obligations.

So how is this going to end up kill Bitcoin? Many people believe Tether cannot possibly harm Bitcoin. Even if it’s a $16 billion scam, Bitcoin has a $200 billion market cap (though again, the smaller the volume the more pronounced the price moves due to less traders having to agree on a price).

Well, Bitcoin will die through Bitcoin’s own mechanics. Recently in May 2020, the “Halvening” took place. This means that the Bitcoin reward for finding a block was halved to 6,25 Bitcoin, down from 12,5 Bitcoin per block. This also means that the Production Cost of Bitcoin doubled. Now, production cost heavily depends on Network difficulty rate (the more people mine, the more difficult it is) as well as the efficiency of the machine (how fast it is or its Hashrate Per Second). It’s hard to find an exact cost, but reading into it it seems the mining cost on the latest generation of machines is between $6000 and $8000 per Bitcoin post-halvening, depending on the electricity cost of various locations. This is to say that it was between $3000 and $4000 pre-halvening, before May 2020.

Well, the Crypto Crash that took place in March dipped the price all the way down to a $4500 bottom. As you can see, this is still $500 above production cost of the highest estimate. Sure, some people in areas where electricity is expensive or working with older gear had to tap out, but in general, the price didn’t drop below cost – and recovered to around $5500 very quickly (not even due to Tether, talk about being oversold when it drops 66% in a day). In other words, the Hashrate of the network never dropped significantly, because no large amount of miners had to tap out. Looking at a historical chart of the Hashrate of Bitcoin, it never dropped lower then December 2019 throughout all of 2020. In it’s entire history, it has rarely dropped and never stayed down long. The biggest drop was the 2018 peak – a peak which the Hashrate surpassed again within 6 months even while price remained depressed.

This is easily explained by the fact that Bitcoin never significantly dropped below production cost before. Sure, very old machines might get booted off the network due to advances in tech in new machines skewing the hashrate capabilities, but once operational the coin wasn’t produced at a loss – any losses where created by the advance of technology and more advanced miners demanding more network share. Basically called the turn-around time of one bitcoin mining rig.

WHEN Tether implodes, and it is a when, they will be found to have many many fewer dollars then they’ll need to satisfy creditors, as is the case with any Ponzi scheme. They’ll Chapter 7 and liquidate to recover as many dollars as possible, as so many scams before. This is in itself not an issue, it happens all the time, even in the crypto sector as it’s rife with scams from “shitcoins”. Where it not that in Chapter 7, whatever assets are on the balance sheet are to be liquidated to recoup as much money as possible. And on that balance sheet is a fuckton of crypto. And How do you “liquidate” crypto currency? Sell it into the open market, as that is literally its only use, to transact with it.

And liquidators do not care at what price, because it’s not their job to care. It is their job to recover as much dollars for creditors as possible, regardless what that means. They are, in effect, Financial Executioners. That’s literally what they are there for. The cleanup crew.

Naturally This is going to depress the price of Bitcoin considerably due to simple supply and availability. And, considering Tether is a CONSIDERABLE reason why the price was so high in the first place, there is little doubt in my mind that the price will drop below $6000 per Bitcoin; certainly since it’s only $11,428 now which’d require a 47,5% drop to bring it below $6000, a certainly not-unprecedented drop at this point. And then, for the first time in its lifetime, Bitcoin will cost (significantly) more to produce then it brings in. The Uranium miners send their regards.