(As it turned out to be a very long article; If you need a summary or a primer, go watch my interview with Palisade Radio here (keep in mind it’s 2 months old): https://www.youtube.com/watch?v=wIjaoRVgOk0 – And Thank You for reading!).

Going into this article, i would like everybody to go into it with a particular mindset:

If you know something is about to happen, wouldn’t you prepare for it?

While this article will feature quite a few numbers and somewhat (basic) math, i wanted to start off writing a little bit about Prediction, as it goes to my motive for all of this happening. Prediction is trying to read the future via indirect evidence of where the passage of time might end up, so you can make an educated guess about where time will take us. While i’m sure there are some very smart people who’ve created some very complex math to describe Chance; that merely obfuscates the issue. Humans, through conscienceless, have an innate ability to predict the future.

“Predicting the future” sounds very grand; But it’s much smaller then it sounds. It simply means running the process of Action – Reaction – Consequence to its logical conclusion. And it’s something all of us do all the time. For example, if you’ve got half a carton of milk in the fridge and you normally drink about half a carton a day, you can very reliably state you’ll pick up milk from the grocery store tomorrow. Yes, it’s always a chance and the future is never a guarantee, that confuses people when thinking about it in the abstract. But, since it pertains to Your milk, Your milk consumption, and Your choices (free will) leading up to the event of You purchasing that carton; You know the future.

Sure, that is still not a guaranteed statement. You might get hit by a bus on the way to the store. But again, this confuses the issue. Life doesn’t work that way. It’s not like people get hit by buses on the way to buy milk all the time. Haven’t seen anybody wrapped in cushions lately to try and dodge those dastardly bus drivers. While we cannot expect any one event to happen, we can – simply through experience of events over a period of time – reliably know the future in the short term. Provided the conditions line up for it, of course (i don’t know somebody else’s milk consumption for example, so i cannot predict the time they go to the store).

Long Term Prediction is nothing more then expanding this process well beyond the daily routine. This too is a skill everybody possesses. If you drink half a carton of milk a day and you only buy one carton at the store, you know you’re going to run out in 2 days. Yes, there’s more possibility you’ll skip a unit of consumption, but the amount of times that happens in aggregate is still very small as we are creatures of habit. So rather then buying 1 item of each thing which would necessitate alot of daily store trips, we buy more and “plan ahead”. Personally i buy 4-5 cartons of milk each time. Simply because the milk i buy has a long expiry date and i know my milk consumption is such that i’ll run out long before i hit that date. As the milk always has roughly the same time in days until expiry which vastly exceeds my usage in every use case, i never check the expiry either: I am so confident that i know the future, i explicitly ignore data that could tell me i’m wrong. Another feature of humans.

Regardless, i’ll never be wrong. Simply because mechanically nothing can change. By law, they can’t suddenly sell fresh milk that expires in days in the cartons which are labeled to contain milk good for months. Naturally the law can change – but such a change would be so extremely strange (legalizing false advertising essentially) that there is no chance i wouldn’t hear about it via various news channels i know i’ll check every day for the rest of my life. The stranger the event the higher the buzz the less likely i’ll miss the event even if i come into contact with it much later.

Now, all of this seems perfectly logical. I doubt there is anybody reading this who hasn’t experienced a similar situation many times over. It is simply important to realize that, by the processes mentioned above, we can extend the prediction of the future, accurately, many months into the future. The reasons of why i drink milk will not change within the next year (just take my word for it this article will be long enough as is). If the milk has an expiry date a year out, and i drink half a carton a day every day (and because of the long timescale, we can average it out as the error margin becomes smaller with longer timesets), since there go two halves into one carton;

(1carton/2halves) x 365 days = 182.5 cartons in a year. Unexpected events have to be taken into account, as well as the expectation of being able to buy more (no food supply issues 12 months out expected), as well as small variations in the true expiry date (AND that the date is always conservative just to make sure nobody gets sued) so we introduce a “safety buffer” of about ~25% (and i like round numbers). So all in all, we can with an extremely high degree of accuracy state i can buy 135 milk cartons and i will use them all within a year. AKA, and this is important, i will not lose money if next time i go to the shop i buy 135 milk cartons instead of 4-5 – it will merely save me trips to the store.

Whether or not i’m going to do that depends on other factors outside of usage, for example storage issues. This is why the further you go out into the future the dataset required to make an accurate prediction about whether or not something is going to happen increases exponentially. That’s why if somebody says they know the distant future they’re bullshitting as the dataset required to be accurate that far out is so large no one human can remember or cross-associate all of it (trust me, i try). However – this pertains to general predictions: Again i cannot predict when and if i get hit by a bus, putting me in a coma and reducing my milk consumption taken over a year below the safety buffer. But the prediction of how many cartons of milk i will use up in the next year is still accurate: The error is not in the prediction of my daily usage, but in the prediction of my continued health. In short; Ya gotta be specific.

The reason i go so deep into that from the beginning is because it’s important to understand the relationship between the general continuation between events – the predictions we make every day like groceries and thus we don’t expect to change; Events that are inevitable – If i run out of milk, i won’t be able to drink milk; And generalized prediction about events that might happen infrequently, but do happen – Getting hit by a bus.

Because the First reason is why people aren’t desperately clamoring for Silver and Gold right this minute; The second reason is the reason why the Comex operates the way it does (or did), and the Third reason is the motive behind the largest – and legal – raid of precious metals in history, that thus far has gone unnoticed but to very few observers.

Let’s take it from the top, as i hope to reach a wide audience with this so forgive me if i run through some definitions first. Not to worry; I’ll introduce things along the way as we go along so it won’t become too much all at once. If the definitions aren’t entirely accurate, i apologize but i am trying to weigh specificity against clarity for the uninitiated.

So what is the Comex?

Well, the Comex is the Futures market for Precious Metals; That is to say Gold, Silver, Platinum and Palladium. As the Platinum and Palladium markets are tiny in comparison, they will be left (mostly) out of the story. Suffice it to say, i have 1 screenshot to prove the same thing is happening in Platinum as well, which at that point was already enough so i focused my efforts instead. I won’t go deep into the distant history of the Comex, honestly there are people far better suited for that then me. What i’m concerned with; Is this year, the now and the near future.

A Future is a contract that gives you the right to buy the underlying asset in the, well… future. They where created at some point as a hedging tool for producers of precious metals. Since you can’t predict when those unexpected events might happen such as rainstorms shutting down production, there’s no way to know the price based on supply and demand in the future either, as you can’t reliably predict either of those components. This requires capital buffers, which reduces capital available for investment.

So rather then selling the metal when it becomes available at whatever the current price is, by making a Future contract you can both time delivery (contractual rules obligate all contracts to deliver on the last date of the contract) as well as hedge future output. The Comex’s inventory then serves as a buffer between now and the next delivery date. Producers have the ability to make and sell contracts into the market both backed and not backed by the physical asset to achieve this hedging. The latter is called Naked Short Selling, and before we get into that, i’ll have to explain Shorting first. Not to worry – it is far less complex than it’s been made out to be.

Shorting, in short, is selling an asset you don’t have. Naturally, that asset has to come from somewhere. Well – you lend it.

There’s all kinds of traders in the markets. Day traders get headlines at the moment, which are on the short end of the time scale of trading. On the long end there are Institutional Investors – Think pension funds. These funds generally don’t sell their assets, or do so very infrequently, as they are making use of the fact that the market “always goes up”. Sure, in the short term it may take a dive, but over the long run it does go up, and has for a very long time. But conversely this means you need to hold those assets for a very long time.

Well assets that are not being traded are considered “dead” assets – they don’t generate any revenue. Sure, they will give you profits when you sell them – but only when you sell them. Same with cash in an account (at 0% interest), it just…. sits there. Economically this is undesirable, as you want your capital to work for you AKA generate more capital, and assets are part of capital too.

So what they do is, via a broker which connects the short sellers to the investors, they offer their assets (let’s say Tesla shares cause that’s hot right now) up for borrowing. As Lending carries Risk, a fee (interest) on the loan is paid, which provides income over otherwise dead assets. When somebody takes them up for the offer, they get the share. Since it’s a loan, the share is contractually obligated to be returned when the loan expires. Remember that loans are always denominated in the asset they’re made in – Dollar loans require Dollars, Share loans require Shares.

It’s also important to remember that Shares are Fungible. This means that 1 share of Tesla is 1 share of Tesla is 1 share of Tesla. Shares aren’t actually held by any one in their name – they’re held in an account in their name (and of course their activity is tracked against fraud). This means that if you sell a share of Tesla, then buy a share of Tesla at the same price, Effectively you’ve not traded at all – the share you bought is as good as the share you sold.

Finally, Time is very important, as the price fluctuates over time. Keep in mind that prices aren’t static; They change. So it is here where we get to the shorting. So keep it simple; i’ll be concise. Let’s say 1 share of Tesla starts at $100:

Investor lends 1 share of Tesla to Trader.

Trader immediately sells it into the market, pockets $100 (this stays within his brokerage account as an “active trade”).

Trader is now “Short” 1 share of Tesla.

Time passes.

Share price of Tesla drops to $90.

Trader closes (or “covers”) his short position in his brokerage account.

Trader HAS to buy 1 share of Tesla on the open market.

Trader does so at current price of $90.

Trader returns 1 share of Tesla to Investor + $1 in interest for the privilege of lending the share.

Trader pockets $9 in profit – Withdrawable from his account.

This is how money is made by “shorting” shares, as opposed to buying a share at $90, holding it until the price hits $100, and then selling it for profit. Naturally the process works in reverse too: Short a share at $90 and the price goes to $100, you will have to buy a share back for more then you sold it for, meaning you need to come up with more money. This is also where Margin Calls come from: If you only had $90 in your account to begin with and you now have to come up with $10 more, you’ll get a call from your brokerage to pony up more money. If you can’t – well you get “carried out the pit” (from the days before Computers, Viruses and Computer Viruses). You’re broke. And yes, the investor will not get his share back, because the person who promised to buy it back doesn’t have the money to do so. And that’s why lending always carries risk.

Anyway, all of this is important because of Naked Short Selling. The “Naked” means that the short position was never backed by an asset in the first place. In other words, the short seller sells an option to a share he doesn’t have and didn’t lend off anybody, so has no guarantee he can come up with it in the future. The asset doesn’t exist, yet the person sold the right to the asset anyway. Naturally this is extremely dangerous and was a big cause of the 2008 market collapse – share loans are in shares, and when the market dropped in 2008 and alot of these loans “came due” – people had to pony up alot more shares then often even existed of the asset in the first place! Can’t buy what doesn’t exist, so naked shorts imploded en masse. Naked Short Selling was banned in the US after the 2008 crash, for good reason.

However. On the Comex, it’s part of the design: Producers always make 2 contracts for every 1 bar of precious metal, 1 contract that is backed by the bar and one that is not. This because the Futures market is (supposed to be) a hedging tool: If the price of gold goes up between making the contract and delivering the bar, they will make more money on the contract backed by the bar – but lose the money on the naked short they have to buy back. In this case, the “naked” refers to the physical asset that was never there to begin with, the contract not backed by any precious metal expected to be produced. It’s fine for producers, because their income is from the bar anyway, it’s the spread they want to negate.

When the price goes below expectations, where the producer would previously lose money on selling the bar at a reduced price, now they still have to do so but they make more money then expected on their naked short. As when they made the contracts, they immediately sold them into the market (pocketing the increased cash), while the delivery happens at a later date which is when they have to buy back the short to balance out the market again (at a lower price of cash). Again the passage of time is important.

So, naked shorts don’t have to be a problem per se. On paper it’s a very good system that adds value in stabilizing prices for producers of precious metals, something anybody creating any asset desires.

In practice, it doesn’t work that way. Because of everybody’s favorite villains: Those Dastardly Banks. Bullion Banks, to be precise.

Now for the whole system to work, you need at least some sort of relative size. If you rely on just producers making these contracts whenever they produce these bars, and if there’s only a few of them, the price remains volatile because you’ve just moved the problem, not solved it. And considering we already have a large amount of gold and silver in the world that has already been produced, we can use that as a buffer. In case there’s some sort of unexpected event causing a production slump, the Bullion Banks – who are considered “market makers” for this reason – can create contracts backed by physical assets they already own.

Naturally what goes up must come down, so too with the prices of precious metals, some times they just go down. So to prevent bullion banks from permanent losses by only being able to sell contracts backed by bars into the system and then losing money when they have to deliver at a lower then expected price; They have the capacity to create naked shorts too.

And that is how the system got out of hand. Because the ability of the banks to make these naked short contracts is, as far as i know, completely unrestricted. If it isn’t – that just makes the situation worse because then they broke that rule and ran over it with a steamroller for good measure. The ratio of backed to unbacked contracts has gotten way out of hand compared to the close-to-1-to-1 ratio it’s supposed to be.

And finally, to top it off, these contracts are Fungible too. Obtaining delivery of a bar (so from a “backed” contract) is as simple as buying any random contract, and standing for delivery. Closing a short is as simple as buying a contract back, and not getting delivery (in the same way your brokerage would “close the short position” and you never really touch the money you sold the share for in the first place). While i’ve never stood for delivery on the Comex or am privy to its inner workings, it’s the only way the system can function in its current state. Even if there’s supposed to be safeguards against it functioning like this: It is what i observed, and the safeguards have been compromised. While i’m sure the ownership of bars is securely and accurately tracked in the bank’s books, you don’t actually need a serial number on the contract (not that they give us that data anyway).

As long as bars are fungible too (and they are as purity and weight is strictly controlled and verified, while the fungibility of gold is one of the reasons its money in the first place) you can just grab a random bar with a random serial number, look at whatever that number is, and transfer that serial number over to another account on paper. I’ll refer to this as “Changing the title” to the gold, as when the book says you “own” the bar, you own the title to that bar as you would own the title to a house. Holding a title to something is how we declare/prove we have ownership of something.

As the setup is complete, let’s start moving into how the Comex used to work. You see; Gold (and Silver) have fallen out of favor with the populace, especially as money. I can see why, it’s far more cumbersome to pay with heavy weighing metal then it is with a light plastic bank card. This has relegated those assets to basically industrial demand and their respective permanent fanbases, central banks included. Neither will go out of style, but they can go out of focus. That is where we are at currently, and that is where we were at in February of 2020 – the last month of “normal” deliveries before the Pandemic changed everything.

In the before-times, Nobody really took delivery of any metal on the Comex. Silver was delivered more then Gold in general, as Silver was suffering from a mining deficit (less produced globally then consumed) because of falling out of favor as money on the one end and increasing demand from the solar/semi-conductor industry on the other end. But both amounts where negligible in the grand scheme of things; The global precious metals markets. I’ve often heard the Comex referred to as a backwater market, as nobody ever took deliveries there and it was used merely as a speculative tool (WHICH is where the regulators should’ve stepped in really. But they didn’t).

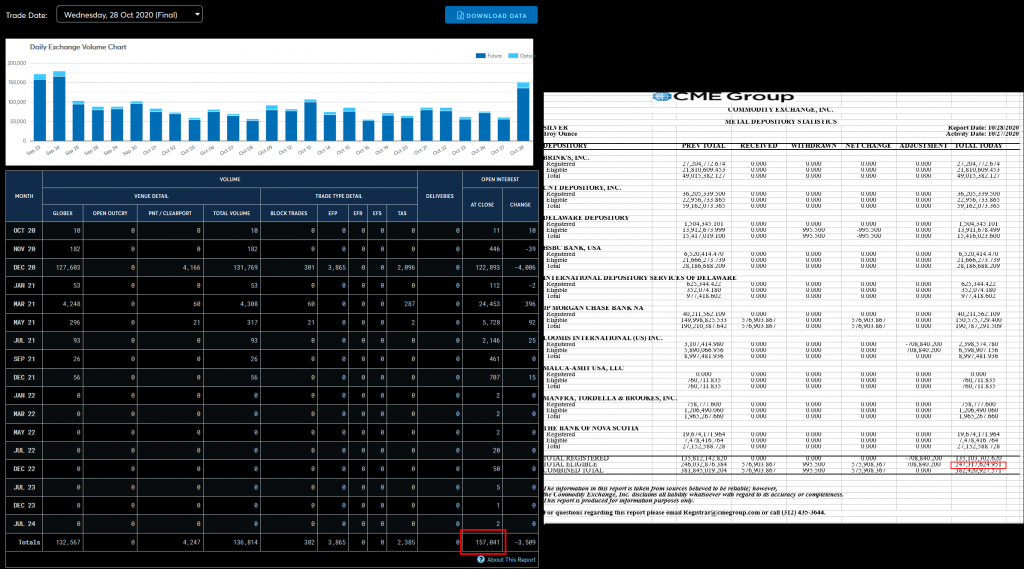

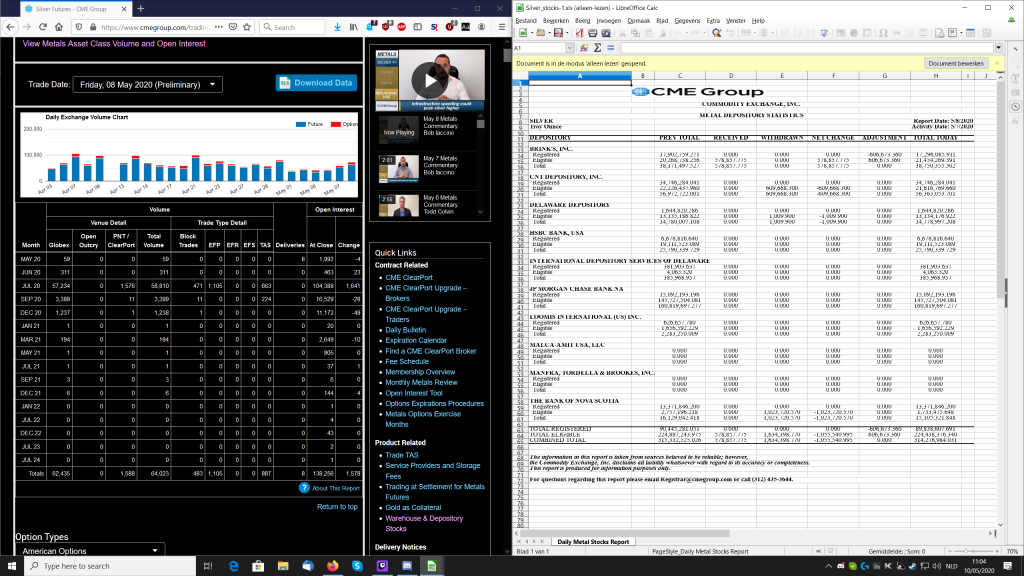

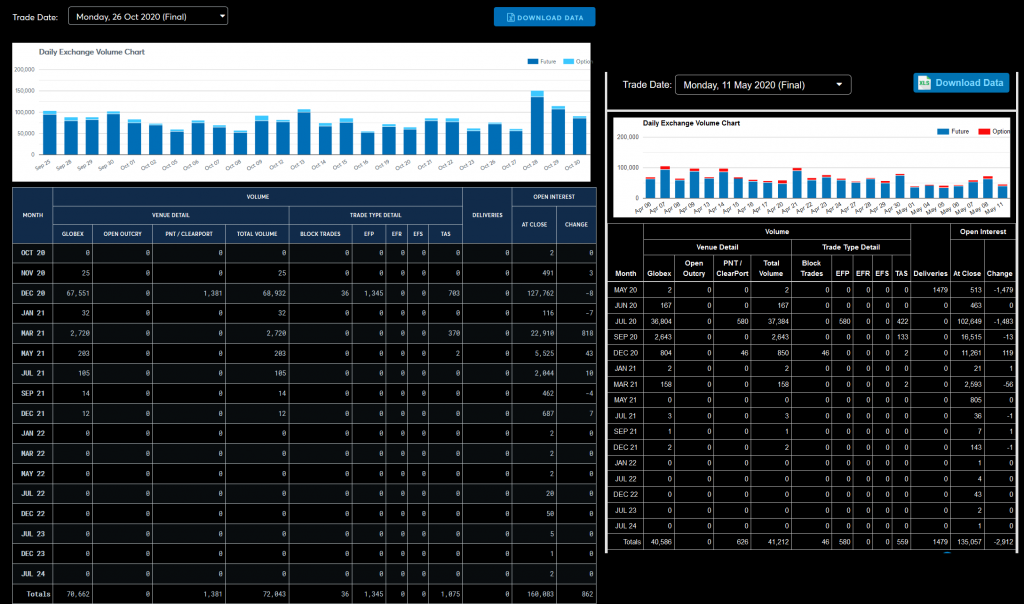

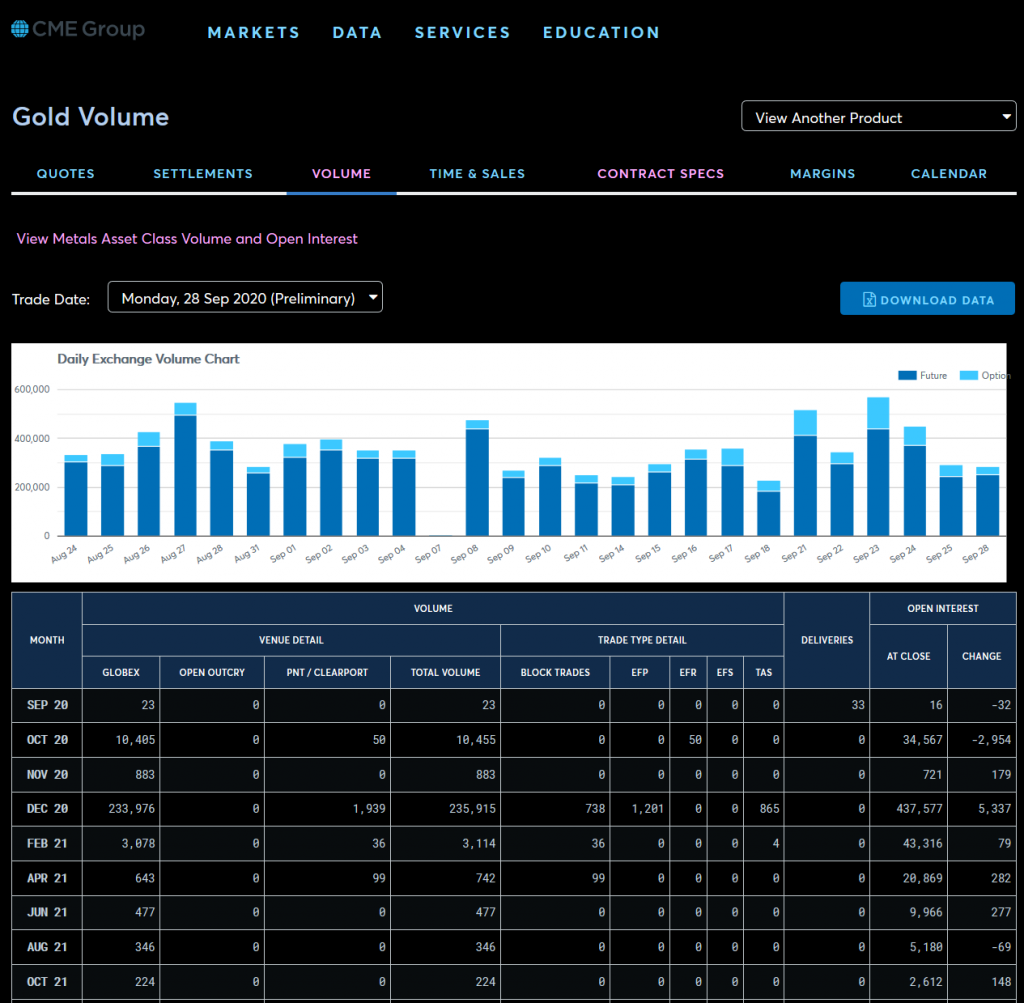

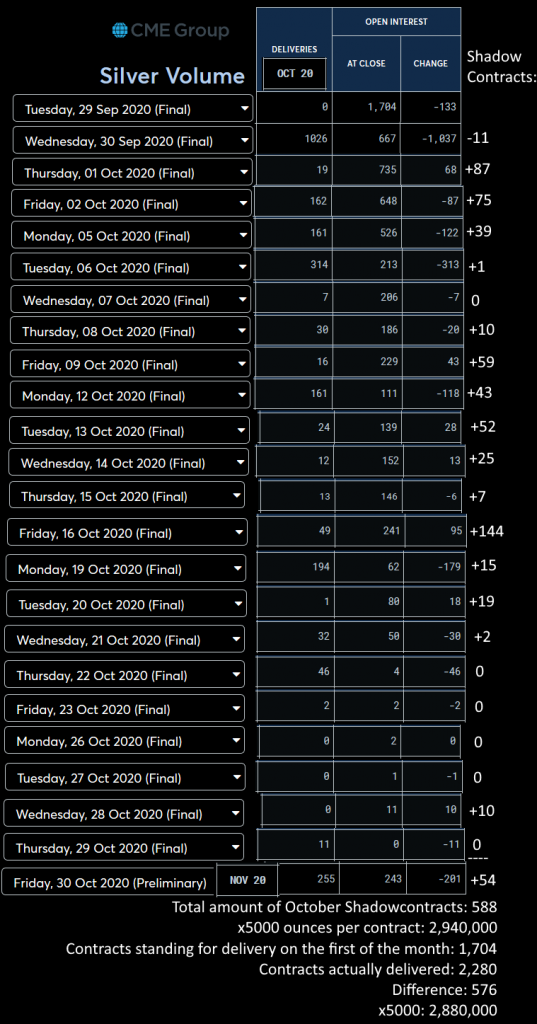

What you’re looking at is a screenshot of the trading data for Silver on Wednesday October 28th, combined with a screenshot of their publicly available report of their current Silver stocks. While the numbers may be overwhelming now (i’ll ease ya into it don’t worry) i’ve highlighted the important parts. On the left is the Total Open Interest in Silver. Open interest meaning “Amounts of contracts available for trade on the open market”. If Open Interest (also referred to as OI) drops by 1, that means 1 contract was Destroyed (most likely by covering a short). On the other hand, if the OI goes up by 1, a contract is created (most likely a naked short due to the speculative nature of the market).

On the right is the Comex’s Total Eligible Silver inventory. As you can see, their inventory is split into multiple categories, Registered and Eligible. While we will get into the specifics of those along the way, for now, it’s enough to remember: Deliveries Come Out Of Eligible. In other words; If you want to exchange a contract for metal instead of cash, the metal comes out of the pile called Eligible – Cause it’s Eligible for Delivery.

Finally, it is key to remember the Contract Size. Precious metals are measured in Troy Ounces, which is about 31,103 grams per ounce. Naturally buying it one ounce at a time would be cumbersome, so the Silver contract size is for 5000 ounces while the Gold contract size is 100 ounces (due to gold being more expensive and less prevalent).

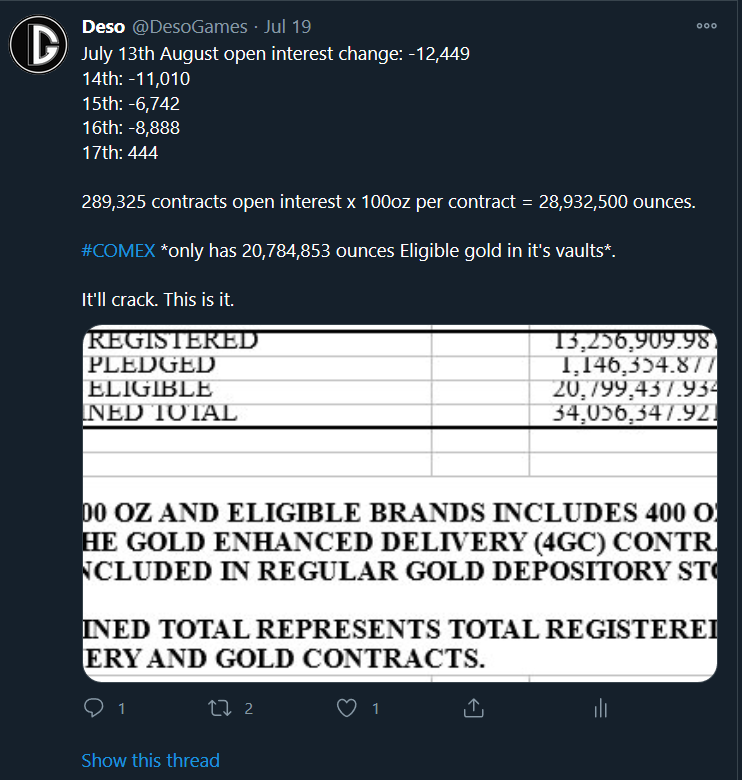

Simple math does the rest to show that the Comex is overleveraged; That is to say has far more contracts outstanding then they will ever be able to deliver metal. 157,041 contracts in total open interest times 5000 ounces per contract equates to 785,205,000 ounces of silver. While the Comex themselves have 247,317,624.951 ounces listed as Eligible for delivery. Assuming half of the contracts are shorts like they’re supposed to be, 785,205,000 /2 = 392,602,500 ounces of Silver needed to satisfy delivery of all contracts on the Comex. This exceeds even the total amount of Silver in the vaults.

However Registered cannot be counted as eligible for Delivery: The Registered category is where metal is moved to upon delivery. As i stated before, once you take delivery the title to the gold changes – But you still need a place to store it just as much as the producer/bank needed a place to store it. So while the metal might still be in the same vault and on the same balance sheet, in actuality the Title to that gold has changed and it is NOT available for trade!

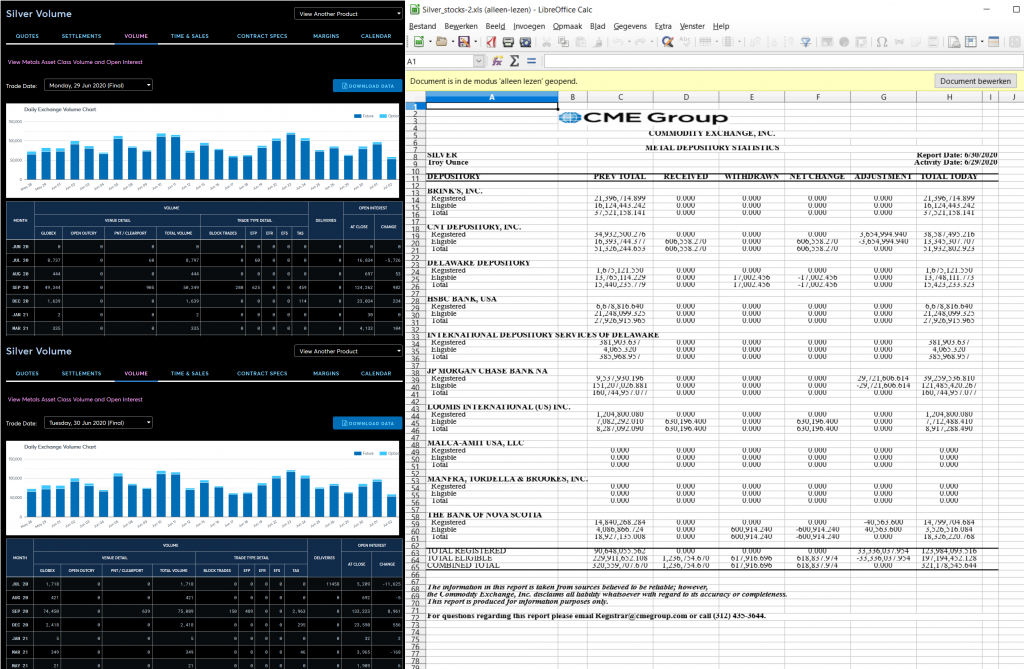

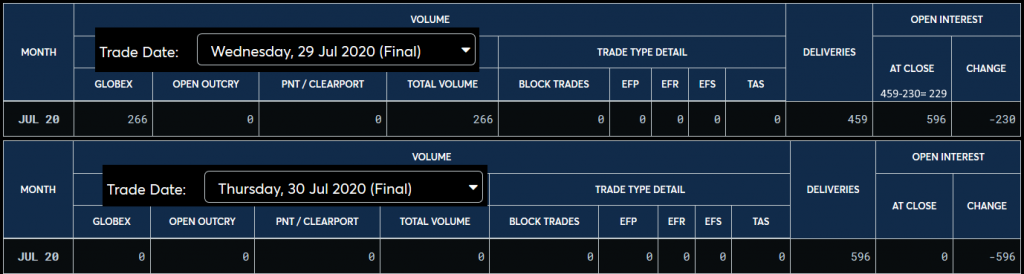

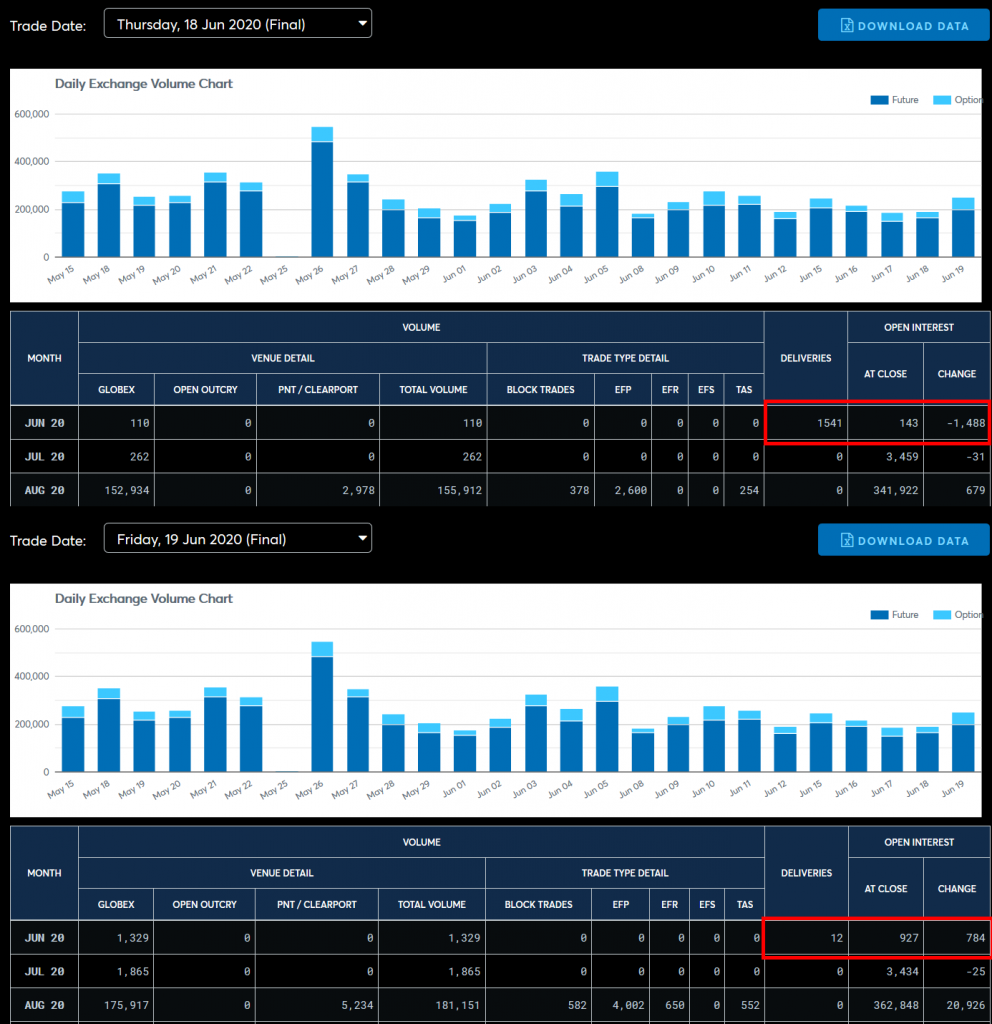

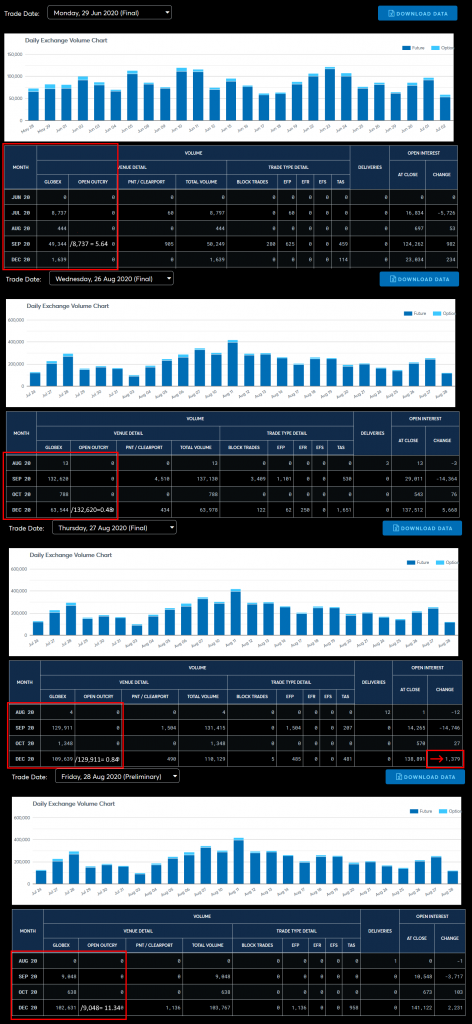

If you need any example; the first day of deliveries of the July 20 contract in Silver is a great one:

Regardless of what both categories may be defined as by the CME Group (owners of the Comex), in a real life empirically measured massive delivery situation; This Is What Happens. Massive amounts of Eligible get transferred to Registered when people stand for delivery en masse. And the reason i’ll follow that event over any explanation, is because it’s an empirical observation of a large scale event; And the larger the scale of the event, the harder it is for any one person to manipulate it, obfuscate it or change the outcome. In other words, if you’re looking for truth in the markets, big events both expected and unexpected are ones to watch out for. No matter who might tell you otherwise; There is power in numbers.

Immediately we run into a problem that has so far confounded even me. If you can’t handle numbers not lining up better get out now because there will be alot of them. The first to start off with is the 33,336,037.954 ounces moved to the registered category on that date. Since 11,458 contracts where delivered, and each contract is 5000 ounces in size… That gives us 57,290,000 ounces of Silver. Now it may be just me, but i’d call a discrepancy of 23,953,962.046 ounces a slight numerical faux pas.

That is to say; You can’t trust these numbers worth Shiat. I have legitimately no idea where those ounces went or why these two numbers don’t even come close to lining up. I checked other days but didn’t see any movement. Regardless, while the numbers might not line up, we can still gather some information from this situation: During massive deliveries, massive amounts change in title by moving to the registered category from the eligible category on the balance sheet. It’s just not the total amount expected. For now this’ll do; The point is we have to look at Eligible ounces on the balance sheet (though somebody in charge should REALLY check it out….)

For anybody claiming different; I simply pose the counter argument of: Well if the title doesn’t change what the hell is the point of taking delivery? The movement of the metal doesn’t enter into it. If you don’t get ownership of the gold when you pay for delivery, then what the hell are you paying for? It’s the change of ownership that matters, something we can only see on the Comex/bank’s books – which i remind you nobody has any idea about because they remain Unaudited.

But i’m getting ahead of myself. Now that we know what the Comex is and how it works (and the rest is just fluff or not relevant to this article), let me run through the Comex in 2020.

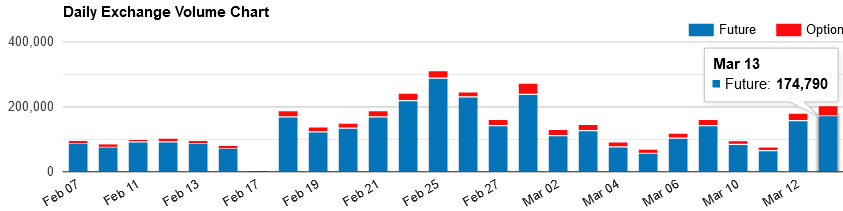

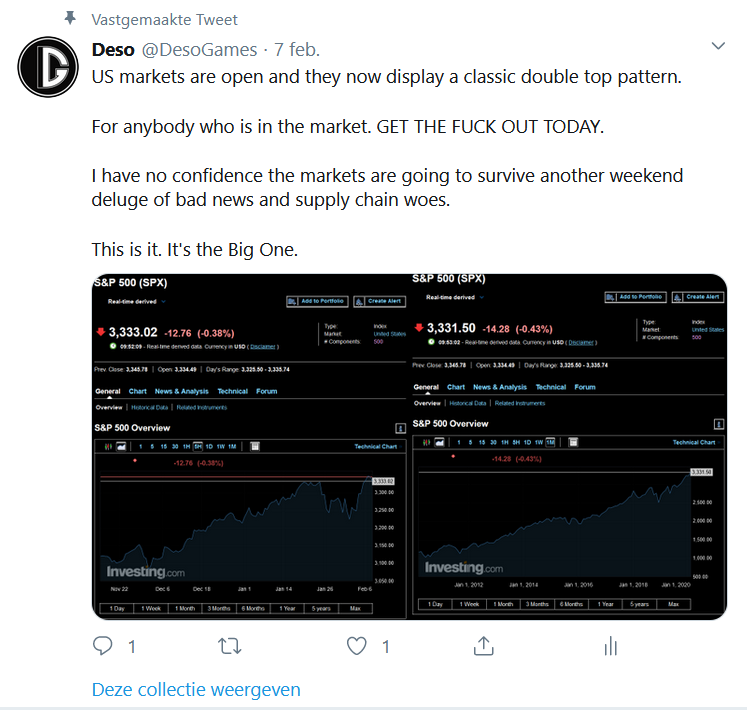

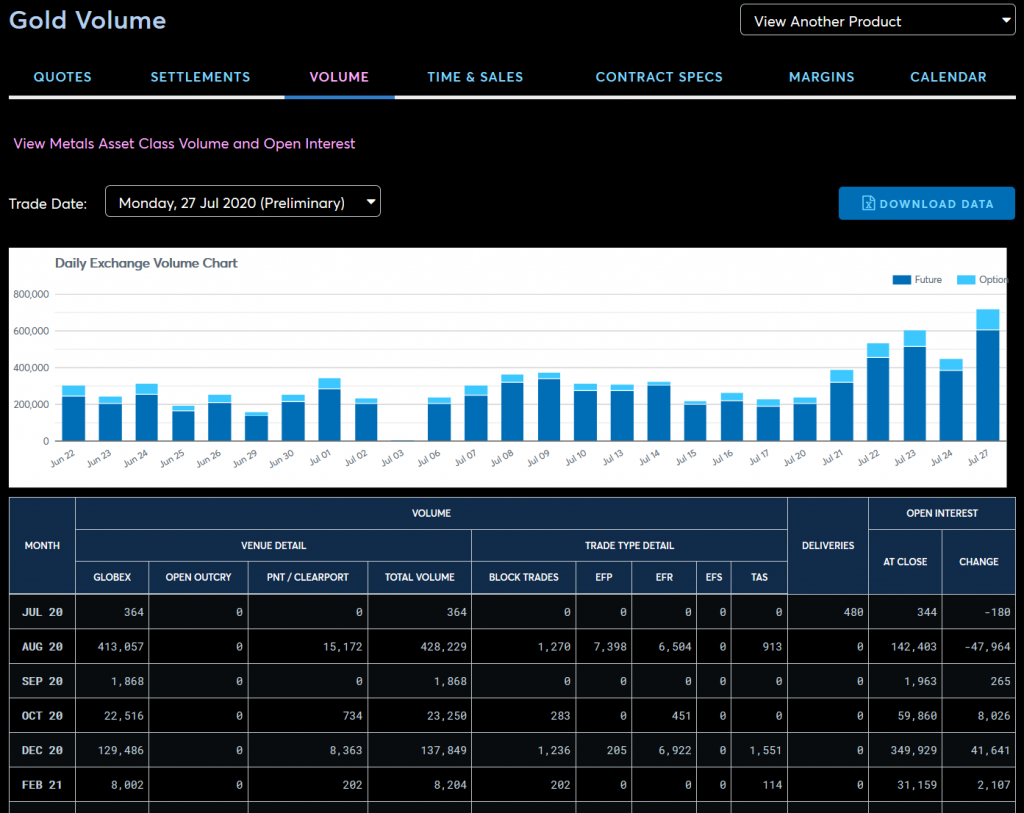

This is the earliest screenshot i have. I only captured volume at the time as it was relevant to a post i was making, so it only serves to prove i was very much active and already looking at the futures numbers at the time that i claim i was. Luckily, i have a penchant for remembering numbers.

February 2020 was the last month of “normal” deliveries, as while the price of precious metals had already begun to slide at the end of February, the liquidation panic didn’t happen until March. At the time, i observed the following pattern in deliveries in Gold futures:

February 26th: 0 deliveries.

February 27th: 0 deliveries.

February 28th: 0 deliveries.

February 29th, last day of the contract: ~276 deliveries.

I can’t remember the number exactly, but i can remember it was in the 270s, the high 200’s for sure. In any case, it is to say: the normal pattern at that time and indeed on the Comex up to that point in time was that it wasn’t used for deliveries. Yes, you could obtain the physical metal, but few ever did. Most activity was in Silver due to its use in industry and its concurrent mining deficit; Industrials drew on the Comex to get supply. However this too was immaterial compared to the metal Comex claimed to have, so nobody outside of the hardcore silver/gold sphere ever looked any closer.

That includes me by the way; lest i become known as some sort of super expert on Silver before the shenanigans started. Up till February i was quite content just reading around on the internet on what others where saying on the status of Silver and Gold. Ofcourse i understand their value so i’ve always kept up to date – But i mean to say i read articles of others instead of writing my own, and the lesser form of knowledge that comes from reading information instead of looking for it yourself. I’d mention names if i could remember (all of) them but truthfully i rarely check sources. Due to my unique disposition of having to figure out human behavior, i can generally tell from a text by it’s logical inconsistencies – or lack thereof – whether it’s true or not. Sure, that has a error margin, which i negate by applying consistency: If i consider the information on its own merit 20 times, and i arrive at the same conclusion 20 times, there’s likely to be a significant amount of truth there. And if not; well. There’s always the apology.

But then. The Virus. The Panic. The Toilet Paper.

I’ll skip the event that all of us know but for mentioning the one thing i continue to harp on about: Crashes Matter. In this day and age of Algorithms, Central Bank Shenanigans and Balance Sheet Manipulation (The community can go adjust my EBITDA all day long) you’re not going to get truth from the markets. There has been record delivery wall after delivery wall on the Comex and while the price may be up on the year, economic conditions haven’t improved, the price of silver is still (at the time of writing on October 29th) down 22% off its August 10th peak. And then they say markets are forward looking -.-;

But humans are fallible. All it takes to fool a smart person is to draw his focus to a problem, and he’ll apply all his intellect to solving the problem; Not having time for anything else. Algorithms are no different; They are made by some incredibly smart people. The Key ingredient to Manipulation may be that the subject must remain Unaware; If the manipulator himself isn’t aware of his own environment, well…

There’s always a bigger fish.

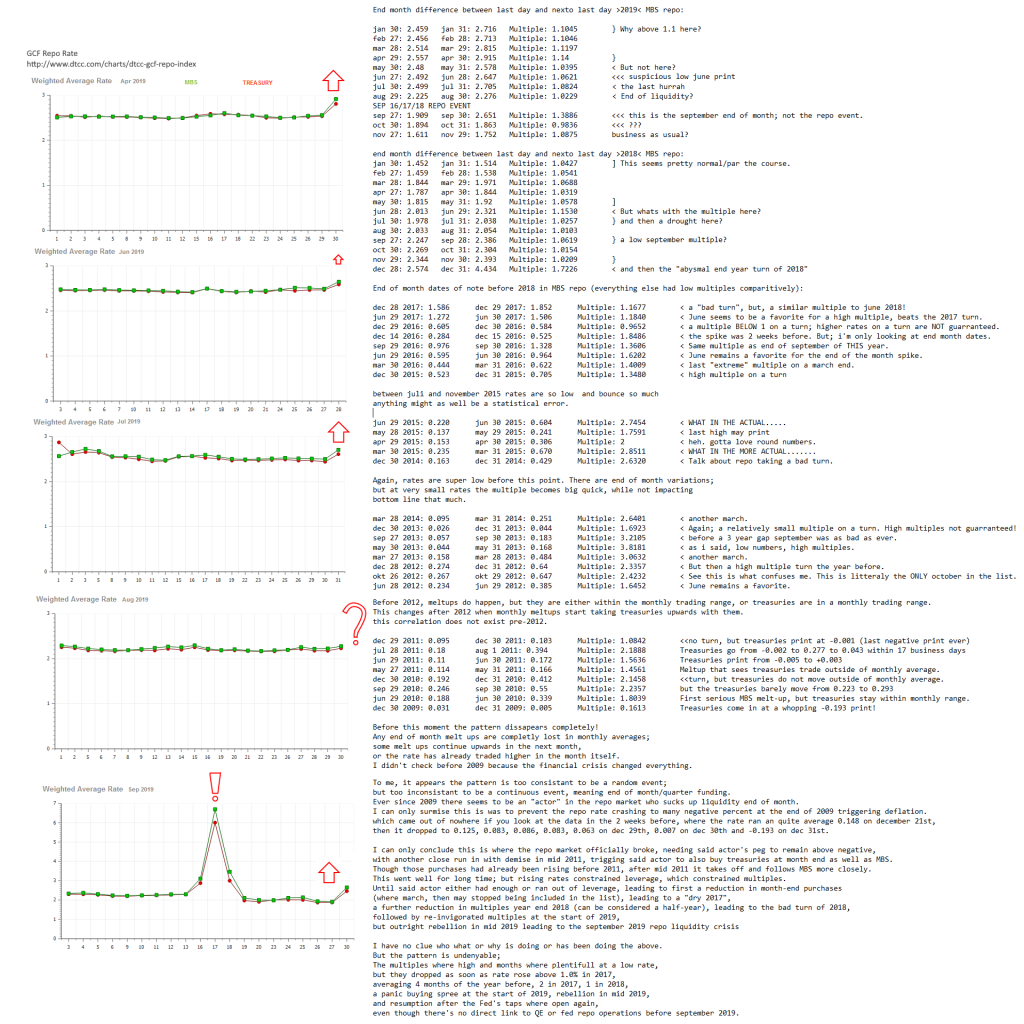

In this case everybody got caught with their pants down by the virus, because everybody was focusing really hard on the problem at hand: The Repo crisis. Regardless of what Jerome Powell may say about “the virus caused this and we’d do well to remember that”, he personally printed $500,000,000,000 on December 16th to avoid Zoltan Pozsar’s doom prediction of the previous day, of the Repo rates spiking again around the year end funding problem, as they did in December of 2018 (Repo rates hit 4,4% on December 31st 2018, after being 2,5% on December 28th 2018, which stopped Quantative tightening and led to rate cuts throughout 2019). In fact; i managed to trace problems with the Repo market allllll the way back to December of 2009:

I’m not going to explain what’s going on there. If you’re deep into finance and you wanna track a ghost, be my guest – i’ve tried for a year to get people interested in it and nobody gives a crap. All the info you need is contained in the picture (right-click > View Image for the full resolution). For the general reader: It’s just to point out that the Federal Reserve’s straight up hardcore lying and i found systemic problems going 10 years back. Out of all the shit Jerome Powell has pulled in 2020, that one statement – That it was the virus – I will not let slide. He can do what he wants. Even before Zoltan’s prediction, in the early morning of December 8th 2019 i converted my life savings to physical silver and gold and put it in a private vault with a company that guarantees in all situations the contents of the vault are mine, legally and economy. I’m out bitches! Have been for a long time.

And i did that because i realized what the Repo crisis truly meant: The United States of America went Broke. The day QE could no longer be shut off was always the day that started the hyperinflationary process. And that day was September 16th 2019. Can’t forget that Hyperinflation just means alotta-inflation. It starts off small, then grows, then goes exponential. There’s evidence for my claim of course: Go look at the 2 year – 10 year US treasure spread, you’ll find it bottomed in 2019 when it inverted shortly prior to the Repo crisis. Good Ol’ Yield Curve Inversion does it again. Though, i’m not sure i’d call an increase in the price of gold from $1541.30 to $1868 at the time of writing small. That’s still a 21% increase in the price of gold (which is still money!) in little over a year and we’re currently in a dip because the market is whining it might not get as much as an ungodly amount of stimulus with a split Democrat/Republican house/senate as it would with a sweep of either party. Forward looking markets my hiney.

In any case; this is just to indicate the situation at the end of February 2020. It’s this situation and expected money printing that all the “smart” people where focused on. It’s what led to Ray Dalio’s statement of “Cash is Trash” right infront of the liquidity panic – It’s because he was focused on the Federal Reserve’s “Temporary” repo operations that where supposed to end in April of 2020. Nobody expected that to happen, so the original outlook was that the market was going to crash somewhere in July, after 1-2 extensions of “temporary” repo finally spooked the market into no longer believing the system was safe. The start of QE5: QEfinity at the bottom of March ended the repo problems as it functions the same (and even better) in providing liquidity to severely overlevered market participants.

Naturally, a crash causes a flight into safety. Since Cash is considered the most safe, the markets rushed into cash and everything dropped like a brick in what we call a Liquidity Panic, since cash is the most liquid (universally accepted). Since to sell you need a buy, if nobody wants to buy because everybody is looking to sell, markets drop. Rewatch the movie Trading Places to get a good sense of this.

However, that only goes for the digital markets. So while the price of gold did drop, it’s because the price of gold is set by the futures market, which is digital. The people in the markets who own these futures often do it to have gold as part of their portfolio – and before 2020 that made sense because nothing was going on so it provides exposure to the price of gold without the mess of owning the physical. Once those same people started getting margin calls on their accounts because the entire market dropped, they had to sell whatever was available to not instantly go broke. Which includes gold futures, even physical gold if the need is bad enough – Losing a ton of money is better then losing all of your money.

But nobody wants to sell gold. Because Gold is considered the safest haven, even safer then cash – it’s just not taken for margin calls directly (dollar loans need dollars). Countries have gone broke before. Currencies have died before. But gold is eternal. As Warren Buffett remarks – it’s just a shiny rock. But that is precisely why the demand, and with it value, of gold is eternal. All trade is human. All humans like the shiny. All humans, at some point, desire to trade for the shiny. Whether it’s to retain value or because they’re increasing in wealth and want to display it.

I also just wanna dedicate a paragraph to call the people who say gold has no industrial use complete and utter buffoons. PURELY decoration is already an industrial use! GOLD LEAF you morons. Lots of stuff is covered in gold leaf to make it look pretty. If you say making things pretty is not an industrial use then lets get rid of the fashion industry as it is hella annoying. Also, gold is extremely non-reactive. You can swallow a pellet of gold and it’ll come out the other end untouched. I remember a popular teen alcoholic drink that had flakes of gold leaf in it – the selling point being “it makes your poo gold”. That’s still metal you’re swallowing, i wouldn’t try it with flakes of Lead. It’s this property that has made it so desirable throughout history. People didn’t understand chemicals, or bacteria, or Rust. All they knew is, you can eat off a golden plate and never get sick. You can use a silver knife and it’ll never rust – And the people who did use rusty cutlery didn’t seem to be doing so hot. We simply try to avoid using gold for industry because of its universal utility (the shiny) and thus monetary qualities. Gold leaf gets used because it’s extremely thin and thus uses very little actual gold, even though it still is gold. Smartphones ALL contain gold – but in minute amounts because we try to conserve it.

Which seems to be the only damn thing we actually put any effort into conserving.

In the market this was shown by the gold price recovering rapidly: On the 16th of March the gold price dropped below $1500 for the first time, but between March 23rd and 24th it recovered nearly completely – back up to $1668. Up on the year, because the January 6th spike as the Iranian retaliation happened against the US drone strike of their top general topped out at $1600. Not bad for a week after the fastest crash in history. I mean Bitcoin went from $9180.60 on March 6th to $6762 on March 24th. So it dropped sooner, and recovered much later.

Naturally me highlighting this human demand for gold is not without reason. It goes to proving the disparity between Paper and Physical. Even though futures are digital now we still call them “paper” gold, because they’re not real gold. They’re Futures – promises to future delivery of gold. Promises can be broken, and that’s just not good enough in a panic.

The reason i link that screenshot is not to brag (per se*cough*) but because of an event that happened not long after the crash in gold price. I was using a website that sells gold/silver in the Netherlands to keep track of local availability as the panic hit, so i saw the supply issues develop. On that website, when i posted i posted my twitter message calling the gold bottom on March 23rd (i wanted to do it on the Saturday before, but the site i looked at only allowed trading during market hours), they still allowed orders for gold and silver, though multiple messages warning of delivery delays because of excessive demand already littered that website as well as every coin dealer’s website i checked.

The day after i posted the March 23rd message, it was no longer possible to order any gold or silver on the website. All orders where closed due to supply issues. So even though prices where historically low – you couldn’t buy any of it, because nobody was selling any. Again, first rule of trading. To buy, you need a sell. Something alot more people will run in to going forward.

The point of this part of the story though is to show simply; there wasn’t enough Silver or Gold to go around at the time. Not for the consumer… Not for the Comex:

As the price rebounded, a difference in price emerged between the London market, the LBMA, and the US market, the Comex. This indicated that there where big delivery problems, as normally those prices trade very closely together. The LBMA and Comex use different sized bars (400 ounce vs 100 ounce bars) and the refineries in Switzerland where closed due to the virus; As well as all air travel shut down. This difference in price later lead to the “Arbitrage” explanation for the increased demand, where traders where supposedly standing for delivery to benefit off the price spread, only to sell it again when the spread went down. Considering there is still massive demand currently, with no metal being moved off the exchange, even though the London AM Fix at the time of writing this is $1896.85 and the live gold price is $1867.60. If there was ever a time to reverse that trade….

The continued shortages in gold ended up leading to not just 1, but 2 memos jointly issued by the LBMA and the Comex. This was remarkable at the time because the LBMA and Comex are supposed to be separate entities. They operate within the same system, the gold market, but they’re each their own. So for the LBMA to issue a joint warning to “please not panic” and do it twice is remarkable.

In any case, as the world had more pressing matters to attend to, the markets calmed down somewhat and the spread tightened a bit. However this changed nothing about the situation the Comex was in when it entered the panic, the way it was during the February deliveries: Extremely overlevered. Which is the reasons for the double memo in the first place. Had the world called their bluff the entire global financial system would’ve been dead and buried by now.

The moving on of time changed nothing about the general chaotic situation in the world and with it, the demand for physical. So when the first month rolled around that had a lot of contracts available for delivery, alot of people stood for delivery. At the time open interest was spread out more evenly across more months, but in general most of the open interest is located on one month. Silver and Gold exchange active month one after another, so while Gold is active and delivering in April, the open interest in April Silver is minor; And while the open interest in Silver in May is very large, Gold is almost non-existent in April.

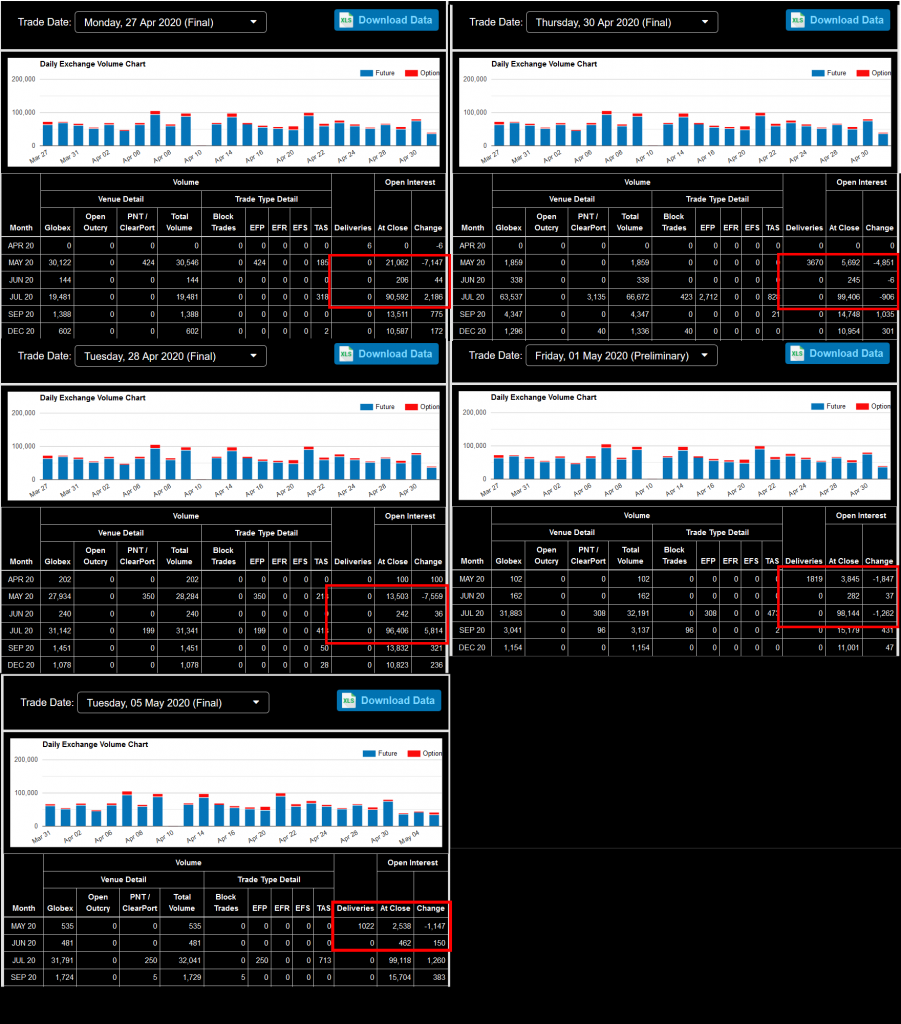

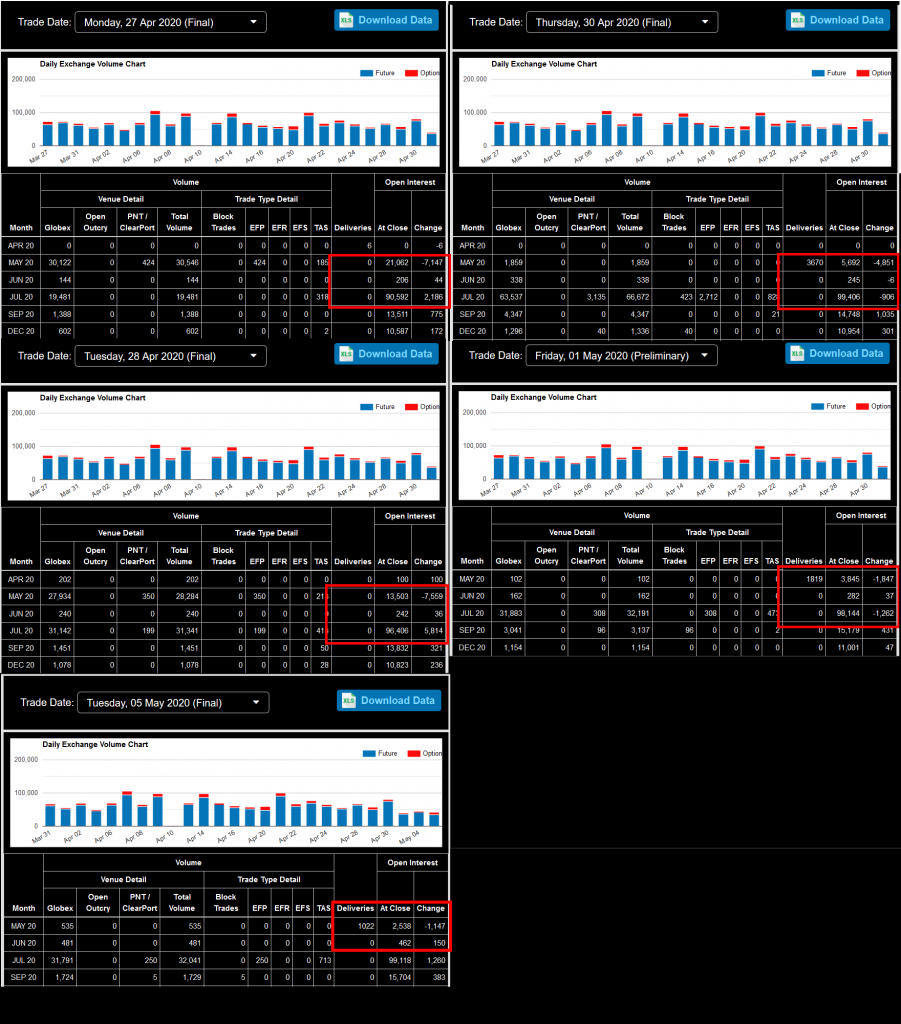

Its here that i can offer my first screenshot of some actual numbers. While i don’t know the exact number of deliveries of gold contracts in April (or those of Silver in March) i thought they where around 53,000 in gold – so a total of ~5,3 million ounces, which is the number i’ll be using going forward. Trust me, once we get to the shadow contracts, specificity goes out the window anyway. Even if i’m off by a few thousand, the difference between 53,000 and 276 contracts standing for delivery 2 months apart should be obvious.

I took this screenshot at the end of April, awaiting the massive amount of contracts in May in silver and seeing how many would stand for delivery.

A total of 10,543 May 20 contracts of Silver at a total of 52,715,000 ounces stood for delivery on April 29th. Clearly, this is no small amount, especially contrasted against the 241 million ounces of eligible silver in their vaults now; Which was substantially less earlier in the year. Now the full and exact history of the delivery walls as i’ve come to call them i’ll leave up to others – their exact height concerning me less then the fact that they’re happening at all.

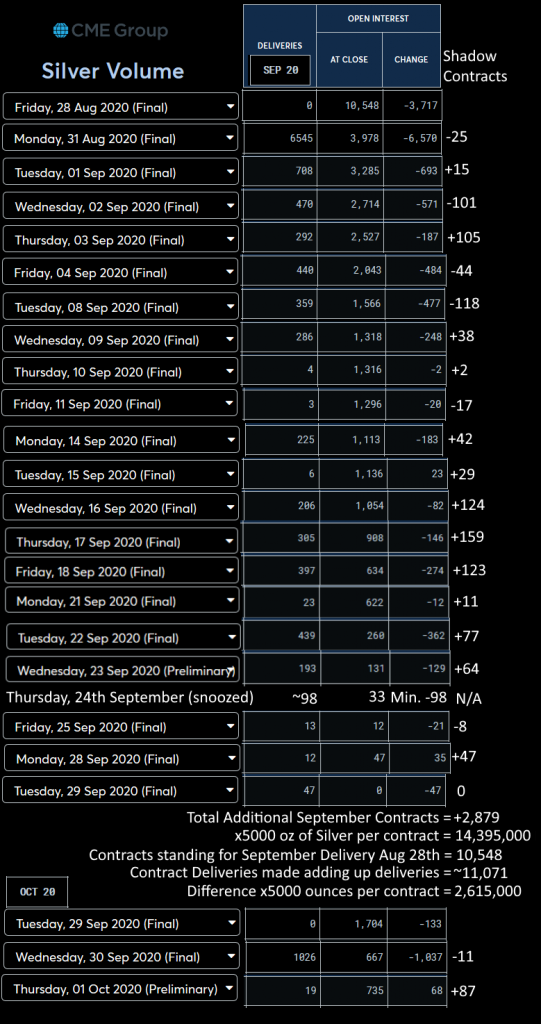

And they didn’t just happen once. I could understand a delivery spike after the crash, maybe 1-2 months after. Same thing happened in 2008 before dying down again after the immediate panic. But on August 28th, 4 months after the May silver wall, 10,548 Sep 20 Silver contracts stood for delivery. Clearly this change from no deliveries to massive deliveries is a sea change; a paradigm shift, some thing hidden yet known to alot of people has changed from “it’ll be fine” to “AAAAAAAAAAAAAAAAAAAAAAAAA”.

This does not have to be public knowledge of some sort of scheme by the way. You’ll find humans are very much alike and there’s plenty of us to go around. The change could’ve been nothing more then the 2 memo’s the LBMA and Comex sent out in March; And a mass of well-off/rich families independently of each other adhering to the adage “when they tell you not to panic, Panic.”

But, i’m getting ahead of myself. We have only just arrived at the May silver delivery wall… And here’s where the juicy stuff starts.

See, here is where the mindset i started the article with starts to pay off; And why i spent time on manipulation and shenanigans. After all the answer is almost self explanatory; Ofcourse if you knew something was going to happen, you’d prepare for it! But that comes with the caveat of having to know. Well, if you’re still with me up to this point it should be fairly obvious that whatever the case, the current situation cannot continue. The Comex was not set up for this many sustained deliveries, nor did they go into this situation expecting to ever having to deliver such massive amounts, I.E. Overlevered as all hell.

I’m just a guy behind the PC with a penchant for numbers and a nose for bullshit. I don’t know the exact numbers or whats on the books of the Comex or the bullion banks. Neither does pretty much anybody else, because again, they remain unaudited and the regulators…. Well they’re either complicit or criminally negligent at this point. Seems to be a theme of late. However, a few people do know what’s on those books: The Comex and the Bullion Banks.

And they started to sweat early on. Naturally they’re not going to say so, hence the memos. But while a manipulator can hide his words and his actions, he/she cannot hide the actions that they have to undertake to continue the state of manipulation. As i said before, they key ingredient to any manipulation in progress is that the subject remains Unaware he/she is being manipulated. Should they become aware, they rebel. That pesky free will again.

In this case, the memos are such an action – designed to curb demand. Another such action is to prepare to mitigate possible failure. Gamers know the “it’s not a bug it’s a feature” statement all too well. And as such, should the Comex not be able to come up with the Silver required under the rules and therefor break them, if the rules change beforehand, the rules where never broken. Comex changing the rules is also well known to the precious metals crowd.

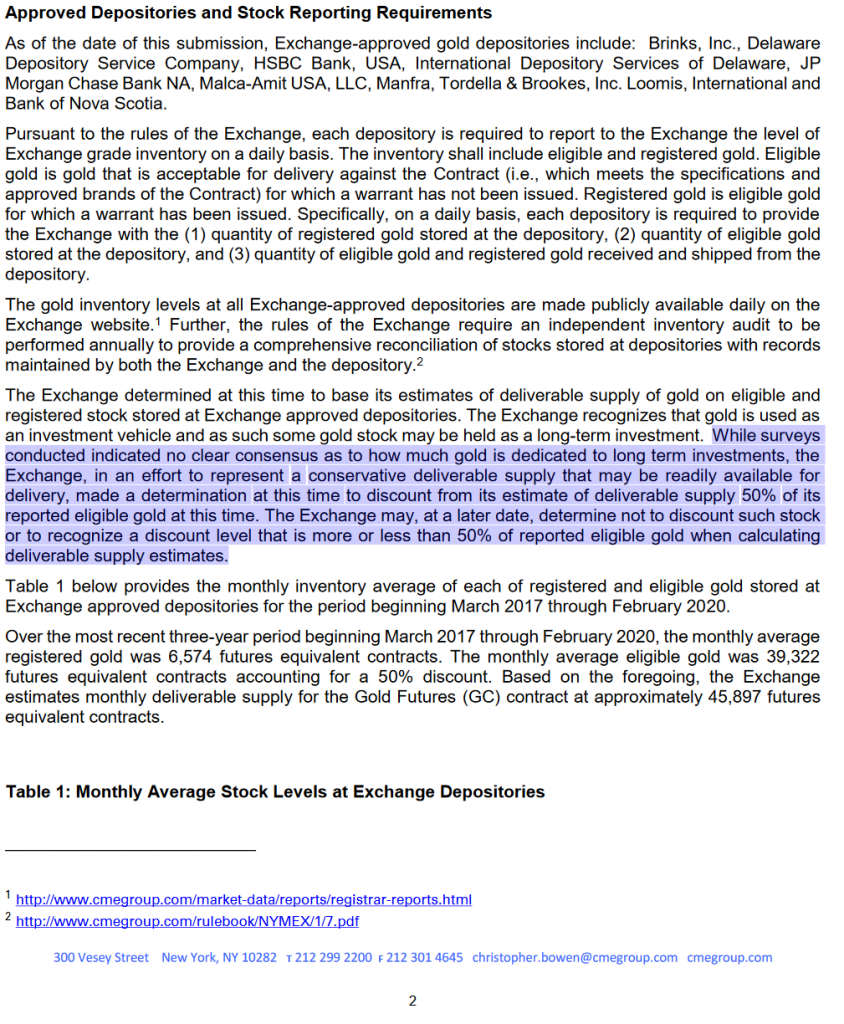

Coming in via my good friend Robert Kientz from Goldsilverpros.com who brought this to my attention (and who has done good work on the Comex himself), the CME group (again the owners of the Comex) made this change on April 9th 2020, ahead of the delivery wall shown on the first screenshot. The document can be found here: https://www.cmegroup.com/content/dam/cmegroup/market-regulation/rule-filings/2020/4/20-184.pdf

First let’s start with the obvious: The Comex is straight up admitting they have no idea how much Eligible gold is actually available for delivery. While the language is somewhat ambiguous the end result leaves no question: “surveys conducted indicated no clear consensus as to how much gold is dedicated to long term investments”. If they don’t know how much is not-available for eligible delivery, then they also don’t know how much is available for eligible delivery.

“in an effort to represent a conservative deliverable supply that may be readily available for delivery, made a determination at this time to discount from its estimate of deliverable supply 50% of its reported eligible gold at this time.” There’s 2 things remarkable about this sentence. First is the obvious. The Eligible gold supply – which is the only supply they can draw from to deliver – is cut in half by decree. But the second one that might get easily missed is the wording. It’s strange. We humans tend to read over these things easily, but look carefully: “at this time” is contained twice in the same sentence.

Well there’s 2 options here. The likely one is that they made a mistake. In a document you can be assured they took great pains to word carefully as to not blow up a market with a lit fuse, then buried it in between filings since people are still going to look. The only other option if it’s not a mistake is that both “at this time”s do not refer to the same thing. So, what they’re effectively saying “Right now, We’re cutting the supply of eligible we think we have Right now, in half”. So this pertains to the eligible gold they thought to have at the time…. But not going forward. That might seem like a real nitpicky detail but that’s how they getcha. The devil is in the details as they say.

“The Exchange may, at a later date, determine not to discount such stock or to recognize a discount level that is more or less than 50% of reported eligible gold when calculating deliverable supply estimates.” This sentence shows more careful wording, and that the previous sentence was not a mistake. The first part of the sentence is a “recovery”. You’ve just dropped a bombshell on somebody (50% cut of eligible gold at a time of supply woes) so you need to tell them it might not be so bad, or in this case, “we might not do it again”. Or we might. That’s the second part of the sentence – We might also choose to discount more then 50% you don’t know go fuck yourself. While that might sound crude, i actually swear for a reason – a manipulator always hides behind sweet language. Swearing is abrasive to people, which causes distrust. Since it’s key that the subject remains unaware, you cannot afford to create any distrust. When you think about what i said, and what the language of the document says, while i might express it more crudely – the spirit remains the same. Which means that in reality i have not been any more unkind to you then the document has – yet due to the emotional reaction to swearing, you think i have. I fucked you but they fucked you with a smile. Since those trying to point out manipulation tend to be more passionate due to nothing more then having a conscience and they can’t stand for inflicted suffering, pure civility has extended many scams beyond even their physical limits.

The last part of the sentence goes to why i highlighted the “mistake” in the previous sentence. “when calculating deliverable supply estimates”. Taken in a vacuum, you might arrive at the conclusion that “Oh, in the future they’re just going to look at their eligible supply again and then recalculate their discount. That must be why they said it could go up again”. But when a pattern of behavior has been established, namely that they haven’t just recalculated the discount but also their eligible supply, the meaning changes.

They won’t be re-using any of the calculations of April 9th. When they “recalculate the discount” they’re not going to say “On April 9th it was 50%, we dropped another 10% so the discount’s at 40%”. No, the 50% cut has happened, and then from that basis scenario, if they decide the discount is 50% again, it’ll be 50% of the NEW level – 25% of the April 9th level total. However, when you or anybody who doesn’t know this document exists, reads about a 50% discount in the future, it will read as “Eligible supply has been discounted by 50%”. Even if you know of this document’s existence, your initial reaction would be “oh so it’s the same, ok”….. But that’s not what the text says.

Clearly, they where in trouble. The fact that the LBMA had to offer its gold up for delivery on the Comex, with the Comex willing to go as far as to introduce an emergency “sliceable” contract so 4 people could own 1 400 ounce bar, shows the situation was dire. This document change, along with other reported shortages such as the ETF GLD sourcing the physical for its demand from the Bank of England means the situation was truly near collapse.

On the GLD by the way, since i recieve many ETF questions; Same as futures: Get The Fuck Out. Today. Nothing in the Bank of England’s vault is owned by anybody but the Bank of England. There’s more reputable ETFs or you can just stop gambling with your soon-to-be-in-short-supply money and buy physical while you still can. SLV same thing, only you’re dealing with JP Morgan, so worse. You want more info on those ETFs; go look at the work Ronan Manly has done over at Bullionstar.com

And as i showed above; That’s not the first time i’ve said that.

If you knew the futures, wouldn’t you prepare for it? Well, the delivery wall months aren’t the only months with contracts on the Comex – as i said earlier, at the beginning of the year, they where far more spread out over the rest of the year. And you can trade all of these contracts just as well as the currently active month. They just don’t have nearly the volume of the active month, because all the retail CFD traders automatically switch over to the next active month. But trades still do happen, and those who are in control of the trades can see exactly who is trading what. They can see if a contract is traded from one entity to another, as in from a bank to a producer, a hedgefund or “other investors”.

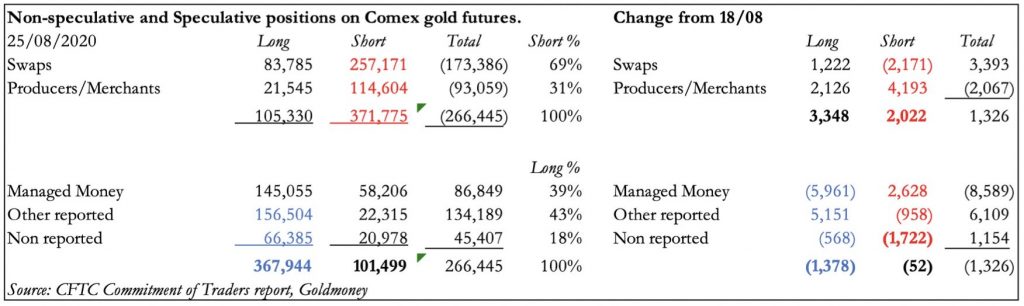

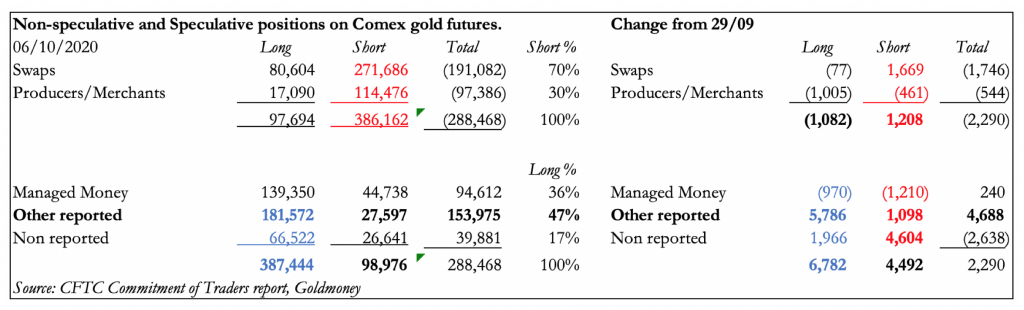

Coming in via Alasdair McCloud who writes on Goldmoney.com (and does amazing work on the coming economic troubles), this shows the open interest on the Comex as per August 25th 2020. This isn’t a particular date of note, but it’s just a while back when i happened to grab one of his regular reports. I do remember seeing one such report in January, and one such report in May. The reason i remember those two instances is because on the first report, i remember seeing the “Other Reported” being a paltry 11%. In other words; insignificant in the scheme of things (though i’ll be honest – i can’t be entirely sure i looked at the right number a lifetime ago).

In May that had jumped to 41%. No doubt helped by the massive reduction in open interest after the market cratered. Now, these “Other Reported” are basically the rich and well off family offices that have a direct line to banks and don’t have to go through Robin Hood like the rest of us plebes. Clearly, the elite didn’t buy the V shaped recovery from the start, and given it was 43% by august and the most recent update on Goldmoney says it’s now 47% after reaching 48% not too long ago; They’re not even buying the supposedly beneficial for them K shaped recovery. Not only that, but “going long” in their instance means basically standing for delivery. After all if you exchange cash for gold then hold the gold on the exchange you can always sell it again for cash, or “take it off the exchange”. Which is another thing people are expecting these folks to do: Because all the gold is basically still located under Registered so technically it’s still on the exchange, they’re expected to sell it back into the market “when the arbitrage trade unwinds”.

I’m sorry but the spread has vanished and the political situation in the US has only gotten worse this year, not once did things get better as depressing as that is. These are humans holding the gold and anybody selling their gold now is an ox and a moron, which anybody can see. And they do hold the gold. Even though it’s still on the exchange, the title is theirs. The document i linked even says as much: “The inventory shall include eligible and registered gold. Eligible gold is gold that is acceptable for delivery against the Contract (i.e., which meets the specifications and approved brands of the Contract) for which a warrant has not been issued. Registered gold is eligible gold for which a warrant has been issued.”

Well when a warrant has been issued against eligible gold, and only that person has that warrant, and the warrants aren’t tradeable (cause that’s what the futures market is for), and the exchange is obliged to hold the gold issued against warrants in perpetuity…… Well then it doesn’t matter that the exchange has the gold in its vaults on paper, does it? You have a chain of custody. The warrant owns the gold and the other reported owns the warrant. Ergo, the other reported owns the gold. They decide, not the exchange, what happens to the gold tied to the warrant (which is just another form of contract, really).

We cannot see these other reported trades. We don’t know who owns what contract or who got what warrant. The deliveries have happened, but that doesn’t mean people bought those contracts on the day before delivery. You can buy a December 2024 contract right now and just HODL for 4 years. Naturally ones instinct is to say “Well the problem is happening now, wouldn’t everybody pile into the current contract?”

Well they did, and that prompted the change from the CME. The language is civil, but basically equates to “Back off or we’re gonna do this again and then the party ends right quick”. Again no collusion is needed; When there is only one obvious solution humans will take that solution independently of each other, as if they where communicating while they where not. I played many videogames at an extremely high skill level where this is the norm not the exception – chat is often not needed for professionals to do what they want each other to do. So the exchange managed to survive another day. But as that change pertained to right now, that does not change anything about later. And as they said, they might not do it later. So why not just buy and hold a later contract? And as i stated before, all the “smart” investors got caught with their pants down in March and they weren’t hoisted much higher in April. Meaning all of them had an incentive to play along, try to recoup losses and buy more gold with that (as evident by the ever rising Other Reported category regardless of price action).

In April after the change, they must’ve seen the shift in contracts behind the scenes and concluded the inevitable: This Turkey is Toast. There’s no salvaging this. People standing for delivery all throughout the year (by buying and holding contracts made in advance) means the continuation of the delivery walls, based on ratios, should’ve been fairly obvious from the beginning. And this is just based on monetary panic, even at the end of October 2020 outside of one off spikes the recovery rate of cases of the virus never fell below the detection of new cases. The early prognosis of “it all being over by May” was never realistic to begin with with a populace that so sternly refused to prepare in February. No event changes humans that fast. Jesus can come back to earth, miracles and all, and if the words he says contradict large parts of the bible he’ll be denounced as unchristian within a week.

So here we come to the discovery of “Shadow Contracts”.

Well, not entirely at the discovery of them. After all, another tool in the toolbox of manipulators is Gradual Change. The old “Put a frog in a pot of boiling water and he’ll jump out, but heat it up slow enough and he’ll boil alive” story. While that is an urban myth, all those myths exist because of a core of truth. Animals, which includes Humans, are incredibly susceptible to gradual change. As they are incredibly suspicious of sudden, drastic change. So when one looks at the above screenshot, one might not immediately notice something.

I didn’t. I missed it, even though i was staring right at it at the time. Captured it by accident. Can you spot it?

The deliveries do not match the reduction in open interest of the contract up for delivery

In fact, that screenshot exists in that current form because it was around the news that Nova Scotia, one of the bullion banks, gave up and quit their precious metal business on the back of huge losses from the crash in March. As i said everybody got caught with their pants down, including banks that suddenly in a panic had to deliver metal that they didn’t have. Naturally that doesn’t mean all metal is gone – it just means whatever’s left starts commanding a premium. Those premiums killed Nova Scotia’s precious metal business. A short time later they forced ANB Amro to sell and close their business in similar fashion and HSBC took huge losses as well.

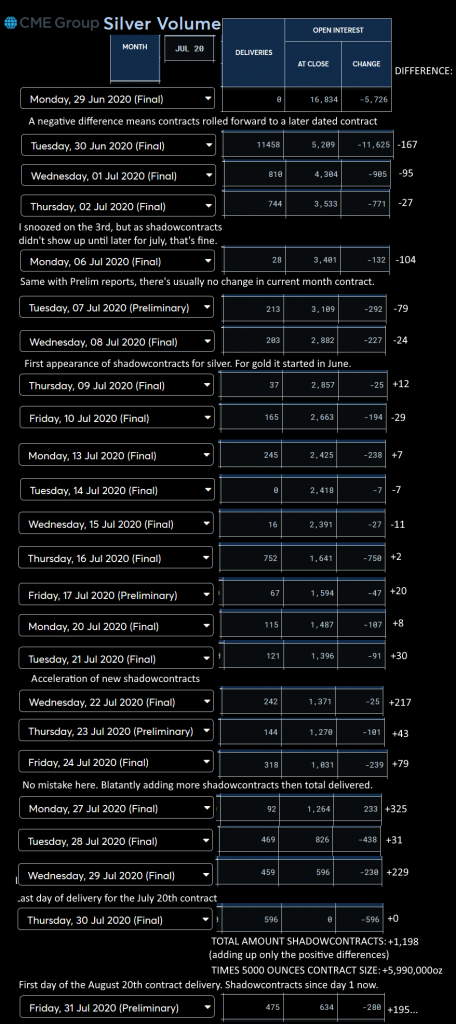

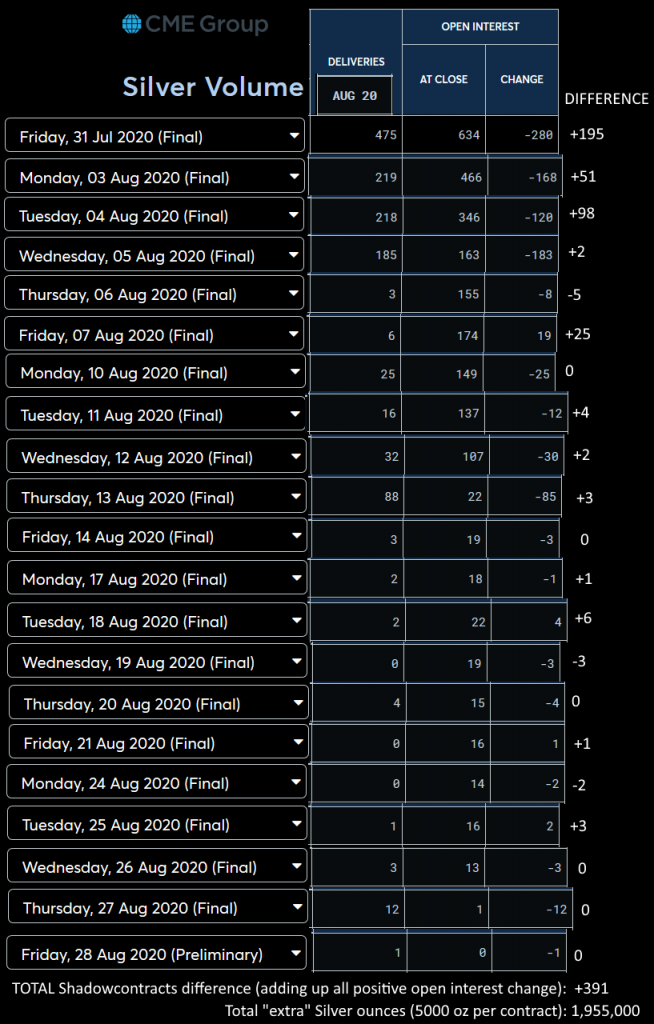

Now as there has been some confusing sown over the name (and people don’t deal well with day/24h timespans), as the person who discovered the discrepancy let me make it clear once and for all what a Shadowcontract is specifically defined as:

“A Shadowcontract is a Futures Contract made in the current delivery month, slated for next day delivery.”

– Kirian van Hest

There is evidence to support this definition.

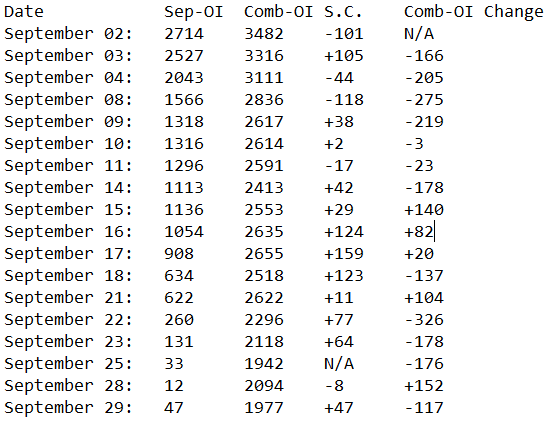

The above screenshot is cobbled together from screenshots i’ve been taking of the current contract open interest in Silver for months. I tend to cobble the data together by just cutting and pasting stuff, because in the first place i have no 2D art skill what so ever so it’s never gonna look nice anyway (and you can forget about me being able to Photoshop *anything*. I can make a meme look decent-ish), and in the second place so that the data is both transparent and undeniable. I can make the raw, original stuff available on request (but i just save screenshots in layers of Paint.net, and with a 1440p desktop the files get kinda big), the only edit being i’ll crop out my 2nd monitor so it hides my horrible desktop management/what i was watching at the time. In any case, i wanted there to be no doubt as to the authenticity of the data: It’s all their own.

As you can clearly see, with 459 deliveries and 230 contracts removed from open interest, the numbers show a discrepancy of 229 contracts. Logic dictates that once you deliver a contract, be it a warrant or a bar, the contract must disappear because it has become worthless – the asset underlying is no longer the contract writer’s to give. Just like you don’t keep a job contract forever, once the job is lost, the contract is voided and legally speaking disappears – you are no longer employed at that business. Since the open interest changed with less then the amount of deliveries, and it pertains only to two very simple numbers – deliveries and total change of contracts that day, the inescapable conclusion is that: “A Contract Was Added”. In fact, 229 contracts where added on July 29th 2020.

Since these contracts go per month, there must be an ultimate delivery date, where the contract expires and any contracts left must be delivered, as the next day the next month becomes active and available for delivery. There is, and for Silver in July for the Jul 20 contract, that date was July 30th. And indeed, we see all remaining contracts delivered. This proves conclusively that 229 new contracts where made the first day and delivered the second day, satisfying the “next day” condition. Furthermore we can conclude that, because those contracts where delivered the next day, and delivery can only take place with an underlying asset (it’d better otherwise you’re effectively getting nothing, Registered is compromised too and the problem is EVEN worse), that the 229 contracts made where not naked shorts – they where legitimate contracts backed by an asset.

And here we arrive at another crux of the story, another one that has sown some confusion:

Are Shadowcontracts indicative of Fraud? Yes. Are Shadowcontracts Illegal? No.

The beauty of it is that on the face of it, it’s perfectly legal. Bullion Banks are allowed to make contracts with an underlying asset. As Market Makers, that is literally their entire function in the market. It was set up this way from the start. There’s ways to be legally fraudulent too you know, by taking advantage of a system that was never intended to function in a certain way. If you find a glitch on a webshop that allows you to buy all goods for $1, that’s fraud too. It may be their website and their lack of due diligence, but that doesn’t give you the right to exploit that weakness.

“Give me control of a nation’s money and I care not who makes it’s laws”. What if you where in control of part of a global money system, Thé money system, the international gold and silver markets?

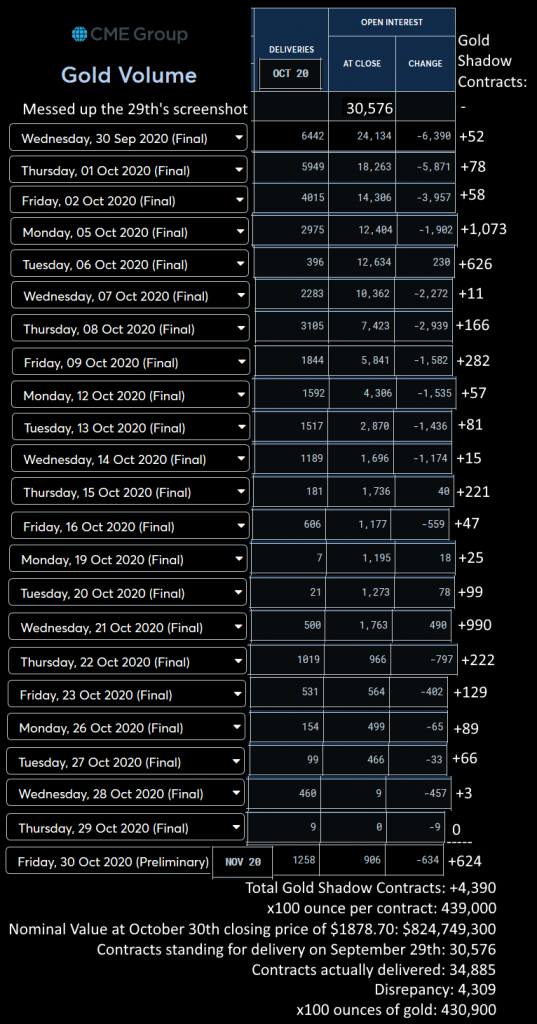

Every good story needs a villain. So let me introduce Jamie “That’s why i’m richer then you” Dimon, CEO of J.P Morgan-Chase. Considering the seriousness of the situation i can’t see how this doesn’t go all the way to the top, but for the sake of plausible deniability, let’s focus on the bank he’s CEO of: JP Morgan, the biggest bank in the United States and indeed, in the world. Until the Fed prints its way past JP Morgan’s derivative exposure, of course.

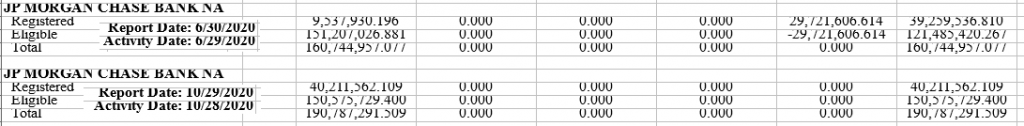

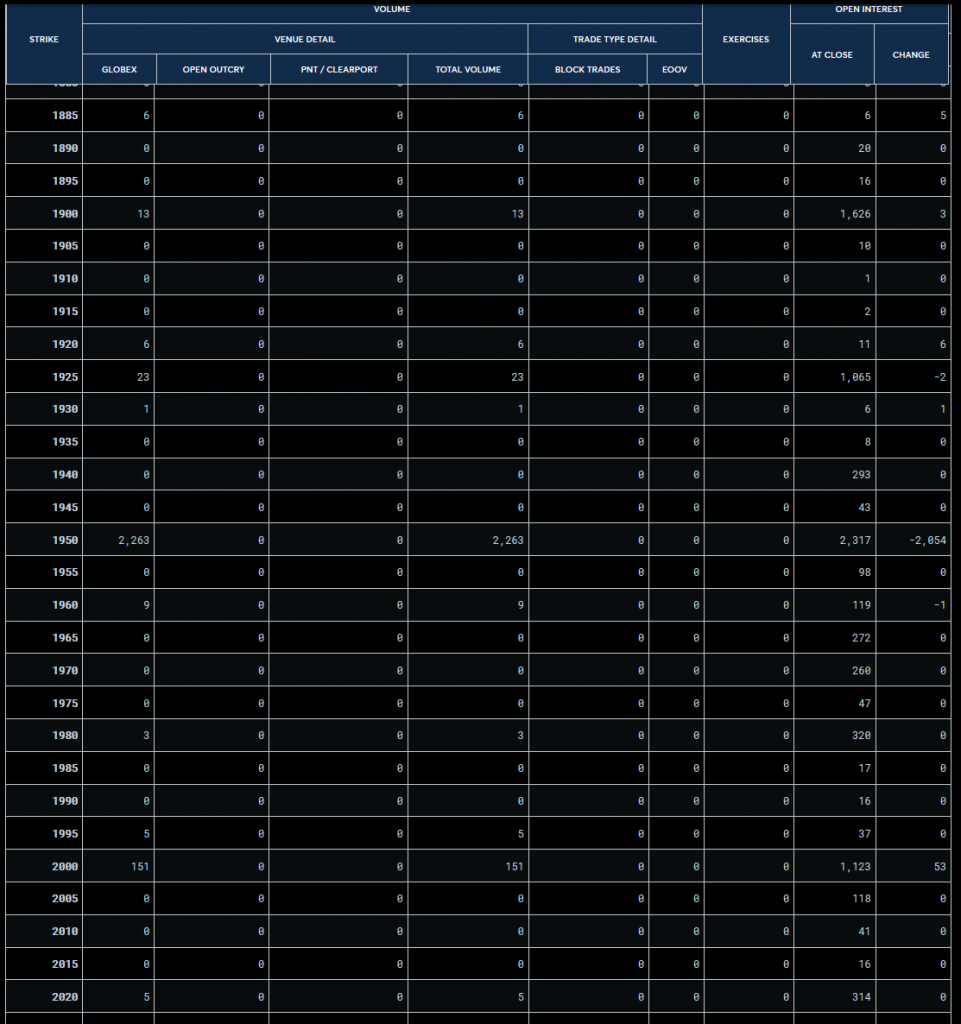

Besides being the biggest bank by balance sheet, they are also the biggest bullion bank. By far the biggest bullion bank. Below is a screenshot of their current holdings in Registered and Eligible Silver, as compared to the balance sheet i already linked earlier during the massive deliveries.

Focusing in on JP Morgan, we can see the change on their books was a massive 29 out of 33 million ounces during the delivery wall. As a ratio relative to their size, that’s incredibly skewed. They are (nearly exactly) 50% of all silver holdings on the Comex, yet on that date they consisted of nearly 89% of the change from Eligible to Registered Silver. There’s more evidence that JP Morgan is in deeper then they’ll claim. Here i’d like to introduce another famous quote; “I’ll give you the bottom 10% and the top 10% of any move if I get to keep the middle 80%.”

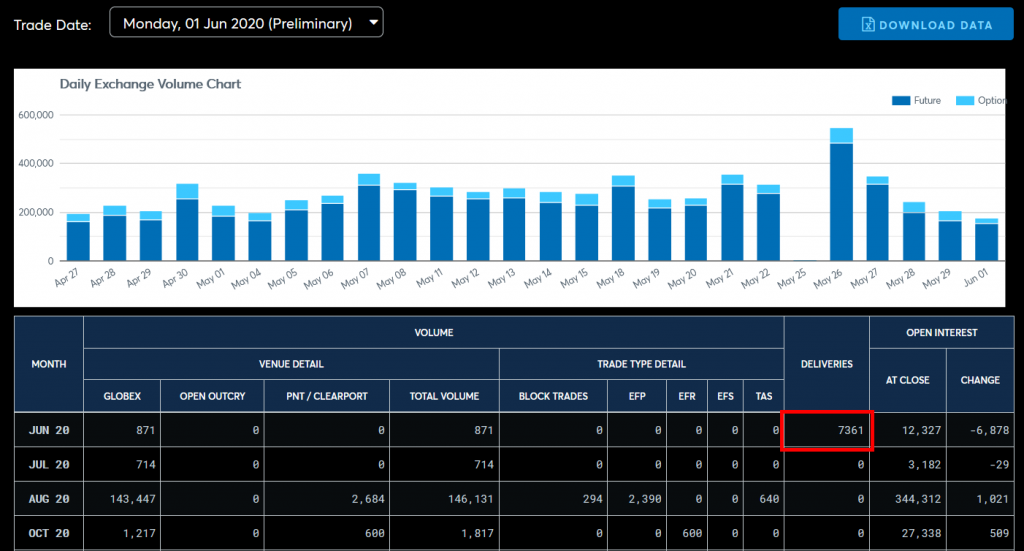

7340 contracts is nothing to sneeze at. At 100 ounces per contract (734,000 ounces) that’s 22,8 tonnes of gold. At June 1st closing price of $1763.70, it’s almost $1,3 billion exactly. In 1 day. That’s why i screenshotted it in the first place and drew the box.

However, this time, they fucked up. Because i drew a biiiiig red box around those numbers to make sure people would focus on the right numbers. And when it made me focus on them, it made me think:

“….Seven thousand isn’t Six thousand…..”

The one off Shadowcontracts in May was genius. Small changes. If anybody would’ve noticed, the CME could’ve said it was a glitch in the website. Glitches happen all the time in tech, most of them happen once in very specific conditions and then never again; repeatable glitches are often patched out. The observant among you might’ve noticed that the design in the last screenshot is different from the earlier designs – That’s because between the middle of May and the end of June, they changed the layout of the website. I am positive they where planning on running that as cover in case anybody noticed a “glitch” after the design changed. (My thoughts at the time where “Oh cool this looks better it’ll upgrade the look of my screenshots”) After all; “It’s a new design, haven’t worked out all the kinks yet haha (quickswitchtoplanB)”. Should the one before the change be discovered: “Well, that’s why we’re changing the site, it’s broken.”

Fooled me. But…. A difference of a thousand is too much for me to swallow. Even though the actual difference isn’t nearly a thousand, individual numbers matter. That’s why you see stuff priced at 9,99 – because we perceive 10,00 to be vastly larger then 9,99 – even though the difference is the same as 8,23 and 8,24. Even though the difference is only 483, i perceived it as 1000 – And that triggered the ol’ bullshit detector.

Now, i can draw conclusions on the flimsiest of evidence incredibly quick, but even i’m not that quick. I thought the same thing as all of you would: Must be a glitch. Unfortunately for the Comex though, i’ve done an IT education and have always felt very comfortable around computers, so i’ve seen my share of glitches. Computers are stupid. All that talk about A.I. is absolute baloney. There’s nothing intelligent about it, all we’ve done is tell the computers to iterate on its own code according to set rules, and after a few million simulations we can’t read the code anymore. Well the same thing happens if you let a couple of self-taught nerds code the program, it’ll work just as well and it’ll be just as devoid of intelligence when you look at the code. COMMENT, you bastards!

Bad code is bad code. And the computer only runs what it is told to run. So, if the computer is told to run bad code, it’ll run the bad code regardless of what it says. It could be a glitch that detonates all nuclear weapons on earth; Computer don’t care. It Computes. Ergo, when it is told to run the same bad code twice, you’re going to get the same glitch twice. That’s what Quality Assurance consists of in Game Development: Jumping 1000 times in a corner to see if you can create a specific circumstance to jump through the world, exposing bad code. Once you can replicate it, you know where the bad code is located (and if you can’t replicate it it doesn’t matter, because the glitch only happens once).

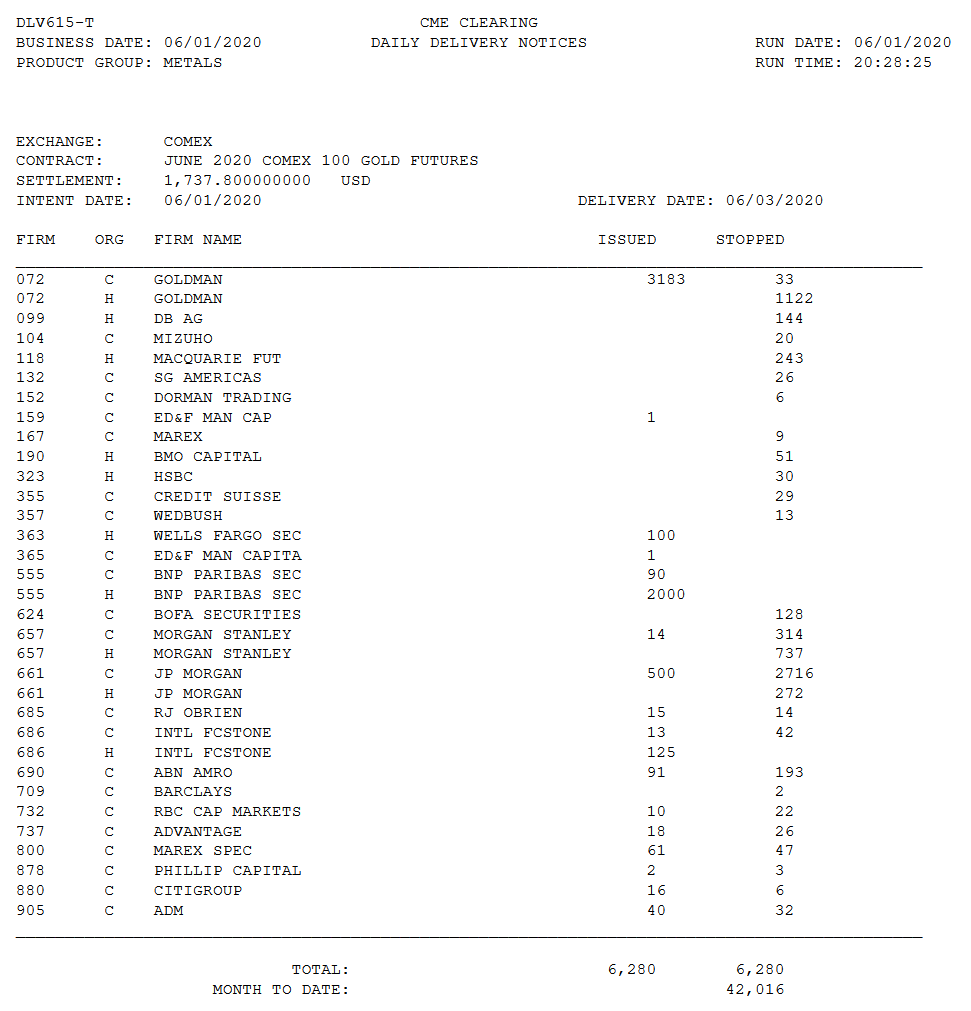

Now since i didn’t know what kind of glitch i was dealing with on the 1st (and i’m a system operator and a problem solver, i dig like diglett) so i opened up the daily delivery notices for June 1st:

Going through the list, there isn’t any particular pattern or discrepancy that pops out to me, so i assumed it was unrelated to whatever glitch there might be. Lots of numbers under “stopped”, which makes sense on a day with alot of deliveries. Now i’m not entirely sure on the specificity of that terminology; i think it simply means “contracts opened and closed”, including shorts, so that’s what i have assumed.

Well the thing that pops out obviously are the 3 big customers on that list: Goldman Sachs, BNP Paribas, and JP Morgan. Goldman Sachs and BNP Paribas are heavily slanted on the Issued side; JP Morgan on the Stopped side. I figure “stopped” contracts includes contracts that are delivered, as those are closed on delivery.

Now considering JP Morgan’s size i didn’t think it was odd for them to be on the delivery notice in such force, though i did note i thought it was weird Goldman Sachs was on there, as they are not listed as a bullion bank. PNB Paribas is a name i’d already seen pass my newsfeed: https://www.bloomberg.com/news/articles/2020-05-06/hsbc-bnp-repeatedly-breached-trading-limits-in-market-mayhem.

So i felt it safe to assume JPM was on the right side of this trade.

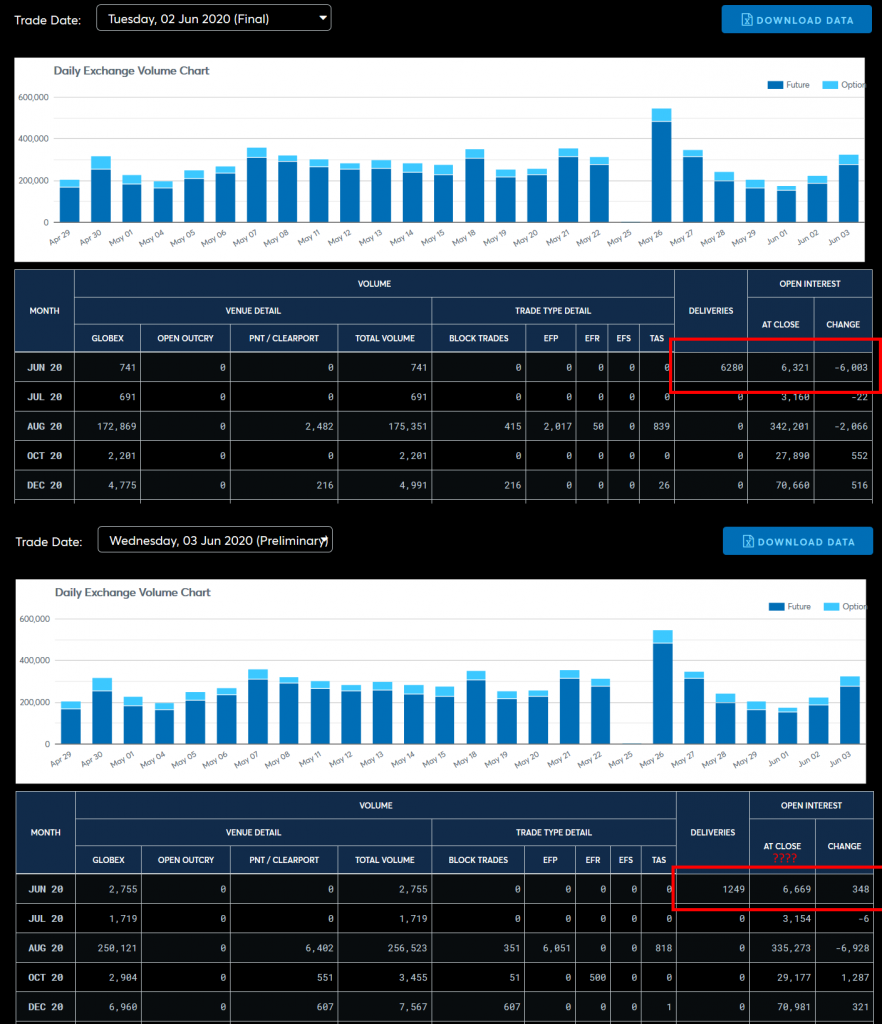

But a glitch is still just a glitch. One day does not a pattern make. But it does peak my interest. So i went back the following day.

On June 2nd it happened again. This time with a difference of 277 contracts. I did look at the deliveries, but nothing that caught my eye stood out so i didn’t screenshot it. Though that’d just mean that JP Morgan returned to a sane issued/stop ratio, or possibly even went positive for a day to hide their shenanigans. Well, a glitch of 277 is 3 digits as well, so it was not impossible that it is indeed a returning computer glitch, a bug in the website.

Except that i sniff out my own bullshit as well, and that theory just didn’t hold water. Fine, a glitch in the website – but the design had been live for a week or two and in those two weeks – no Shadowcontracts. The website also is programmed to just display database data, often SQL and all this stuff has been integrated into live feeds these days because that costs less effort. So it seemed unlikely the glitch was in the website and not the trading data. I’ve seen plenty of glitches develop on their own…. And i’ve also seen plenty of exploiters in my day too. So we wait another day.

3rd of June and the pattern changed! Now, Not only do the deliveries and the change not line up; they’re POSITIVE!

Positive change of 1597; Meaning the glitch expanded to 4 digits AND expanded to such a size that now the number’s become POSITIVE?!

Once is happenstance. Twice is coincidence. Three times is enemy action. If it was a computer glitch, it wouldn’t have changed 3 times in a short time: 1. It wouldn’t have come into existence out of nothing after 2 weeks of stability, it needs a trigger. It also did NOT happen the day before with more deliveries. 2. It started repeating itself after coming out of nothing which is not normal behavior for one off glitches, 3. It changed its behavior to expand on a massive scale again without any identifiable triggers. As stated, computers don’t change on their own. Certainly not this often. And i’ve seen alot of bad code in my day but i’ve never seen a “rotating” glitch that just hovers on a particular error effect before moving to the next one.

This is a pattern of intelligence. Somebody is somehow actively messing with the numbers.

Numbers don’t lie, people do. So it’s pointless asking the CME for an explanation for this. If they where likely to be forthcoming with the information as to what is happening, they would’ve never gone into this situation the way they did, both in terms of overleverage, and the specific wording of the official document i talked about earlier. They’re already actively trying to hide their actions and a lie is the lowest effort form of hiding your actions. After all i never pirated a single piece of software in my life.

*cough* There is still some skill involved though *cough*

There is more evidence of course. In fact there are many more pictures to come. After i had basically come to the conclusion there had to be direct manipulation going on (and knowing the authorities would be useless), i decided to start forming a theory on my own. While i might be capable of detecting a pattern on short notice, that tells me nothing about what the pattern does or is what it’s for (though this one’s pretty obvious). Context does that, and absent context, i know nothing except where to look.

In this case all i had to go on where the general conditions of the time. I’d spent 12 hours a day from January 12th onwards reading all the news i could find (from all kinds of alternative sources) so you can definitely say i was well informed on the global situation. On June 3rd when i drew my conclusions, the protests in the United States over the death of George Floyd where just heating up beyond simple riots in the city where the event happened. The lockdowns had become politicized, where the Democrat party first was against them in the beginning (the left was stuck in it’s “don’t be racist hug a foreigner” paradigm for a while) now they had gone full panic mode – Mostly in response to the Republican side and Trump’s actions of “It’s just a flu don’t muzzle me muh freedum”.

Look i’m a-political; I’ve been hurt far too much to care about either side and i’m not gonna lead your damn revolution either. I just have a fervent hate for incompetent authority. Both for the powers that be that have caused this situation; And the many supposed experts on the other side that have been calling doom and gloom for years but stare so blindly at trees they miss the forest – overlooking this pattern completely. All Y’all can get Fucked. Even if you ride precious metals up, if you don’t recognize when it’s overbought and when to rotate out you’re just going to end up riding them down again – Just like the people who rode bonds all the way up and are now stuck in that paradigm; Meaning they’ll ride those bonds down too in 2021 and going forward.

What i care about is Truth and Data. It’s simply a fact the virus became politicized quite rapidly and it’s a fact one party is mainly responsible for it with clear motives for doing so (a failing of their objectives so far, to get Trump out by any means possible). I’ll leave the Americans to their own devices, as Joseph de Maistre said “Every country has the government it deserves”. But it does have consequences. The Action was of Trump to dismiss the virus. The Reaction was the Democrats changing their position to the virus being a big deal. The Consequence was their Support-Beyond-Reason for the lockdown. As there hasn’t been a trigger to change this strategy, nor is it a strategy easily changed (geopolitically speaking it’s a “corrupted longshot”; It’s still a long shot but nobody’s going to appreciate you for trying if it fails considering the damage it brings. But if you win you can blame the previous guy) the logical outcome was that this was going to continue. As this is an election year with the elections slated for November with the lockdowns starting in March – a distance of 8 months – it’s clear what the objective and the timeline was: Depress the economy to get Trump out, as people vote economy. This too is a well established fact.

As much as the United States likes to think it’s the center of the universe; The precious metals market is bigger. Much bigger. This because of the universal utility aspect of gold. But so far up to this point, the precious metals market had – since the failure of the London Gold Pool in 1968 and the resulting Comex system – functioned as am “Overleveraged Mexican Standoff”. Basically put, rather then have 2 or 3 people all pointing guns at each other, there’s a few million. All of them know there’s far less gold then there’s paper – but not a single one of them benefits from pulling that trigger.

This too has been leaning against the universal utility of gold, as when one of them pulls the trigger, they too will not be able to get gold in the future – and they all want gold. Sure, you might be able to collect the gold of whomever you “shoot” that’s closest too you…. But holding gold is no good if you can’t hold onto it through the crisis. In a situation where the gold price runs out of control, nobody really wins. Some people will get rich… But collectively so many more people become poor that the standard of living drops anyway. That leads to undesirable situations like tax increases. Sure, you can always pick up and move… But home is still home. There’s a reason we find Treason such a horrible crime. Home’s not something you want to abandon unless you absolutely have to.

But again this is why crashes matter. If the crash is fast, deep and pervasive enough, scams come to an end. The deeper the crash, the bigger the scam that blows up. And in this case, “what changed” was that the environment where nobody benefited from pulling the trigger changed into one where a few firecrackers where lit and tossed into the middle of the crowd. Not all of them will see the firecrackers before they go off. The ones who do; Know: When the fuse is burned and the firecrackers go off, the similarity of the sounds between firecrackers and gunfire means somebody who did not see it was firecrackers, will pull their trigger. Once somebody pulls that trigger, the resulting much louder sound will set off more triggers, as people realize the paradigm has changed. This is essentially what we call “Doomsday Demand” or “A Panic”. It is where these Shadowcontracts come from; those who saw the firecrackers get tossed.

So the collection of data continued but i didn’t have to wait very long:

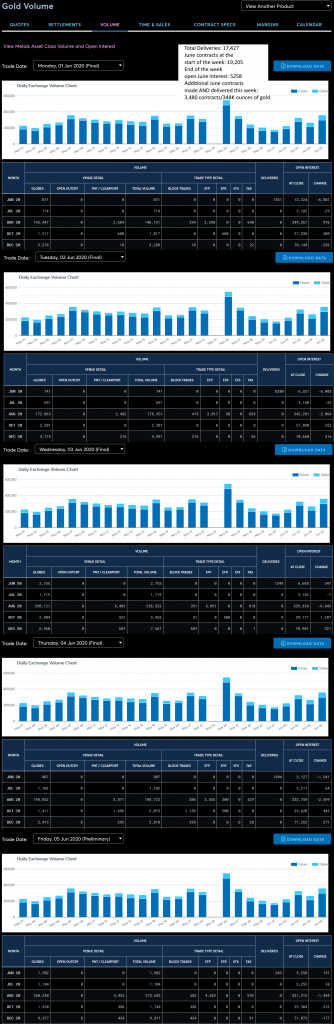

Total Deliveries: 17,427

June contracts at the start of the week: 19,205

End of the week June Open Interest: 5258

Additional June Contracts made AND delivered this week: 3,480/348k Ounces of Gold

See when a scam has been put into operation, you’re basically just running with it while looking to see if anybody noticed. Well i did, but i was a nobody. I had 25 followers on twitter left over from working as a streamer, which by the end of January had dropped to 18 because people didn’t like me spamming about a virus. By the time June hit around i’d climbed back up to ~40, but nobody cares about that few a number. I did tweet at Chris Martenson as he’d been the only one kind enough to as much as like a tweet in the months leading up to that point while i was feeding him as much info as i could (So thanks big guy! You’ve done this planet a service). I decided at the end of January that, considering my highschool dropout background that if i made a Youtube channel about the progression of the virus i would harm the cause more then help it. Especially since i was already failing to convince the people who supposedly cared for me. So supporting others is the route i chose to help. I don’t need to make a career off emergencies and had anybody picked up on my tweets over the months on the Comex, i would’ve been fine with remaining in the shadows.

But apparently this world is even dumber then i thought. During June where i kept regular tabs on the futures market, i was gaining no traction with my warnings so again i’d just go at it on my own. It’s actually now that i decided on the name “Shadow Contracts”. I’d called them mystery contracts before, but that didn’t have a nice ring to it. And if you wanna gain traction in this goddamn world you gotta use clickbait. Which i hate but as i started realizing what was happening and the gravity of the situation, all rules went out the window.

As you can see, the Shadowcontracts continued according to the pattern established at the start of June. Since the discrepancy happened without any media coverage by main stream media or alternative media, one could conclude the “switch”; The change from the normal to the new situation, had worked. As i’ve stated before, humans are suspicious of sudden drastic change. If it happens and nobody gets suspicious, that means nobody noticed – not that they wouldn’t have gotten suspicious. Meaning if you change out of that situation again, the same drastic change has to happen again, so it’s necessary to continue the scam (this is one of the reasons Ponzi schemes don’t have an exit plan – you cannot lower returns lest people get suspicious).